Key Takeaways

- The S&P GSCI Commodity Index ($GTX) continues to climb, now setting the June 2022 highs in its sights.

- Accelerated gains among hard and soft resources would throw a wrench in the AI megatrend, macro policy, and existing intermarket relationships.

- Investors can play the theme through ETFs, and the next six months could be particularly crucial.

Don’t look now, but commodities are making a run.

On Tuesday, the S&P GSCI Commodity Index ($GTX) settled at its highest level since June 2022. It’s a stealthy move, as both WTI and Brent crude oil aren’t doing much — still hovering in the low and mid-$60s, respectively.

But gains are being seen in areas such as natural gas, industrial metals, precious metals, and even parts of the agricultural commodities space. Hards and softs are collectively on the incline, and that has key macro implications along with intermarket dynamics.

From AI Mania to Real Assets

On StockCharts, I gauge price action in $GTX. Notice in the chart below that the index notched a cycle low back in May 2023. The past two and a half years have been all about the AI trade. May 2023 was also when NVIDIA (NASDAQ:) reported its blowout earnings, which revealed just how powerful the AI boom could be. At the time, who wanted to own real assets and old-school economy commodities? Few.

The sentiment doesn’t feel all that different today, but price trends tell a different story. Yes, NVDA and its peers are still in hare-like bull-market mode. Commodities, though, are the tortoise, just gradually stair-stepping higher. $GTX’s long-term 200-day moving average is on the rise, with the 50-day also ascending. Price sits above both, and that’s the ideal makeup for a pronounced uptrend.

Also, take a look at the RSI momentum oscillator at the top of the chart. It has been ranging in a generally constructive zone between 40 and 70, never touching technically overbought conditions since a spike this past June.

COMMODITY MOMENTUM BUILDING BENEATH THE SURFACE. $GTX sits above its 200-day and 50-day moving averages, which are rising. The RSI has remained between 40 and 70.

Seasonality: The Bears Missed Their Window

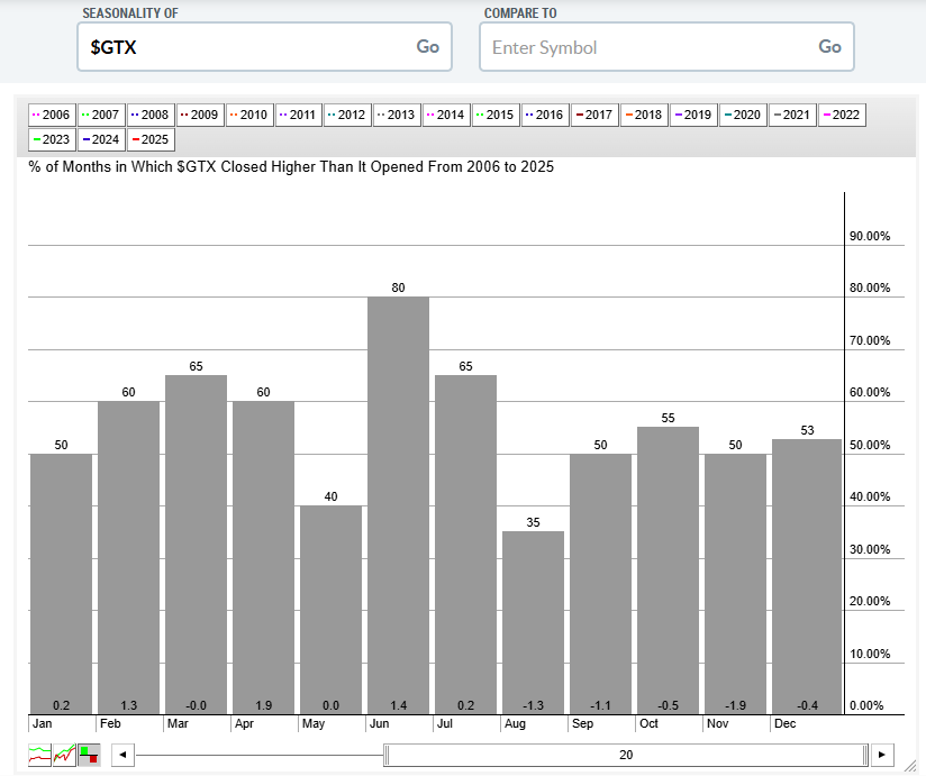

An important question today is whether the upswing will be powerful enough to test the June 2022 record high. It’s quite doable, particularly given that the commodity index has bucked historical seasonal trends.

Venturing over to the StockCharts Seasonality view, we find that $GTX has struggled, on average, from August through November. Since 2006, each of those four months has featured a mean negative return with a positivity rate below 50%.

Calendar trends turn bullish as we near the turn of the year. The January-through-July period is when hard and soft commodities typically get their act together. So that 4300 level on $GTX could easily be in sight if history is a guide.

Cool Tip: When an asset rallies during a weak seasonal stretch, it’s a bullish sign worth watching.

UNCHARACTERISTIC SECOND-HALF STRENGTH IN 2025 IN $GTX. On average, from August to November, $GTX’s performance has struggled. January to July is when commodities fare better.

Macro Ripples: The Fed’s Next Headache?

So, we’ve formed a thesis — a continued commodity rally into the first half of 2026. Next, let’s look at the macro and intermarket impacts.

First, this rally could put the Federal Reserve in a bind. Rising commodity prices — from to to to — could undermine the apparent cycle. Come late May 2026, there’ll be a new Fed chief at the helm (presumably dovish), and they might have their work cut out for them in forming a consensus to ease monetary policy further.

Intermarket Signals Flash Inflation

Central bank happenings are often noisy and distract from pure tape reading. With that in mind, let’s pivot to classic intermarket relationships.

During an inflationary scenario (which global markets have been bobbing around since the pandemic), rising commodity prices usually correspond to higher interest rates (lower bond prices). If we take signal from the multi-year, albeit quiet, commodity bull market, then leaning against Treasuries is the play.

The Dollar Dance

Another inflationary-regime relationship: an inverse correlation between the and commodities. This one makes intuitive sense — dollar-denominated commodities enjoy an extra tailwind when the buck is under pressure.

Today, the ($USD) chart doesn’t look bad. There’s a rounded-bottom pattern, and the 100 to 100.60 range is the line in the sand. Above that, a measured move price target to about 105 is in play (based on the depth of the ongoing consolidation). A breakdown under the July–September double-bottom low, however, would certainly give a second wind to the so-called “debasement trade.”

The Dollar Tries To Form A Bottom.

Dollar depreciation versus other global currencies would not only benefit gold and , but also the overall commodity arena. That’s often what markets do — when investors are collectively focused on one trade (long gold and crypto amid a weaker dollar), something else happens, often on a bigger scale. Here, it could be a broad-based commodity thrust.

What Comes Next

We can go down other rabbit holes. How would the AI trade react to richer input costs? What might the underperforming Energy sector do if WTI sports a $70-plus handle? Can consumers grapple with higher food costs and prices at the pump, and what would that mean for the midterm elections less than a year away?

What’s your take? You can trade it through commodities ETFs such as the iShares S&P GSCI Commodity-Index Trust (GSG).

The Bottom Line

Does the global stock market hinge on stable commodity prices? Probably not. Other factors are at play, but the sneaky rise in the S&P GSCI Commodity Index may soon make headlines and garner attention if it persists. And, as technicians, we know that trends last until there are definitive signs that they have ended.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.