Charles Rotblut leads a class in AAII’s new Essential Investing Video Course. Go to https://www.aaii.com/ves for more information and to subscribe.

-

Evolution of dividend investing strategies and why yield alone no longer defines success -

AAII’s value-oriented dividend framework emphasizes valuation, growth and strength for income and appreciation -

BetterInvesting’s total return approach focuses on growth, stability, governance and shareholder-friendly capital allocation

Strategies for investing in dividend stocks have evolved significantly over the years. The changed environment requires evaluating stocks based on many traits rather than focusing on dividend yield alone.

To help you successfully navigate the ongoing low-yield environment, we are sharing two strategies for investing in dividend stocks. AAII’s Dividend Investing (DI) approach seeks out undervalued dividend growth stocks. BetterInvesting’s (BI) approach focuses on growth stocks that pay dividends. Both strategies can be used to help you seek capital appreciation and income—a win-win for investors.

How the Dividend Landscape Has Changed

A brief look at how dividends have changed will help you better understand the logic behind our respective strategies.

Traditional dividend investing strategies originated from academic research following the 1929 stock market crash, when financial theorists like Benjamin Graham, David Dodd and Philip Fisher sought reliable stock selection methods. Their foundational work assumed that virtually every established company paid dividends, making yield-based strategies both practical and comprehensive.

There was a good reason for this. During the 1930s and 1940s, dividends represented a major component of total investment returns, with market yields ranging from 4% to 8%.

The “go-go years” of the 1960s saw changes in corporate allocation strategies. Reinvestment of capital increased in importance due to technological innovation. Companies like Polaroid Corp. and Xerox Holdings Corp. ![]() (XRX) emphasized funding research, pushing yields down toward 3%.

(XRX) emphasized funding research, pushing yields down toward 3%.

This trend accelerated during the 1990s bull market when technology companies commanded premium valuations while paying minimal dividends. The dot-com era pushed yields near 1% as investors focused on capital appreciation rather than current income.

Today’s dividend investors face a landscape that is different from that of most of the 20th century.

Dividend yields for the U.S. stock market have consistently remained below 2% since the Greek government debt crisis shook the global markets in 2011. (The sole exception was the brief coronavirus pandemic bear market, when yields temporarily spiked.) As of September 2025, the iShares Dow Jones U.S. ETF ![]() (IYY), a broad market exchange-traded fund (ETF), yielded just 1.1%.

(IYY), a broad market exchange-traded fund (ETF), yielded just 1.1%.

AAII’s Value-Oriented Dividend Approach

Today’s dividend landscape requires investors to look beyond traditional metrics. AAII’s Dividend Investing strategy seeks attractively valued dividend growth stocks. Its model portfolio has a yield of 2.6%, more than twice that of the broader market.

This yield shows that attractive dividend opportunities still exist across sectors and market capitalizations. To find them, investors must be willing to look beyond traditional blue-chip stocks and market-weighted indexes.

Nearly two-thirds of companies in the S&P MidCap 400 index pay dividends, and so do many small-cap companies. The DI model portfolio holds stocks from nine different sectors, including industrials and information technology, demonstrating the breadth of opportunities available to patient investors.

Yield Works as a Valuation Tool

Central to AAII’s Dividend Investing strategy is the methodology developed by Geraldine Weiss. Known as the “Grande Dame of Dividends,” Weiss ran a successful dividend investing newsletter for decades. Her contrarian approach treated yield as a valuation tool rather than simply seeking the highest available yields—a distinction that proves crucial in today’s market environment.

Dividend yields are inversely related to valuations. Weiss believed that when a stock’s yield rises significantly above its historical average, it often signals undervaluation. Yields move inversely to valuations, so the dividend payment increases in percentage terms relative to the share price when a stock falls.

Conversely, when a stock’s yield falls well below its historical average, it typically indicates overvaluation. Investors are paying more for each dollar of dividends than the market has historically allowed.

Those who incorporate technical analysis into their strategies will recognize this “channel-like” approach. Investors buy stocks when yields reach the upper channel boundary and sell when yields touch the lower boundary. Weiss believed that stocks require approximately three years to move from undervalued to overvalued status, then about two years to cycle back—creating predictable opportunities for disciplined investors.

