Last week’s ExplainSpeaking column used official data to detail why, despite publicly defending the strong real GDP growth rates, policymakers in India continue to act as if the economy is actually much weaker.

In particular, it highlighted that the two biggest engines of economic growth in India — all the money spent by Indians in their personal capacity as well as all the money spent by private businesses and governments towards boosting the productive capacity of the economy — have been underperforming.

Many readers wrote back asking for a deeper dive into the investment engine of GDP growth. Here’s an attempt to explain why weak investments into the economy by private businesses has been the key area of concern for policymakers for over a decade, and how despite several policy incentives by the Modi government, the situation on this front continues to present a challenge.

What is the nature of the problem?

India’s GDP is calculated by adding up all the expenditures in the economy. The biggest chunk — which accounts for 60% of India’s GDP — comes from the money Indians spend in their individual capacity.

The second biggest engine of GDP is the money spent towards increasing the productive capacity of the economy. Think of private businesses building new factories and buying new machines, and governments building roads and bridges and ports, not to mention people building houses or buying cattle for dairy, etc.

Basically all such expenditures that add to the fixed assets in the economy are included under this rubric, and together they are called Gross Fixed Capital Formation.

Story continues below this ad

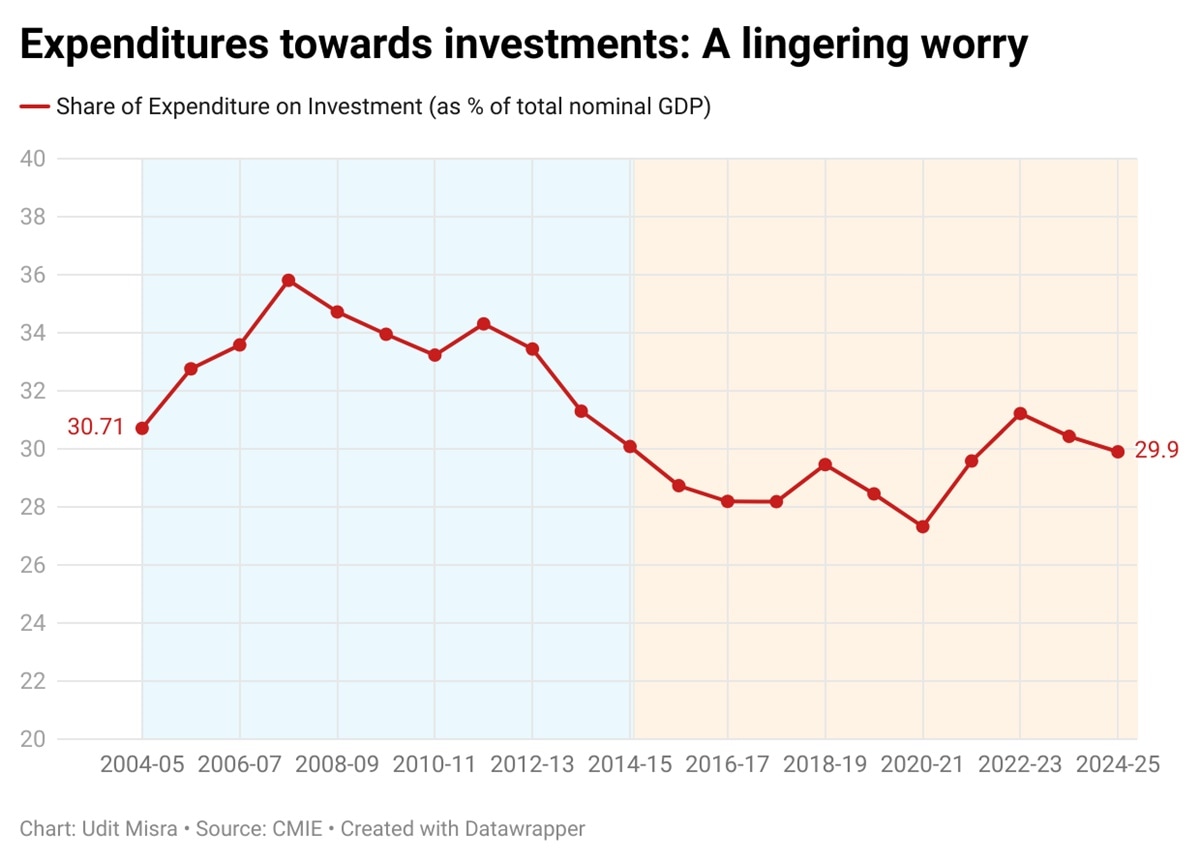

CHART 1 maps the contribution of such expenditures to the overall GDP over the past 20 years.

