Copper price wired for a rally. Stock image.

Copper rebounded after Federal Reserve Chair Jerome Powell signaled the central bank is on track for another quarter-point interest-rate cut this month and traders at an industry gathering in London see prices of $12,000 a ton within reach.

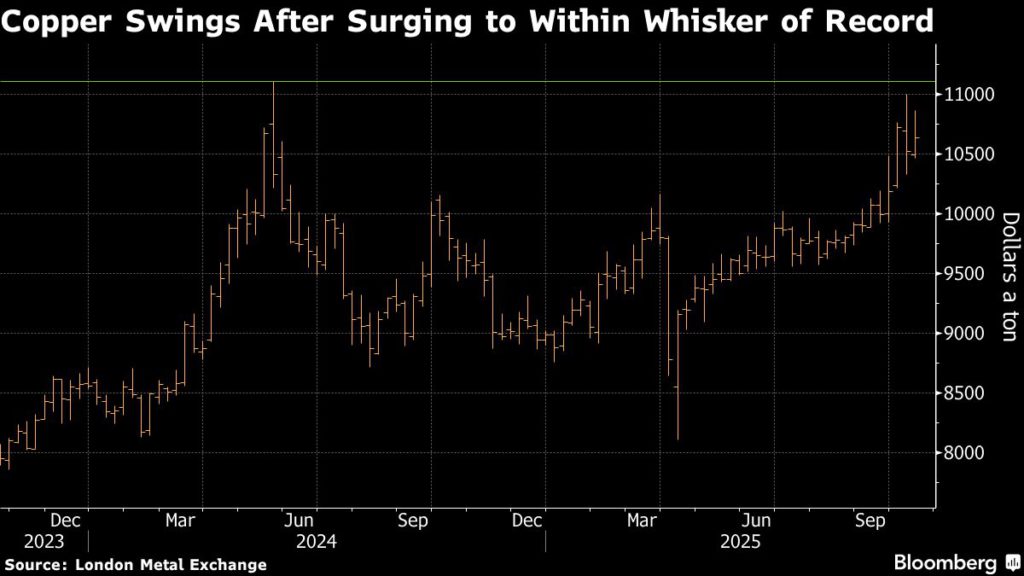

The metal, seen as a bellwether for the global economy given its widespread industrial use, advanced as much as 1.8%. Powell’s remarks helped buoy prices after US-China tensions derailed a rally that saw copper within striking distance of a record above $11,100 a ton last week.

Copper has been supported in recent months by a series of global mine disruptions, underscoring significant challenges ahead to meet rising demand for the metal used is manufacturing and key to the world’s growing electrification.

Prices could potentially end the year at $12,000 a ton, Kenny Ives, who heads the trading arm of giant Chinese miner CMOC Group, told a Bloomberg event during LME Week in London. That level could be reached “quite easily” given serious supply setbacks and the flow of investor money into metals, Mercuria Energy Group’s head of metals research Nick Snowdon said at the same event.

Copper on the London Metal Exchange settled 0.6% higher at $10,641.00 a ton as of 5:51 p.m. local time. Other industrial metals on the LME also rose.

Other voices at the seminar were more cautious. China has probably passed the peak of its latest industrial cycle, and prices typically lag the turn in such cycles by three-to-six months, said Graeme Train, head of metals and minerals analysis at Trafigura Group. The global market is still in surplus and will be balanced next year, Goldman Sachs Group Inc. analyst Eoin Dinsmore said.

Metals prices have been buffeted by swings in sentiment since Friday, when President Donald Trump floated fresh trade penalties against China, the top buyer of copper and several other commodities. In his latest salvo, the US president said he might stop trade in cooking oil with China in retaliation for a halt to purchases of US soybeans.

There were some conciliatory tones, however, with US Treasury Secretary Scott Bessent proposing a longer pause on high US tariffs on Chinese goods in return for Beijing putting off its recently announced plan to tighten limits on critical rare earths.

Read More: Copper’s rally needs China impetus to reach record