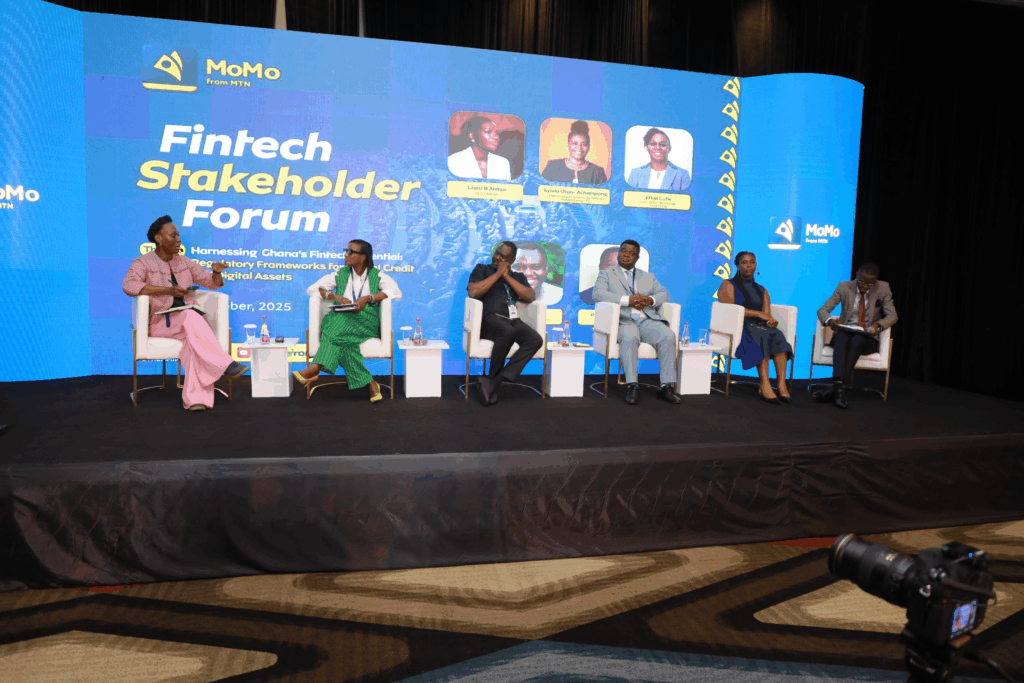

MobileMoney Ltd (MML) has successfully hosted the 2025 Fintech Stakeholder Forum in Accra.

The forum brought together over 200 key stakeholders from the financial, regulatory, and technology sectors to deliberate on the evolving fintech landscape and chart a sustainable path for digital finance growth in Ghana.

Held under the theme “Harnessing Ghana’s Fintech Potential: Regulatory Frameworks for Digital Credit and Digital Assets,” the event explored how policy, regulation, and innovation can align to build an inclusive and resilient digital financial ecosystem.

In setting the tone for the conversation, Shaibu Haruna, CEO of MobileMoney Ltd, emphasised the forum’s core purpose.

He said, “This gathering is not just about dialogue, but more importantly, about partnership and shared commitment to shaping the future of digital financing in Ghana, and perhaps across Africa.”

He noted that as the fintech economy evolves, there is an urgent need for policymakers, regulators, and industry players to engage innovators to harness the potential of digital credit and digital assets to deepen financial inclusion, empower small businesses, and contribute to national development.

Mr Haruna added that “innovation must continue to serve people and uphold the dignity of society.”

Delivering the keynote address, Mrs Matilda Asante-Asiedu, Second Deputy Governor of the Bank of Ghana, said the central bank is focused on defining “the new rules of trust” to balance innovation with financial integrity and consumer protection.

She noted that digital finance has become the “new infrastructure for opportunity” across Africa, with digital credit users in Ghana estimated between 2 and 5 million and crypto adoption steadily rising, making the forum’s theme particularly timely.

Mrs. Asante-Asiedu commended MML for convening the platform, adding, “We are not here merely to discuss innovation; we are here to define the new rules of trust.”

She reaffirmed the Bank of Ghana’s dual mandate to safeguard financial stability while fostering innovation that promotes inclusion.

Providing key regulatory updates, the Deputy Governor announced that the Digital Credit Directive, which enforces clear disclosure and ethical lending practices, came into effect last month.

She further disclosed that the Virtual Asset Service Providers (VASP) Bill is in its final drafting stage, and the Bank of Ghana will begin accepting applications for digital credit licenses from November 3, 2025.

She encouraged private sector actors to “innovate boldly, but with integrity,” citing a recent enforcement exercise that uncovered more than 400 illegal digital lending operators.

The forum also featured insightful presentations by Selorm Branttie of Imani Africa and Prof. Peter Quartey of the Institute of Statistical, Social and Economic Research (ISSER), who offered valuable perspectives from policy and academia on the future of fintech in Ghana.

Other panellists who contributed to the conversation were Clara Arthur- CEO GhIPSS, Ethel Cofie -CEO Edel Technologies and Sylvia Otuo Acheampong – Chief Products and Services Officer Mobile Money Ltd.

MobileMoney Ltd expressed optimism that the insights shared and the collaborative spirit fostered at the forum will guide the next phase of digital finance policymaking and ensure that innovation continues to improve the lives of Ghanaians.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

Source link