CHART 1.

CHART 1.

Two things stand out:

1. This contribution has essentially been following a downward trajectory since 2011-12.

2. This contribution has largely stayed below 30% for most years since the change of guard in 2014.

Story continues below this ad

Why do private sector investments matter?

On the face of it, the key concern for India’s policymakers has been to boost private consumption levels in the economy. This is the money Indians spend in their individual capacity — technically called the Private Final Consumption Expenditure. This spending includes expenditures on a whole host of goods and services, such as buying a fridge or getting a haircut or going on a vacation. Last week’s piece showed how this engine had been dragging down overall economic growth.

To boost this kind of expenditure, the government has, over the past couple of years, given income tax relief, apart from providing direct cash transfers wherever possible. The latest move towards this goal has been the cut in GST tax rates.

But, while private consumption appears to be the goal, it isn’t the final goal.

What the government hopes to achieve by boosting the total demand for goods and services in the economy is to push the economy into a self-sustaining cycle of economic growth. That, in turn, can happen only when private businesses take the lead and start investing in the economy. A rise in consumption demand is a prerequisite for the private sector to start investing. To sweeten the deal for the businesses, the government has rapidly boosted its own spending towards building India’s physical infrastructure in a bid to “crowd in” private sector investments into the economy.

Story continues below this ad

Why does it matter? Because when the private sector enthusiastically invests in the economy, there is less pressure on the government to be the prime mover in the economy. The pressure on the government to either provide economic doles, or provide tax relief or indeed create jobs will come down even as the burden of economic vibrancy shifts to the private sector.

This is in line with Prime Minister Narendra Modi’s long-standing belief in “Minimum Government, Maximum Governance”.

Finance Minister Nirmala Sitharaman reiterated this concern when she said the following at a symposium in September: “Today I have a basket of things on which the government has delivered… I hope there is no more hesitation for the industry to invest further, to expand capacities, produce more in India, and what else is required by the government to do, spell them out”.

To be sure, Sitharaman has been looking at the investments by the Indian private sector asking why it is not investing more. Read this 2022 edition of ExplainSpeaking when, out of exasperation, she asked if the Indian private sector is like Lord Hanuman, who at one point, as the story goes, had forgotten his own strength and capabilities.

Story continues below this ad

But where does it show that private businesses are not investing enough?

Many readers wrote back over the past week with this precise question. Here’s an attempt to explain why private sector investments are a lingering worry.

As mentioned above, total expenditures towards building up of fixed assets (or investments) in the economy can be divided into three categories:

