Bloom Energy (NYSE:BE) shares have surged 33% over the last week and are currently priced at $114.06. The recent rally comes amid a recent $5 billion strategic partnership agreement with Brookfield Asset Management to deploy Bloom’s advanced fuel cell technology in AI data centers.

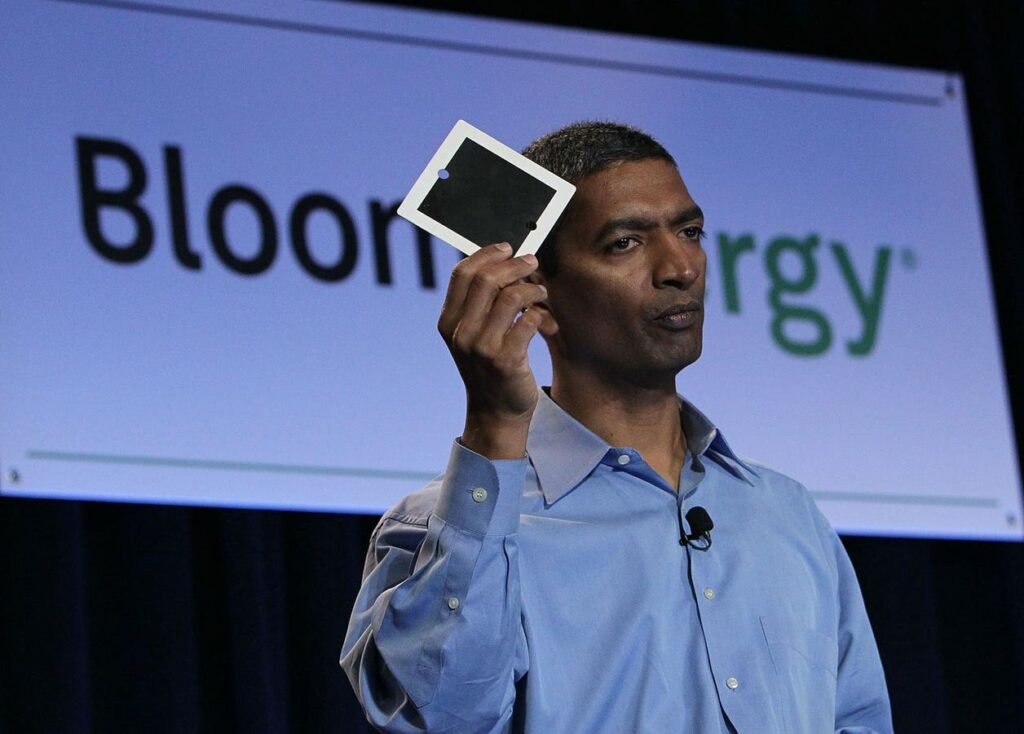

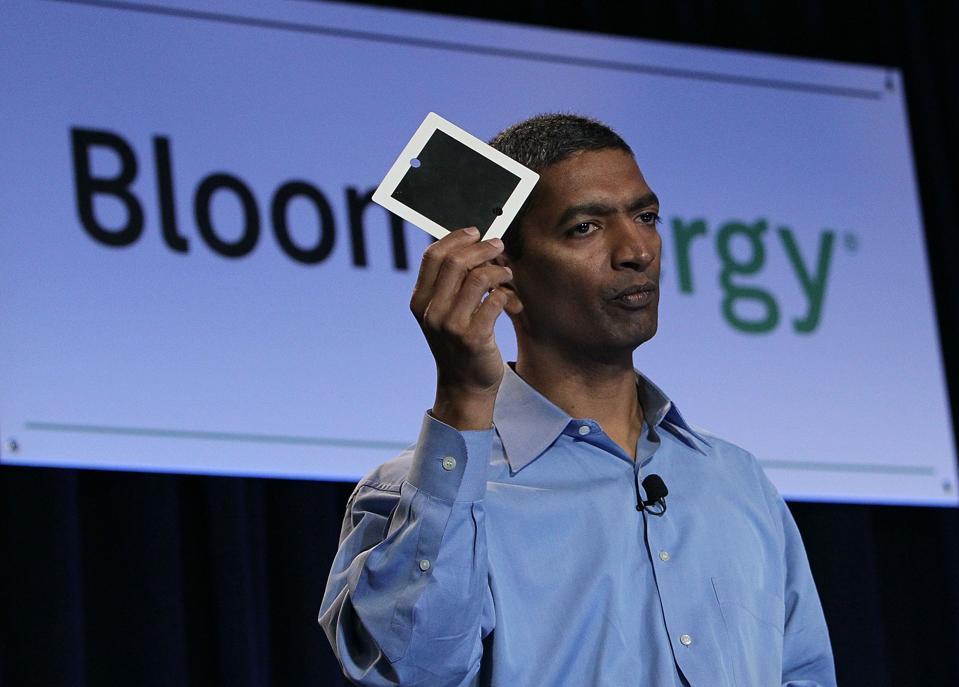

SAN JOSE, CA – FEBRUARY 24: Bloom Energy CEO K. R. Sridhar holds a fuel cell as he speaks during a Bloom Energy product launch on February 24, 2010 at the eBay headquarters in San Jose, California. Bloom Energy, a Silicon Valley start up, introduced the “Bloom Box”, a solid oxide fuel cell device that can generate electricity at a cost of 8 to 10 cents per kilowatt hour using natural gas. (Photo by Justin Sullivan/Getty Images)

Getty Images

However, our machine-driven, multi-factor analysis indicates it might be advisable to sell BE shares on the recent surge. Overall, we have a pessimistic outlook on the stock, and a target price of $80 could be within reach. We think there are only a few concerns regarding BE stock considering its general Moderate operational performance and financial health. However, taking into account its Very High valuation, we view the stock as Unattractive.

Below is our analysis:

BE stock has recently experienced significant gains, yet we currently find it unattractive. This may seem like a warning, and there are considerable risks in depending on a single stock. Nonetheless, we believe there is substantial merit in a more broadly diversified approach, as we utilize with Trefis High Quality Portfolio. Consider this question: Over the past 5 years, which index do you believe the Trefis High Quality Portfolio has outperformed – the S&P 500, S&P 1500 Equal Weighted, or both? The answer may surprise you. Discover how our advisory framework improves your chances.

Let’s delve into details of each of the assessed factors, but first, for a quick background: With $27 Bil in market capitalization, Bloom Energy offers solid-oxide fuel cell systems for on-site power generation, specializing in design, manufacturing, sales, and installation of solutions both domestically and internationally.

[1] Valuation Looks Very High

This table illustrates how BE is valued compared to the broader market. For additional details, see: BE Valuation Ratios

[2] Growth Is Very Strong

- Bloom Energy has experienced its top line increase at an average rate of 18.8% over the past 3 years

- Its revenues have risen 23% from $1.3 Bil to $1.6 Bil over the last 12 months

