Zoho’s Fintech Gameplan

Zoho

Zoho’s Arsenal Grows: At the Global Fintech Fest 2025, the company launched a suite of point-of-sale (PoS) devices, a soundbox, virtual accounts, marketplace settlements, and payment integrations across its ecosystem. Zoho also plans to embed payments into Arattai, its WhatsApp rival that’s seen surging downloads recently.

Decoding The Fintech Leap: The hardware foray (PoS) is designed to create a seamless link between a merchant’s front-end sales and the company’s back-end tools like Zoho Books and Zoho Payroll. On the other hand, the new payout capabilities will enable its clients to manage everything from disbursements to settlements within a single, integrated platform.

The Expanding Zoho-verse: This fintech push is just one piece of Zoho’s expanding portfolio. In recent months, the company has launched Vani – an AI-powered visual collaboration tool, introduced a suite of AI products, rolled out a large language model, and even bought its remaining stake in Asimov Robotics to bolster R&D capabilities. Arattai, its instant messaging app, also recently topped app store charts and clocked 10 Lakh+ downloads in a week.

To Be Or Not To Be: Zoho is entering a market which is already saturated with UPI apps and PoS providers. It is also competing with network effects, bundled offerings and deep pockets that giants like Walmart-backed PhonePe, Paytm and Google Pay have built over the years.

However, the bootstrapped unicorn’s advantage lies in its captive audience – thousands of businesses already using its software. So, can Zoho build a successful payments business, or will this diversification stretch the SaaS major too thin across too many fronts? Let’s find out…

From The Editor’s Desk

🏢 WeWork India’s IPO Sails Past

- WeWork India’s INR 8,684 Cr IPO ended with 1.15X oversubscription, driven by strong employee and QIB participation. The OFS comprised 4.62 Cr shares, with Embassy Buildcon offloading 3.5 Cr.

- The company’s IPO comes right after it posted a profit of INR 127 Cr in FY25 on a revenue of INR 1,949 Cr.

- WeWork India is slated to list on the D-Street on October 10. With this, it will become the fifth listed office space provider in the country, after Awfis, Smartworks, IndiQube, and DevX.

💳 The New Face Of UPI

- On Day 1 of the Global Fintech Fest 2025, NPCI launched key digital payment innovations, including small ticket UPI transactions via wearable glasses, forex services on Bharat Connect, on-device biometric authentication for UPI, and much more.

- The new features aim to boost UPI adoption, enhance the ease of use and security, and cater to new demographics, particularly in rural areas.

- This comes at a time when digital payments are surging in the country. Monthly UPI transactions stood at 1,963 Cr in September, clocking a total value of INR 24.9 Lakh Cr.

💰Intangles Rakes In Big Moolah

- Deeptech startup Intangles raised $30 Mn in its Series B round led by Avataar Venture Partners to expand its global footprint, strengthen its product portfolio and grow its team.

- Founded in 2016, the deeptech startup offers AI-powered predictive analytics solutions to fleet providers and OEMs like Tata Motors, Volkswagen, Volvo, Mercedes-Benz, Honda, among others.

- The company claims its solutions help fleet owners improve net profitability by up to 50% and achieve a per-truck ROI of 5X. Its platform currently supports more than 4 Lakh vehicles across North America, Europe, Southeast Asia, and the Middle East.

🚫$20 Mn Funding Later, Niro Shuts Shop

- Embedded credit solutions provider Niro has wrapped up operations due to regulatory challenges, lack of funding and a decline in credit quality.

- Founded in 2021, it helped companies offer personalised, embedded credit solutions to end customers. At its peak, it had 17 Cr users and INR 887 Cr in AUM.

- Backed by marquee names such as Elevar Equity, GMO Venture Partners and Innoven Capital, Niro reported an operating revenue of INR 9.5 Cr in FY23 against a net loss of INR 23.8 Cr.

💸 Secondaries Seeing A Spurt

- As per Inc42’s Q3 investor survey, nearly 41% of Indian investors now prefer secondary exits, signalling a shift from IPOs and acquisitions to faster liquidity and diversification.

- With homegrown VC funds from 2014–15 nearing maturity, investors are no longer waiting for IPOs to cash in on their bets due to compliance complications and lock-in periods that impact the IRR.

- India has also witnessed the launch of several secondary-focused funds over the past year. In 2025, for instance, Neo Group floated an INR 2,000 Cr secondaries-focused fund, while PixelSky Capital and White Whale Venture launched funds of INR 400 Cr and INR 250 Cr, respectively.

