Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

A merger between Glencore and Rio Tinto would create the largest copper company in the world, at a time of surging demand for the metal driven by the clean energy transition and the booming artificial intelligence sector.

The proposed tie-up, which comes hot on the heels of the megamerger between Anglo American and Teck Resources, would also create the world’s largest mining group, with an enterprise value of more than $260bn.

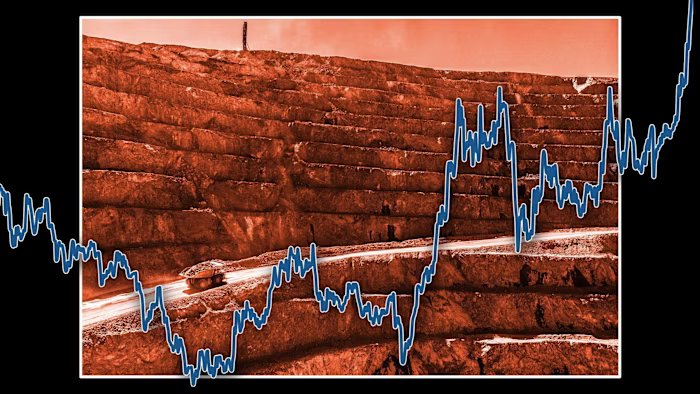

An industry-wide race for copper has driven a frenzied rally in the price of the industrial metal. The highly conductive material is used in industries from construction to energy and defence, with demand on the up thanks to rising global investments in electrification, renewable power and the data centres needed to run AI.

“Two trends are inescapable: everybody wants to be big in copper, and shareholders seem to support growth in copper,” said Paul Knight, founder of AltaVista Advisors and a former banker in the sector.

Kaan Peker, an analyst with RBC Capital Markets, said the rationale for the possible deal was “obviously copper”.

A combined “GlenTinto” would produce more than 7 per cent of globally mined copper in 2026, according to Benchmark Mineral Intelligence, in addition to significant shares of other critical materials, including zinc, cobalt and nickel.

By contrast, Anglo Teck, the planned merger of the London- and Canada- based miners, would produce roughly 4 per cent of copper in 2026.

Copper prices have shot up more than 40 per cent in the past year amid warnings of an upcoming supply crunch. Having rallied to a series of record highs since October, they broke through $13,000 per tonne in January.

Demand for the metal is expected to increase by up to 50 per cent by 2040, according to S&P Global Energy & Market Intelligence, which projects a production shortfall by then of up to 10mn tonnes per year.

James Hayter, chief investment officer at Orion Resource Equities, said copper-focused deals reflected the difficulty of developing projects from scratch as well as a shift from the historic focus among mining majors on steel-intensive businesses towards future-facing minerals such as copper and lithium.

Iron ore producers need to invest in that shift to “remain relevant”, with copper “the latest market and most investable market” at present, according to Hayter. Any premium that Rio paid for Glencore would probably be a “strategic premium” based on the current and potential future value of the group’s copper portfolio, he said.

Building mines is time-consuming and expensive, while extracting metal from existing projects has become more expensive as energy costs have climbed and ore quality has declined over time.

Rio is aiming to increase its copper production to 1mn tonnes per year by the end of the decade, from about 700,000 tonnes in 2024.

Copper took up almost half of Glencore’s industrial capital spending in 2024, despite accounting for only a quarter of the division’s revenue.

With an eye on battery materials and the energy transition, copper is not the only prize. Glencore is the world’s second-largest producer of cobalt, used in batteries and smartphones, mostly as a byproduct of its copper and nickel mines in the Democratic Republic of Congo, Australia and North America.

Rio has made strides to build its lithium business, another important battery metal. It acquired Arcadium Lithium in 2025 for $6.7bn and aims to boost its output of lithium carbonate to 200,000 tonnes by 2028, from a target of about 60,000 this year, to meet demand for batteries.

Experts said they expected more mining deals this year.

“Does this start off a wave of M&A in the mining sector? Yes, I think so,” said Hayter, adding that BHP’s failed bid for Anglo in 2024 was “the starting gun”.

One industry veteran said: “We are seeing some more natural combinations come to the market, and there are more possibilities if people can think about where the world is going, not where it has been.”

Another said: “I don’t think there’s much left in the majors after [Rio Glencore] is done,” “there could be in the second rung [of companies] down”.

Additional reporting by Nic Fildes in Sydney