Canadian institutional investors have slowed investments in US real estate this year, despite ploughing US$5.84bn (€5.06bn) in the market in the first nine months of 2025, according to MSCI data.

Although the US continues to be the biggest target of Canadian outbound real estate capital, its share this year has fallen to 29.5%, almost half the long-term average of 56.1% since 2007.

Meanwhile, a number of markets including UK and China/Hong Kong – the second and third largest target markets for Canadian investors – saw their share increase above their long-term averages.

But Jim Costello, executive director of MSCI Research & Development, cautioned against concluding that the shift was a direct consequence of political upheaval in the US. In in a blog, Costello wrote: “One might see this falling share and assume that the decline is about politics, but sector allocations are at play as well.”

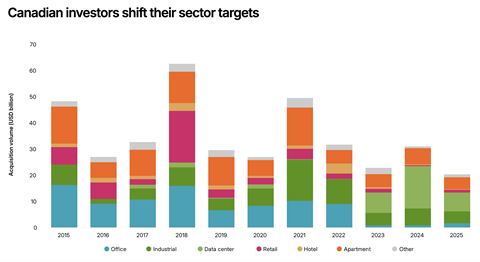

Between 2015 and 2022, the office and apartment sectors were their largest targets, drawing 26% and 24%, respectively, of outbound Canadian capital, followed by industrial at 17%. But since 2023, data centres have jumped from an average share of 2% to 40% of all Canadian outbound capital, while offices are down to 4%.

This reversal of capital deployment helps account for the changes in global capital flows. “Of the capital deployed in the US and the UK, much of it has focused on data centres,” said Costello.

In the third quarter of 2025, data centres represented half of all Canadian acquisitions in the US and 60% for the UK, this figure stood at 60%.

Canadian institutional real estate investors, including the very large ‘Maple 8’ pension funds, are well know for investing outside their domestic market, and the US is an obvious target given its proximity and the size of its property market.

Costello wrote: “At the start of the year, turmoil around political changes in the US raised fears that Canadian capital would divert elsewhere in the world. The story of investment since then has put some of those concerns to rest.”

He added: “Our annual look at the size of the global investable market for commercial property showed that North America represented 42.7% of all investable assets worldwide. Much of this North American share is concentrated in the US.

“With such a high concentration of assets, Canadian and other global investors looking to deploy capital worldwide have simply needed to continue targeting US investments. The political changes in the US may be troubling to these investors, but so far asset availability trumps the political situation.”

To read the latest IPE Real Assets magazine click here