AAII’s Dividend Investing strategy implements this methodology by seeking stocks whose current yield exceeds their five-year average yield. This indicates potential undervaluation. Stocks become candidates for deletion from the DI model portfolio when their current yield falls below their five-year average yield, suggesting overvaluation. This disciplined approach allows dividend investors to capture both income and capital appreciation while potentially qualifying for favorable long-term capital gains treatment.

The Critical Importance of Dividend Growth

Yield represents just one part of the investment equation. Dividend growth matters significantly more than yield for long-term wealth-building.

Analysis from Ned Davis Research and Hartford Funds demonstrates that stocks of companies that initiate or grow their dividends greatly outperform all other dividend policies. An investor who owned a portfolio solely composed of dividend growers and initiators would have seen an initial $100 investment made in 1973 grow to nearly $16,000 by the end of 2024—a remarkable 15,900% return over five decades.

The performance contrast with other dividend policies is striking and instructive. Stocks of companies that maintained dividends without growth turned $100 into approximately $3,000 over the same time frame—a 2,900% return. Most concerning, companies that cut their dividends reduced $100 to just $63—a devastating 37% loss before even accounting for the additional eroding effect of inflation.

This data shows that avoiding dividend cutters proves crucial for long-term wealth preservation. When companies reduce dividends, it typically signals fundamental problems with the underlying business model, competitive position or financial health that may persist for years.

AAII’s Three-Pillar Dividend Framework

AAII’s Dividend Investing strategy evaluates stocks based on three essential dividend pillars: valuation, growth and strength. Each stock receives a letter grade ranging from A to F for each pillar.

-

Dividend Valuation Grade: Assesses how a stock’s current yield compares to its five-year average yield. A grade of A is assigned to stocks with the highest current yields relative to their five-year average, indicating potential undervaluation, while a grade of F goes to stocks with the lowest relative yields, suggesting overvaluation. -

Dividend Growth Grade: Examines the fundamental metrics that drive sustainable dividend increases. Key factors include growth in cash flow from operations, return on assets (ROA) relative to sector medians (higher is better) and the rate of dividend growth. Cash flow from operations receives particular emphasis because it represents the actual cash generation that funds dividend payments, unlike accounting-based earnings figures that can be manipulated through noncash adjustments. -

Dividend Strength Grade: Evaluates financial stability through several critical metrics. These include the earnings payout ratio (lower than sector peers is better), liabilities relative to assets, the interest coverage ratio (higher than sector peers is better) and overall dividend sustainability based on balance sheet strength.

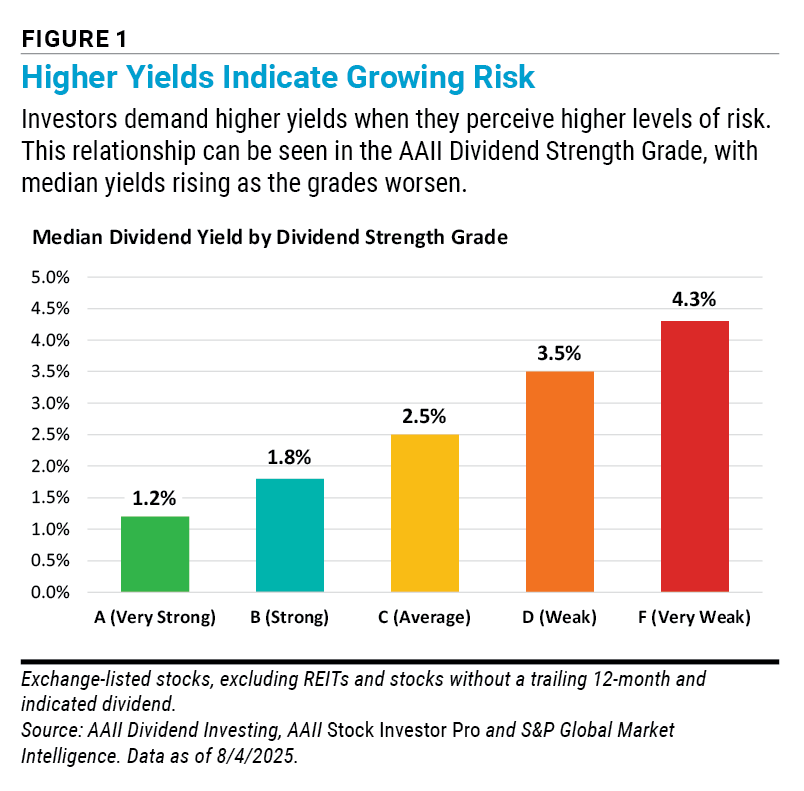

Dividend strength matters greatly when a stock with a higher yield is being considered. While the extra income from the higher yield may seem appealing, tread carefully. Higher yields are often the result of investors demanding higher compensation for greater perceived risks (Figure 1).

