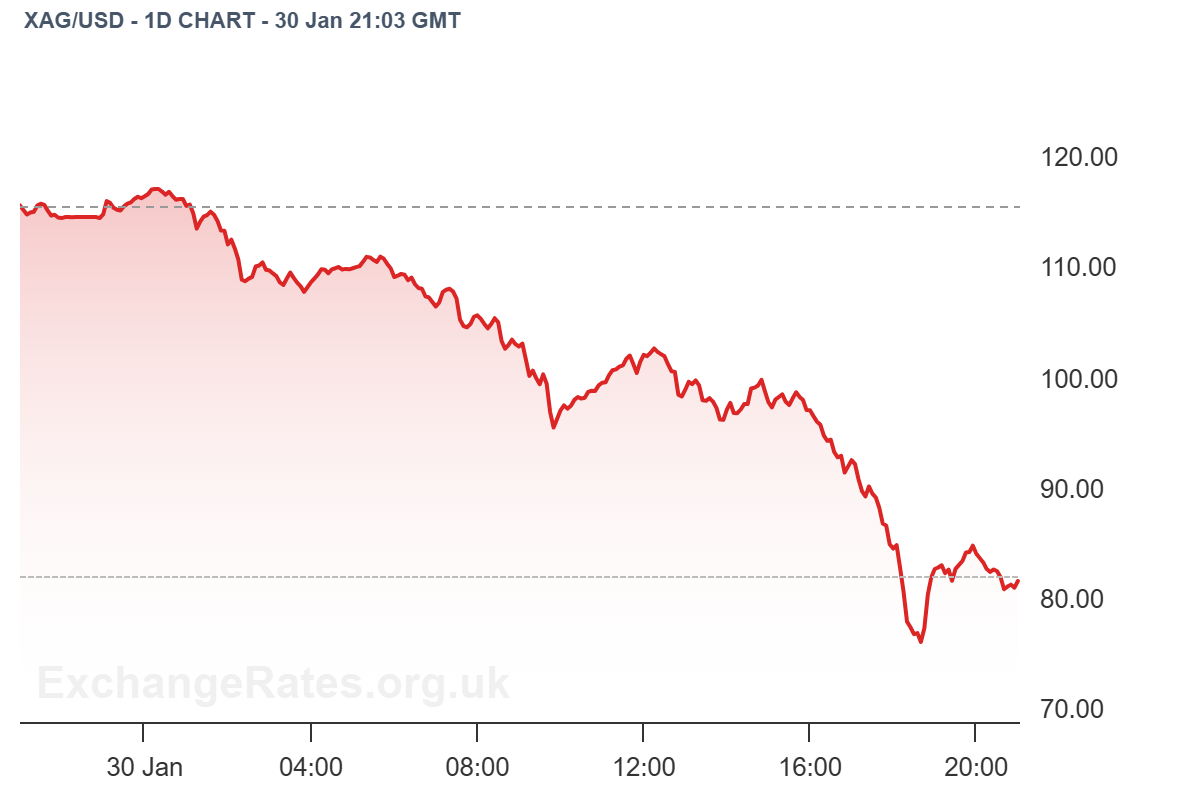

The silver price’s blistering rally came to an abrupt halt on Friday as XAG/USD collapsed by almost 30%, briefly plunging from Thursday’s record high above $120 to near $83.

