This ETF is made up of many time-tested, high-quality companies.

One reason I’m a fan of dividend exchange-traded funds (ETFs) is that they combine two of my favorite parts of investing: guaranteed income and ETFs. Stock price appreciation is great and undoubtedly appreciated, but it’s nice to own dividend stocks and know you’ll get rewarded regardless of the stock’s price movements.

And ETFs are great because they allow you to cover a lot of ground and check many investing boxes with just a few investments. Combine the two, and voilà — you have an investment that can be rewarding and less risky than investing in individual stocks.

It doesn’t require a significant amount of money to receive value from a dividend ETF, either. Even if you have less than $1,000 to invest, the following dividend ETF is a great option to consider adding to your portfolio.

Image source: Getty Images.

One of the best dividend ETFs on the market

If you’re looking for a high-quality dividend ETF, look no further than Schwab U.S. Dividend Equity ETF (SCHD +0.07%). Mirroring the Dow Jones U.S. Dividend 100 index, SCHD has criteria that essentially act as a de facto vet for you. To be included in the ETF, a company must have at least 10 consecutive years of dividend payouts, a healthy balance sheet, and solid cash flow.

Below are some notable names included from different major sectors of the U.S. economy:

- Energy (19.34% of the ETF): Chevron and ConocoPhillips

- Consumer staples (18.50%): Coca-Cola and PepsiCo

- Health care (16.10%): AbbVie and Merck

- Industrials (12.28%): Lockheed Martin and United Parcel Service

- Financials (9.37%): Fifth Third Bancorp and T. Rowe Price

When you invest in SCHD, you can be confident that you’re investing in an ETF that contains a diverse portfolio of high-quality companies. Most of them are large-cap stocks, with 58% of the companies in SCHD having a market cap of over $70 billion.

Schwab U.S. Dividend Equity ETF

Today’s Change

(0.07%) $0.02

Current Price

$27.24

Key Data Points

Market Cap

$0B

Day’s Range

$27.00 – $27.35

52wk Range

$23.87 – $29.72

Volume

20M

Avg Vol

0

Gross Margin

0.00%

Dividend Yield

N/A

A dividend yield worth paying attention to

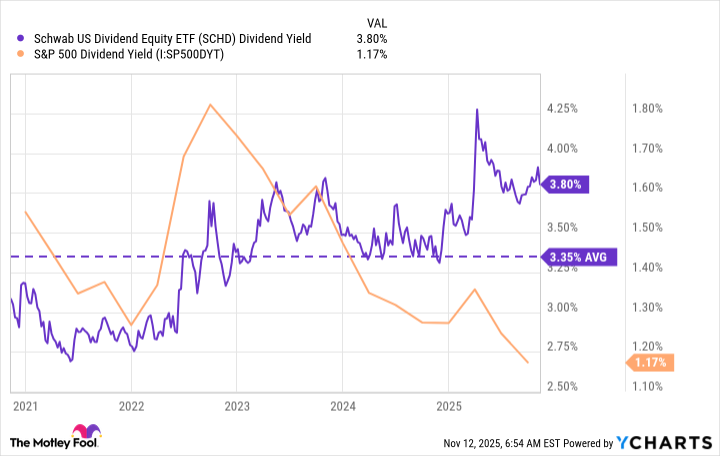

When looking at the upper tier of dividend ETFs, SCHD has one of the higher dividend yields out there. At the time of this writing, its yield is 3.8%, which is three times higher than the S&P 500 average. It’s also slightly higher than its average for the past five years.

Dividend yields fluctuate with stock prices, but over the past couple of years, SCHD has consistently had a yield that’s higher than many S&P 500 dividend stocks and the S&P 500 itself.

A great way to approach investing in SCHD

If you invest $1,000 into SCHD and it maintains a 3.8% yield (which it won’t, but we’ll assume so for the sake of illustration), it would pay out $38 annually. This isn’t life-changing money by any means, so it can often be more impactful if you reinvest the dividends to acquire more shares.

Most brokerage platforms offer a dividend reinvestment plan (DRIP), which automatically reinvests the dividends you receive in additional shares of the stock or ETF that paid them. This makes the process seamless, operating behind the scenes. Ideally, you’d keep reinvesting the dividends for more shares until you’ve acquired enough to receive a decent amount whenever you decide to begin receiving cash payouts.

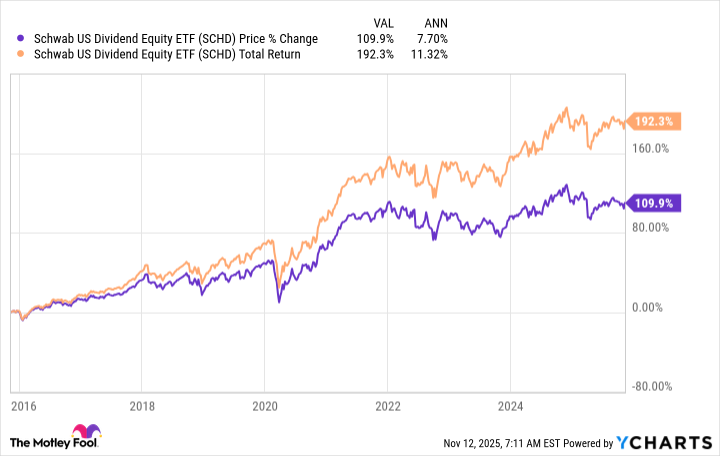

Over the past decade, SCHD has averaged 11.3% total annual returns. With an 11% annual average, a single $1,000 investment would grow to just over $8,000 in 20 years, which would then pay out around $300 annually with a 3.8% yield. If you added $100 monthly, it would grow to around $85,100, paying out over $3,200 annually.

The specific dollar figures will obviously vary based on returns, but this example shows how powerful compound earnings can be, especially regarding dividends and taking advantage of your brokerage platform’s DRIP. The Schwab U.S. Dividend Equity ETF has all the tools (and holdings) to be a great long-term investment. The key is patience.