Key Takeaways

- Sam Zell made his fortune by investing in undervalued real estate and creating REITs.

- He founded Equity Group Investments in 1968, which grew into a global investment firm.

- Zell was known as “the grave dancer” for reviving distressed properties.

- He sold Equity Office Properties for $39 billion, the largest leveraged buyout at the time.

- Zell’s strategy involved buying when others were selling, leading to significant profits.

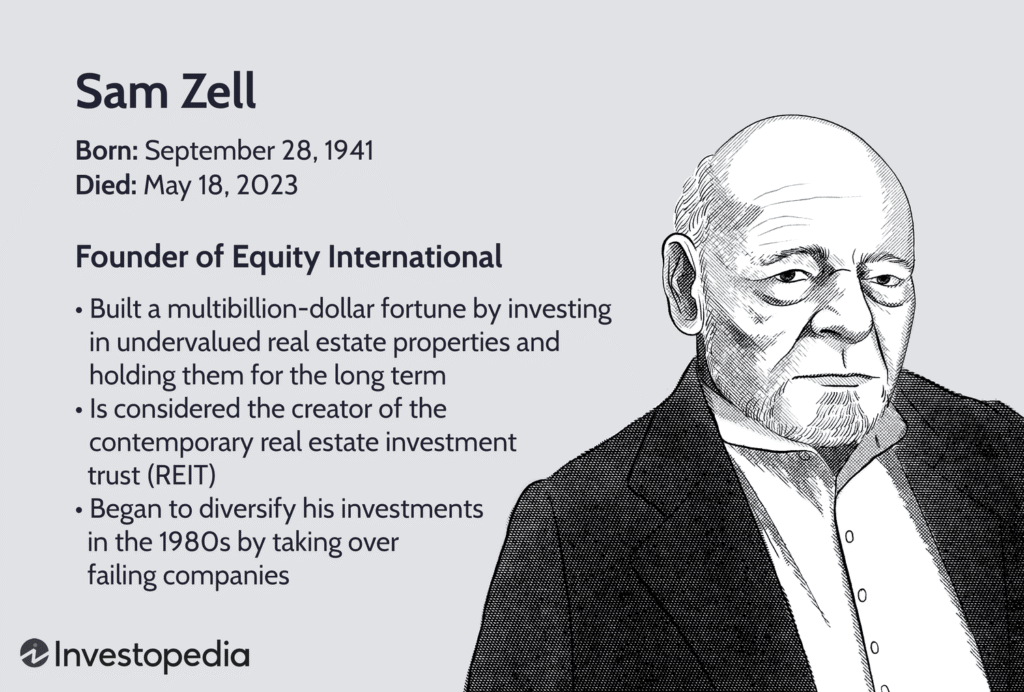

Samuel Zell was one of the wealthiest real estate investors in the world by the time he passed away. An iconic figure in American real estate, Zell died on May 18, 2023 due to complications from a recent illness. He was 81. He built a multibillion-dollar fortune over his lifetime and was known as “the grave dancer” because of his surprising ability to revive real estate properties and projects in distress.

In 1968, Zell created a company, Equity Group Investments (now Equity International), to invest in properties. Equity International has expanded beyond real estate since its founding. The privately held firm controls a billion-dollar investment portfolio with interests spread across multiple continents and several industries, including finance, transportation, energy, and media.

Zell is considered the creator of the contemporary real estate investment trust (REIT). He created some of the world’s largest publicly traded REITs. They include Equity Residential (EQR), an apartment REIT with a market capitalization of nearly $28.78 billion, as of November 2024, and Equity Commonwealth (EQC), an office REIT.

According to Forbes, Zell’s net worth was $5.2 billion as of April 2023. Here is an overview of how he made his fortune.

Early Life and Schooling

Born in 1941, Zell was raised in a Jewish household in Chicago. His parents had migrated to the United States in 1939, shortly before Germany invaded Poland. His father was a jewelry wholesaler.

From a very early age, Zell was interested in the business world. In 1953, when he was 12, he would buy copies of Playboy in bulk quantities for two quarters each and resell them for $1.50 to $3. “That’s when I learned about margin. For the rest of that year, I became an importer—of Playboy magazines to the suburbs,” Zell recalled at a 2013 Urban Land Institute meeting.”