AAII’s Dividend Investing strategy seeks stocks with grades of A or B across all three pillars. This disciplined approach aims to identify fundamentally sound dividend growth companies trading at attractive valuations—the sweet spot for long-term wealth-building.

Identifying Quality Dividend Stocks When Yields Are Low Video

We think you’d like this related webinar! AAII + BetterInvesting: Tools & Tactics for Dividend Investors

BetterInvesting’s Growth-Oriented Dividend Strategy

Investing in dividend stocks in today’s environment requires embracing fundamental changes in corporate behavior and capital allocation philosophies. Corporate boards of directors and executives now favor dividend policies that provide operational flexibility while still rewarding shareholders.

Corporate Capital Allocation Evolution

Share buyback programs have emerged as the preferred method for returning capital to shareholders because they offer several strategic advantages. Buybacks increase earnings per share by reducing the number of shares outstanding. Importantly, companies can easily halt buyback programs during periods of economic uncertainty without generating the investor backlash that accompanies dividend reductions.

Debt repayment also increased in importance as interest rates rose from the historic lows reached during the past decade. Companies have focused on reducing borrowing costs and improving balance sheet flexibility rather than maximizing immediate shareholder distributions through dividends.

These strategic shifts contributed to systematically declining payout ratios across the market. The average S&P 500 index payout ratio has dropped over the past century from approximately 56% to roughly 36% today.

The Total Return Philosophy

BetterInvesting advocates that investors should embrace comprehensive total return strategies that combine reliable income with meaningful capital appreciation rather than focusing exclusively on current dividend yield. This approach acknowledges that sustainable dividend growth depends on underlying business expansion and consistent profitability improvements over time.

Investors must consider both a company’s fundamentals and its capital allocation practices instead of focusing on stocks with the highest yields. High yields frequently signal financial distress, declining business prospects or unsustainable payout policies that significantly increase the probability of future dividend cuts.

The most effective approach identifies companies with a demonstrated ability to grow their underlying businesses consistently over economic cycles. Without sustainable revenue and earnings growth, companies cannot meaningfully increase dividend payments while maintaining the financial stability that ensures payment reliability.

Four-Criteria Analysis Framework

BetterInvesting’s Dividend Informer newsletter employs a four-category scoring system that evaluates potential investments across capital return, growth, stability and governance metrics. Each category receives a letter grade ranging from A to D, creating an assessment of dividend investment quality.

-

Capital return assessment examines shareholder-friendly policies through dividend payment consistency, share buyback program effectiveness and equity issuance patterns. Companies demonstrating systematically declining share counts while simultaneously increasing dividend payments receive higher scores. Such a combination reveals management’s genuine commitment to returning excess cash to shareholders rather than pursuing empire-building strategies that benefit executives at shareholders’ expense. -

Growth analysis is needed because companies cannot sustainably increase dividends without underlying business expansion. The Dividend Informer newsletter evaluates sales growth consistency, earnings per share progression and free cash flow generation. Revenue growth provides the foundation for all other improvements, while earnings per share growth indicates management’s ability to improve operational efficiency and profitability. For real estate investment trusts (REITs), the analysis focuses on funds from operations per share rather than traditional earnings metrics. -

Stability requirements focus on consistent business performance across economic cycles. The analysis seeks companies with steady growth patterns in sales, earnings per share and free cash flow generation. These factors indicate that management teams are focused on building sustainable businesses over extended periods rather than maximizing short-term performance through risky strategies or financial engineering. -

Governance evaluation assesses the alignment of management and the board of directors with shareholder interests through observable capital allocation decisions. Companies demonstrating systematic debt reduction, disciplined acquisition strategies that create value instead of merely increasing a company’s size and transparent communication with shareholders typically earn higher scores in this critical category.

Seeking Good Companies, Not Perfect Ones

Successful dividend investing rarely involves finding perfect companies that score at the highest level across all categories. Instead, a mixture of A’s, B’s and even some C’s often identifies genuine opportunities and attractive values in dividend-paying stocks that may be overlooked by investors seeking perfection.