1. Government sector (expenditures by the governments and all the public sector enterprises)

2. Households

3. Private sector firms

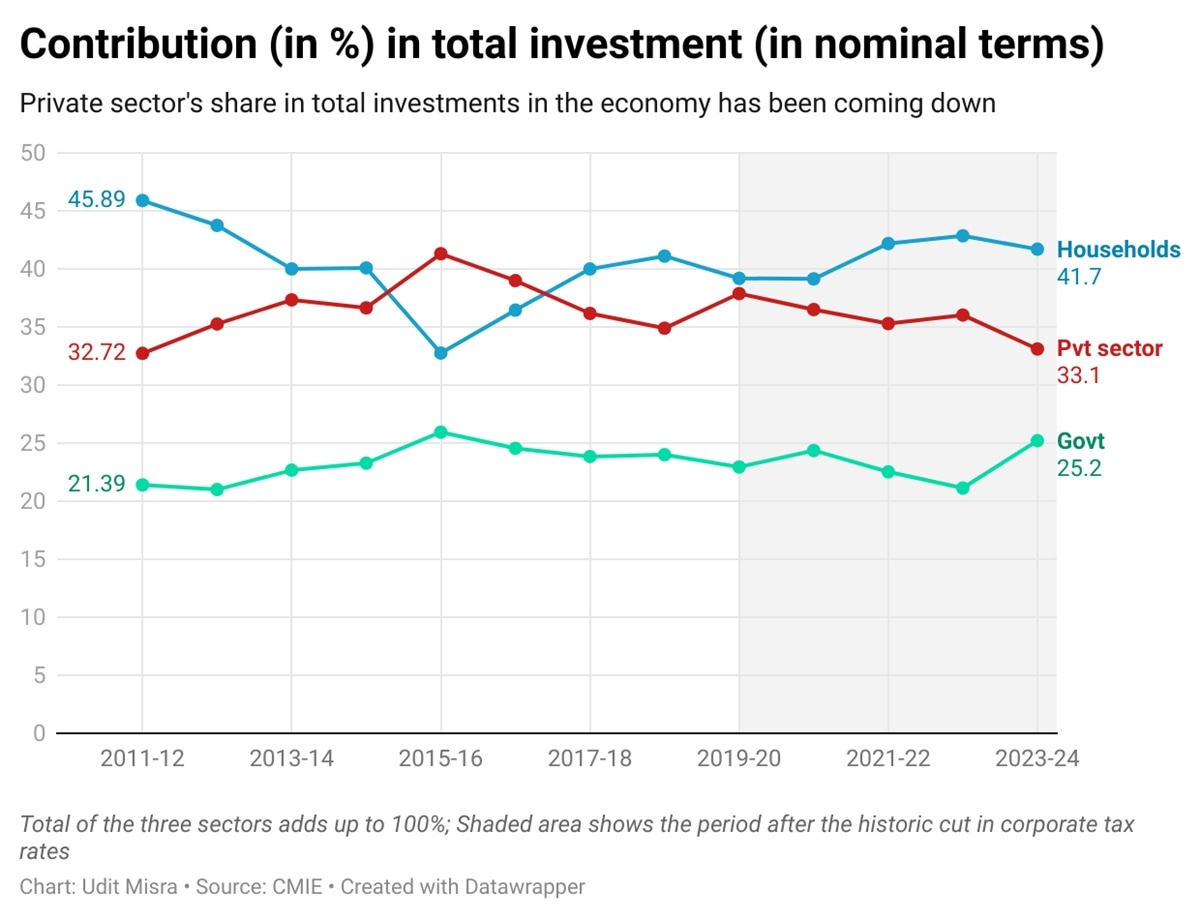

CHART 2 shows the break-up of the total shown in CHART 1.

Story continues below this ad

CHART 2.

CHART 2.

Note that CHART 2 shows the shares of each sector while CHART 1 showed the overall weakness. It is also noteworthy that this data of the break up is only available up to March 2024, unlike the aggregate data in CHART 1, which comes upto March 2025.

The trajectory of the red line, denoting the private sector’s share of investments, underscores how private firms have been pulling away from fresh investments. This is especially true since 2019-20 — the year when Sitharaman announced the historic cut in corporate tax rates in a bid to boost fresh investments by the private sector.

It is also noteworthy that over FY24, the year when overall nominal GDP grew by 12%, shares of both private firms and households fell while that of the government rose. In other words, high growth was not being achieved on the back of the private sector taking the lead in investment.

Lastly, even though we do not at this point have the break up for data in FY25, given that overall share of investments (CHART 1) has fallen further in FY25, it is unlikely that the private sector’s role/share in fresh investments would have improved.

Upshot

Story continues below this ad

What this data reveals is that notwithstanding high GDP growth rates or the whole bevy of incentives (from historic tax cuts for corporates to equally generous reliefs on the income tax front) and subsidies (such as Production and Employment Linked Incentive Schemes), the private sector businesses continue to pull away from fresh investments.

At one level, this is a lingering worry for India’s growth trajectory. After all, as the Finance Minister has repeatedly asked: What would it take for the private sector to start investing aggressively?

At another, it undermines an important plank of the Modi government’s growth strategy where the private sector, and not the government, is supposed to take the lead and solves India’s worsening unemployment and inequality riddles.

Could the government have done things differently to incentivise the private sector? Is the current problem a vestige of the twin-balance sheet problem (over-leveraged companies and NPA-riddled banks) from the UPA government era?

Story continues below this ad

Share your views and queries at udit.misra@expressindia.com

Take care,

Udit