Zell’s entrepreneurial journey continued throughout his post-secondary school years. While at the University of Michigan and its law school, he and a friend, Robert Lurie, managed student apartment units for landlords. Their first gig involved managing 15 homes. However, they spent a lot of time purchasing and improving distressed properties with the goal of either flipping them or renting them to students.

By the time he graduated in 1966, Zell had managed a total of 4,000 apartments and he and Lurie had personally owned somewhere between 100 and 200 of them. Before returning to Chicago, he sold his share of the property management business to Lurie.

Sam Zell’s Early Real Estate Endeavors

Shortly after graduating from law school and passing the bar, Zell joined a firm of attorneys, which he quit after his first week. He eventually decided to make a full-time career out of investing in real estate.

In 1968, Zell founded what was to become Equity Group Investments and convinced Lurie to work with him the following year.

A rash of overbuilding during the late 1960s and early 1970s helped to precipitate a market crash in 1973. Multifamily residential real estate was affected first, with other property types soon following suit. Many loans on commercial properties entered into default, and many developers abandoned their projects. This gave Zell and Lurie the perfect opportunity to acquire high-quality properties at inexpensive prices.

At the end of the crisis, the two possessed a valuable portfolio of apartment, office, and retail buildings.

They held the portfolio for many years and, over time, saw the worth of the buildings regain and eventually exceed their previous valuation levels. In the meantime, Zell and Lurie serviced their debt payments from the monthly rental income the properties produced.

This approach to real estate investing was fairly new then; most property investors made their money by flipping buildings rather than accumulating rental income.

In a Real Estate Review article, Sam Zell described his real estate strategy as “dancing on the skeletons of other people’s mistakes.” The line earned him the nickname “Grave Dancer.”

Diversification Beyond Real Estate: Zell’s Expansive Investment Strategy

After successfully turning distressed properties into valuable ones, Zell diversified his investments. By the 1980s, he began to purchase companies.

Notably, his investment strategy remained the same. As he described in an interview with LEADERS magazine, “Most of the people on the Forbes 400 made their fortunes by turning right when everyone else was going left, and I was one of them. In the late ’80s and early ’90s, I was buying office buildings at 50 cents on the dollar. I kept looking over my shoulder to see who my competition was, but there was no one. I couldn’t help but question whether I was wrong. Fear and courage are very closely related.”

Zell focused on taking over failing businesses to turn them around. After expanding Equity Group’s investment portfolio, Zell invested in companies that operate in various sectors, including rail, container leasing, passenger cruise, plastics packaging, agricultural chemicals, and industrial manufacturing.

It once owned a controlling interest in the Tribune Company, owner of the Chicago Tribune and the Los Angeles Times. The purchase was widely criticized, as in taking the company private, Zell loaded it with so much debt it went bankrupt.

“I’m a professional opportunist,” Zell told the Associated Press following the ill-fated deal. “I’m pretty sure that no matter what topic you pick, we’re involved in some way or another.”

Zell made news in 2007 after he sold his portfolio of 573 office properties, the Equity Office REIT, to Blackstone Group (BX), the world’s largest alternative investment manager, for $39 billion. At the time, the transaction was the largest leveraged buyout deal in history.

It was also considered a shrewd move in retrospect since it happened just before the subprime mortgage crisis and subsequent real estate slump.

Why Was Sam Zell Called the Grave Dancer?

The nickname “the grave dancer” was coined by Zell himself in a 1982 Real Estate Review article because of his ability to “resurrect dead properties”.

How Much Did Sam Zell Sell His Company for?

Samual Zell founded Equity Office Properties Trust and built the company into the largest office REIT. In 2007, Zell sold it for $39 billion. At that time, it was the largest leveraged buyout ever.

What Is the Largest REIT?

As of November 2024, Prologis (PLD) is the largest REIT by market capitalization ($105.04 billion).

The Bottom Line

Zell’s operations made him a controversial figure, but he was one of the wealthiest entrepreneurs in the world during his lifetime. He had built a nearly $4 billion fortune by the time he reached his seventies. He was known as “the grave dancer” for reviving distressed properties. Zell’s strategy involved buying when others were selling, leading to significant profits.