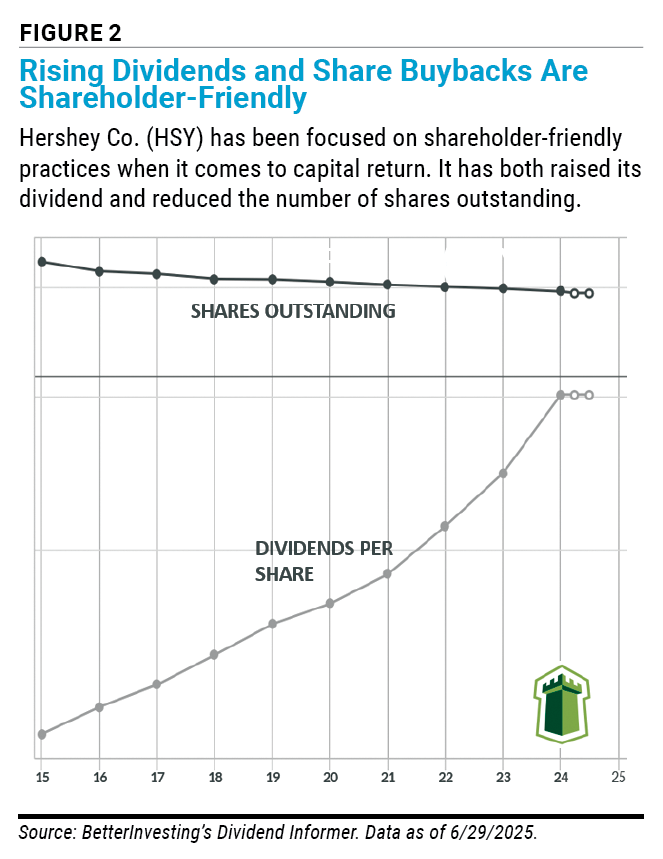

Look at Hershey Co. ![]() (HSY) in Figure 2, for example. There is a distinct downtrend in the number of shares outstanding, while dividends are increasing. To us, this indicates that the company is focused on shareholder-friendly practices when it comes to capital return.

(HSY) in Figure 2, for example. There is a distinct downtrend in the number of shares outstanding, while dividends are increasing. To us, this indicates that the company is focused on shareholder-friendly practices when it comes to capital return.

Another example is Abbott Laboratories ![]() (ABT), which has long paid a dividend. Abbott Laboratories’ revenues, pretax profits and earnings per share have trended upward over the last decade, though not consistently.

(ABT), which has long paid a dividend. Abbott Laboratories’ revenues, pretax profits and earnings per share have trended upward over the last decade, though not consistently.

Strategic Portfolio Positioning

BetterInvesting’s dividend strategy serves investors who are concerned about volatility and desire a middle ground between pure yield-chasing and aggressive growth investing. While this approach may not outperform broad market averages, it aims to deliver reduced volatility through quality company selection.

Successful dividend investing requires a focus on total return, emphasizing companies’ abilities to grow their underlying businesses. The four criteria—capital return, growth, stability and governance—can be analyzed using various screening tools or fundamental analysis. This disciplined approach benefits investors by offering lower portfolio volatility while maintaining an allocation to equities.

Look for Positive Traits Beyond the Yield

The evolution of dividend investing from yield-focused strategies to comprehensive total return approaches reflects the broader transformation of modern capital markets. While dividend yields remain historically low, both AAII’s value-oriented methodology and BetterInvesting’s growth-focused framework demonstrate that attractive dividend opportunities still exist for investors willing to look beyond traditional metrics.

Success in today’s dividend investing landscape requires abandoning the outdated practice of simply chasing the highest yields. Instead, investors must evaluate companies holistically, considering factors such as dividend sustainability, business quality, capital allocation efficiency and long-term growth prospects. Whether you’re following AAII’s three-pillar approach that emphasizes valuation and dividend strength or BetterInvesting’s four-criteria framework that prioritizes total return potential, the key lies in identifying fundamentally sound companies with characteristics associated with rising stock prices.

AAII members can join BetterInvesting for just $99 for the first year (regularly $145). Click here and use the promo code AAII. New BetterInvesting membership includes: the BetterInvesting Magazine, full access to the SSGPlus online tools suite, First Cut stock studies and a learning library.