Make use of this big shopping day to buy these rock-solid dividend stocks with huge return potential.

Who says Black Friday shopping is restricted to splashy store deals? Shopping for stocks is an equally exciting idea, especially companies that pay you to own a piece of them through dividends.

Dividend investing is the cornerstone for investors who want to make their money work for them. Just find top stocks that pay regular dividends and grow them steadily, buy some shares, reinvest the dividends all along, and sit back and watch your money grow.

The right dividend stocks can be a killer combination of income and growth. If you don’t believe me, check out these three stocks that have delivered solid returns so far — one of them has delivered almost 400% returns in 10 years — and could supercharge your portfolios over the next five years if you buy them this Black Friday.

Image source: Getty Images.

1. Big business and dividend plans

There’s something special about companies that have a clear vision of where they want to be in five years. And, there’s nothing like it if returning capital to shareholders is a key part of the company’s growth strategy. Eventually, that should mean a lot of money ending up in shareholders’ pockets.

Brookfield Asset Management (BAM +1.48%) aims to double its business in five years. In other words, it aims to double the fees that it earns for managing assets for its clients.

Brookfield Asset Management attracts large institutional capital from government and corporate clients, invests and manages them through private funds and publicly traded platforms like Brookfield Renewable and Brookfield Infrastructure on the client’s behalf, and earns fees in return. Today, Brookfield Asset Management is one of the world’s largest alternative asset managers with more than $1 trillion in assets under management across infrastructure, renewable energy, real estate, private equity, and credit.

Brookfield Asset Management

Today’s Change

(1.48%) $0.75

Current Price

$51.63

Key Data Points

Market Cap

$84B

Day’s Range

$51.10 – $51.89

52wk Range

$41.78 – $64.10

Volume

2.5M

Avg Vol

2.3M

Gross Margin

94.86%

Dividend Yield

3.25%

Digitalization, such as data centers and artificial intelligence (AI) factories, and decarbonization, such as energy transition, are two of the biggest tailwinds for Brookfield Management. Just days ago, it launched a new $100 billion AI program, backed by tech giant Nvidia and the Kuwait Investment Authority.

Brookfield Asset Management delivered record earnings in its latest quarter. Growth opportunities are so huge that it expects to grow its distributable earnings by a compound annual growth rate of 18% over the next five years. With management aiming to pay out 90% of all those earnings as dividends, you could miss out on gigantic dividends and stock price return potential if you don’t buy shares of Brookfield Asset Management now, while they’re trading 21% below 52-week highs and yielding 3.5%.

2. This multibagger dividend stock could pay you a lot more

I’m a fan of big, boring businesses when it comes to dividends. These companies often provide essential services and make enough money year after year to pay reliable dividends to their shareholders, regardless of economic conditions. Often, these boring businesses also raise their dividend payouts regularly and deliver big returns as dividends compound.

WM (WM +0.52%), formerly Waste Management, is North America’s largest waste management services provider, serving over 20 million customers. The company disposes of almost 70% of the waste it collects in its own landfills. The vertically integrated business model allows WM to realize higher margins and cash flows.

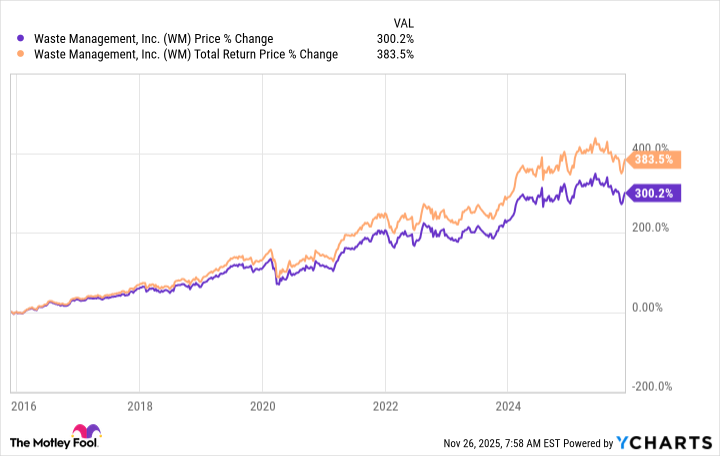

There’s little scope for excitement in the waste management business, but long-term investors aren’t complaining — they’ve made a fortune in WM stock, and dividends have been a substantial driver of the stock’s total returns.

WM has raised its dividend for 22 consecutive years, growing its dividend per share by a CAGR of 8% over the past decade. Having recently acquired Stericycle and adding a strong new vertical of medical waste management to its business, WM expects to generate nearly $29 billion in revenue and more than $4 billion in free cash flow (FCF) in 2027, versus 2024 revenue of $22 billion and FCF of $3.3 billion.

With management targeting FCF payout of 40% to 50%, investors who buy WM shares now can expect solid dividend raises for years to come. WM stock is currently trading 12% below 52-week highs and yielding 1.5%.

3. A monster 8% yield with growing dividends

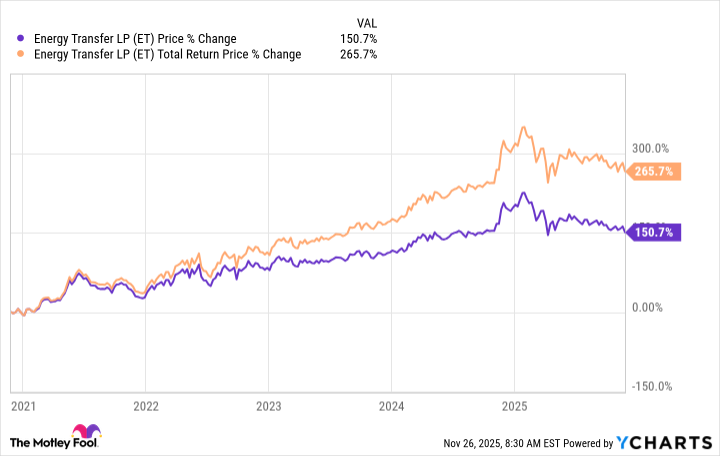

Oil and gas dividends can be volatile, but you need not worry much if you own shares in Energy Transfer (ET +0.98%). This pipeline stock yields a monster 8% and has raised its dividend every quarter since the fourth quarter of 2021. Its dividend growth has made a huge difference to shareholders’ returns over the years.

I expect the trend to continue, as Energy Transfer is targeting 3% to 5% annual dividend growth. That’s a very doable target, given its growth prospects.

Energy Transfer is one of the largest pipeline companies in the U.S., with over 140,000 miles of pipeline. It also owns stakes in fuel distributor Sunoco LP and oil and gas compression service provider USA Compression Partners. Natural gas makes up a substantial portion of Energy Transfer’s business, and that’s also where the growth opportunities lie. The Gas Exporting Countries Forum projects global demand for natural gas to grow by 32% by 2050, unlike demand for coal and crude oil, which are expected to decline.

Energy Transfer’s project pipeline is growing steadily. It expects to spend $4.6 billion on growth projects in 2025 and another $5 billion in 2026. Booming industries, such as data centers, which consume large amounts of power, present a significant opportunity for Energy Transfer. The company recently signed deals with Oracle and XCloudBurst to supply natural gas to three to data centers.

With Energy Transfer trading nearly 24% below 52-week highs, it’s a magnificent dividend growth stock to buy now.