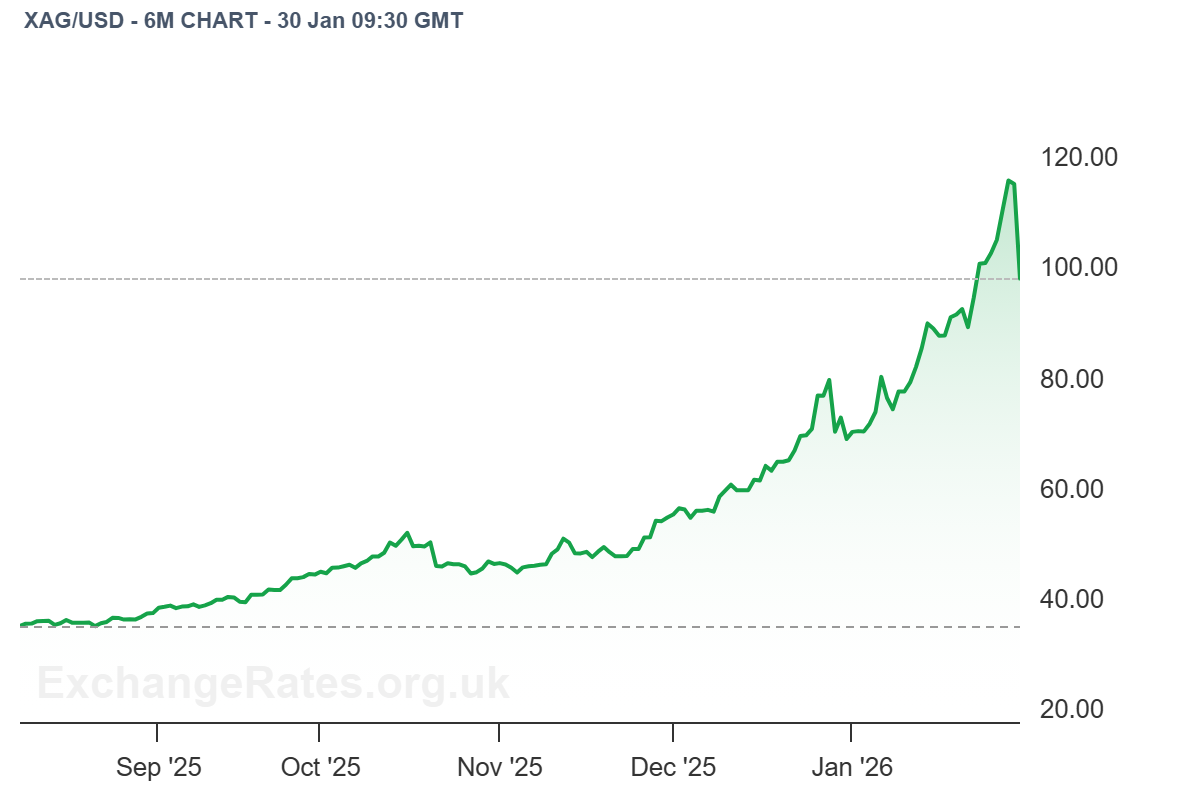

The price of silver had surged nearly 65 per cent this month and close to 300 per cent over the past year, leaving it especially exposed once sentiment turned.

Traders pointed to aggressive profit-taking after an overextended run, compounded by a hawkish shift in U.S. interest-rate expectations following Donald Trump’s decision to nominate former Federal Reserve governor Kevin Warsh to replace Jerome Powell.

Warsh is widely viewed as less inclined to cut rates, a prospect that has lifted the dollar and eroded support for non-yielding assets such as precious metals.

Michael Brown at Pepperstone described the move as a “mass exodus” of leveraged longs, with forced selling accelerating as margin calls rippled through the market.

Overcrowded trade unwinds

Analysts say the sheer scale of the decline reflects how crowded the silver trade had become.

Bank of America warned earlier in the week that prices were overheating, estimating silver was trading roughly 30 per cent above its fundamental fair value.

“Both gold and silver were ripe for a correction given the highly speculative and unhinged nature of the latest surge,” said Ole Hansen of Saxo Bank.

Tom Price at Panmure Liberum added that “generalist investors who have different agendas – like protecting capital – are taking profits”, particularly as Warsh is seen as less likely to pursue aggressive rate cuts.

Independent analyst Ross Norman said precious metals had “discovered gravity”, while Macquarie strategist Alice Fox cautioned that volatility could persist because large funds had crowded into a relatively small and illiquid market.

Correction or trend change?

Not everyone is convinced the rally is finished.

Maria Smirnova at Sprott Asset Management argued the sell-off looks more like a correction than a structural reversal, noting that both industrial and investment demand remain strong and that silver still ended the month more than 40 per cent higher.

Dan Coatsworth of AJ Bell also downplayed the move, attributing much of the weakness to a stronger U.S. dollar and suggesting support could emerge as speculative excess is flushed from the market.

Still, caution remains widespread.

Renaissance Macro’s Jeff deGraaf warned that “parabolic moves have hair triggers”, meaning sharp reversals can occur abruptly when sentiment, rather than fundamentals, is doing the heavy lifting.

Silver price outlook – Where next after this crash?

With key support now clustered around $80 and resistance near $100, most strategists expect a period of consolidation rather than an immediate rebound.

Structural tailwinds such as demand from clean-energy technologies and artificial intelligence, tight mine supply and continued central-bank buying could help keep prices elevated once the market absorbs the shock.

However, after January’s near-vertical ascent, the path ahead for silver is likely to be far choppier than the one-way surge investors had grown accustomed to.