- Additionally, its quarterly revenues expanded by 19.5% to $401 Mil in the most recent quarter, up from $336 Mil a year earlier.

This table highlights BE’s growth compared to the broader market. For more details, visit: BE Revenue Comparison

[3] Profitability Appears Very Weak

- BE’s operating income over the last 12 months was $72 Mil, resulting in an operating margin of 4.4%

- With a cash flow margin of 5.6%, it generated nearly $91 Mil in operating cash flow during this period

- For the same time frame, BE produced approximately $24 Mil in net income, indicating a net margin of around 1.5%

[4] Financial Stability Looks Very Strong

- BE had Debt of $1.5 Bil at the end of the latest quarter, while its current Market Cap is $27 Bil. This results in a Debt-to-Equity Ratio of 5.7%

- BE’s Cash (including cash equivalents) constitutes $575 Mil of $2.5 Bil in total assets. This gives a Cash-to-Assets Ratio of 22.7%

Financial Stability

Trefis

[5] Downturn Resilience Is Weak

BE has underperformed compared to the S&P 500 index during various economic downturns. We evaluate this based on both (a) the extent of the stock’s decline and (b) the speed of its recovery.

2022 Inflation Shock

- BE stock dropped 77.1% from a high of $42.65 on February 8, 2021, to $9.78 on October 27, 2023, in contrast to a peak-to-trough decline of 25.4% for the S&P 500.

- Nonetheless, the stock fully rebounded to its pre-Crisis peak by August 13, 2025

- Since then, the stock climbed to a high of $114.06 on October 14, 2025

2020 Covid Pandemic

- BE stock declined 78.2% from a high of $14.09 on February 19, 2020, to $3.07 on March 18, 2020, compared to a peak-to-trough decline of 33.9% for the S&P 500.

- However, the stock successfully regained its pre-Crisis peak by July 15, 2020

However, the risk is not confined to major market crashes. Stocks can decline even during favorable market conditions – consider events such as earnings announcements, company updates, or changes in outlook. Review BE Dip Buyer Analyses to analyze how the stock has bounced back from sharp declines in the past.

The Trefis High Quality (HQ) Portfolio, which comprises a selection of 30 stocks, has consistently outperformed benchmarks that include all three – S&P 500, Russell, and S&P midcap. What accounts for this? Collectively, HQ Portfolio stocks have delivered superior returns with reduced risk compared to the benchmark index; they offer a smoother ride, as illustrated by HQ Portfolio performance metrics.