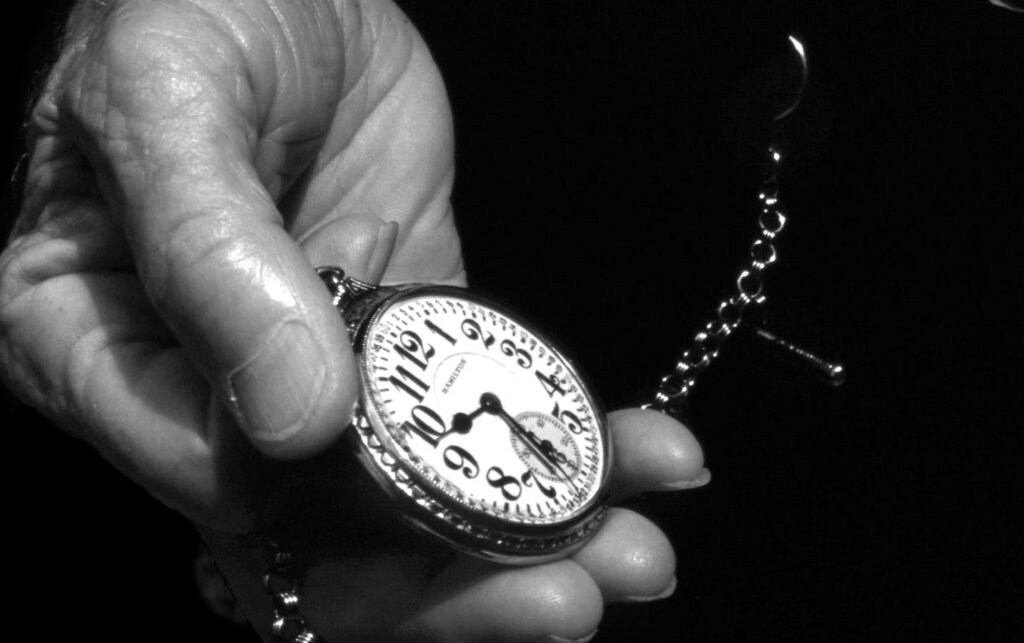

In retirement, time is money. (Photo by Robert Alexander)

Getty Images

Retirement is often viewed through the lens of savings accounts, investment portfolios, and Social Security projections. But what if the most important asset to manage isn’t financial at all? What if the real luxury in retirement is time—and the wisest spending decisions are those that help you buy more of it?

For many, reaching retirement is a milestone that marks the end of a career and the beginning of something new. It’s a chance to live with more freedom, pursue passions, and spend time with the people who matter most. But time, once spent, is nonrefundable. That’s why more retirees and pre-retirees are asking themselves a critical question: How can I use my money to buy more time?

A New Philosophy of Spending

The traditional view of retirement planning focuses heavily on financial security—and for good reason. But once those foundational elements are in place, the conversation shifts from accumulation to allocation. The question becomes: “Now that I’ve done the hard work of saving, what’s the best way to enjoy what I’ve built?”

One powerful answer is this: Spend in ways that give you more control over your time.

Whether it’s outsourcing chores, prioritizing direct flights over layovers, or paying for experiences over material goods, the core principle remains the same—use money to create more meaningful, intentional time.

Time Is the Ultimate Luxury

Consider the value of time in retirement. Unlike earlier stages of life, where schedules are dictated by meetings, deadlines, or family responsibilities, retirement offers a rare and precious autonomy. The ability to choose how to spend the day becomes the true currency of this phase of life.

So how can retirees use their financial flexibility to enhance that freedom?

- Invest in Experiences: Travel, cultural events, or even regular dinners out can offer connection and joy in a way that material purchases rarely match.

- Outsource the To-Do List: Hiring help for landscaping, cleaning, or meal prep doesn’t just reduce workload—it reclaims hours for hobbies, rest, and family.

- Simplify Logistics: Paying extra for convenience—like direct flights or car services—can reduce stress and maximize time spent on what really matters.

The Cost of Convenience vs. the Cost of Time

There’s a tendency to view spending on convenience as indulgent or unnecessary. But reframing the conversation around time can offer a more empowering perspective. Is waiting 90 minutes in a rental car line worth saving a few bucks? Would skipping the layover and arriving refreshed be a better use of resources?

For those in retirement, the answer is often yes. The tradeoff isn’t just financial—it’s experiential. And experiences, especially with loved ones, are the memories that tend to endure.

Make Every Dollar Count—With Intention

Of course, not every splurge is about time. There’s nothing wrong with buying something simply because it brings you joy. But the key is to be intentional. When extra money becomes available—whether from a career wind-down, investment gains, or lifestyle adjustments—consider asking: Will this purchase help me spend my time in a more fulfilling way?

For many, the answer leads to rethinking how spending aligns with values. Time with family. Time for wellness. Time to explore new interests or revisit old ones. These are often the moments that define a fulfilling retirement—and the ones worth investing in.

No One-Size-Fits-All

Buying time in retirement isn’t about following a specific formula. It’s about aligning spending with what matters most. For some, that may mean hiring a dog walker to free up mornings for the gym. For others, it’s booking a family vacation with every detail handled in advance. The goal isn’t perfection—it’s intention.

No matter the approach, the principle remains: Use the resources you’ve built over a lifetime to enhance the time you now have.

Final Thought

Retirement isn’t just the end of work—it’s the beginning of living on your terms. And while the financial side of planning is essential, the emotional and experiential side deserves just as much attention.

By choosing to spend money in ways that buy back time—whether through convenience, experience, or connection—retirees can maximize not just their wealth, but their well-being.

After all, in retirement, time truly is money. Spend it wisely.