Inc42 Markets Inc42 Startup Spotlight

Inc42 Startup Spotlight

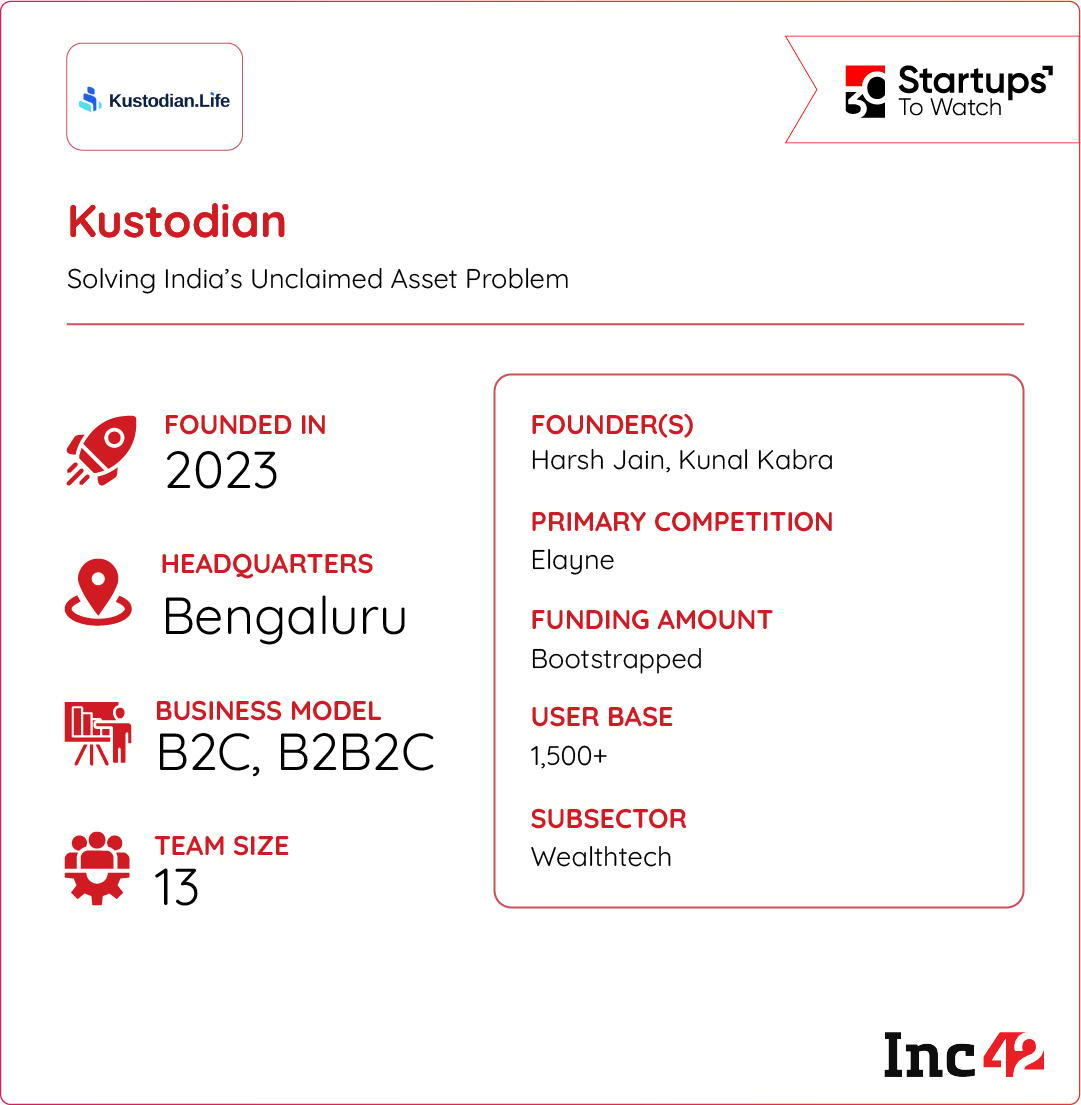

Can Kustodian Solve India’s Unclaimed Asset Problem?

For families dealing with the loss of a loved one, navigating the financial and bureaucratic processes that follow can be a second, unbearable tragedy. Slow, complex procedures often stretch for six to eight months, making it difficult to retrieve funds tied up in EPF, bank deposits, and shares.

A Custodian For Estate Planning: Founded in 2022, Kustodian Life combines AI-driven workflows with human support to assist users with claim filings, documentation, real-time tracking, and dispute resolution. Kustodian also offers essential financial tools like will drafting and estate planning.

From Grief To Relief: In the past year, Kustodian has helped over 1,550 families recover their assets in an average of 2.5 months. By addressing India’s INR 2.5 Lakh Cr unclaimed asset problem, which is growing by more than INR 20,000 Cr annually, Kustodian is tapping into a massive unmet need.

Can Kustodian finally simplify estate and financial recovery for families in India?

Infographic Of The Day

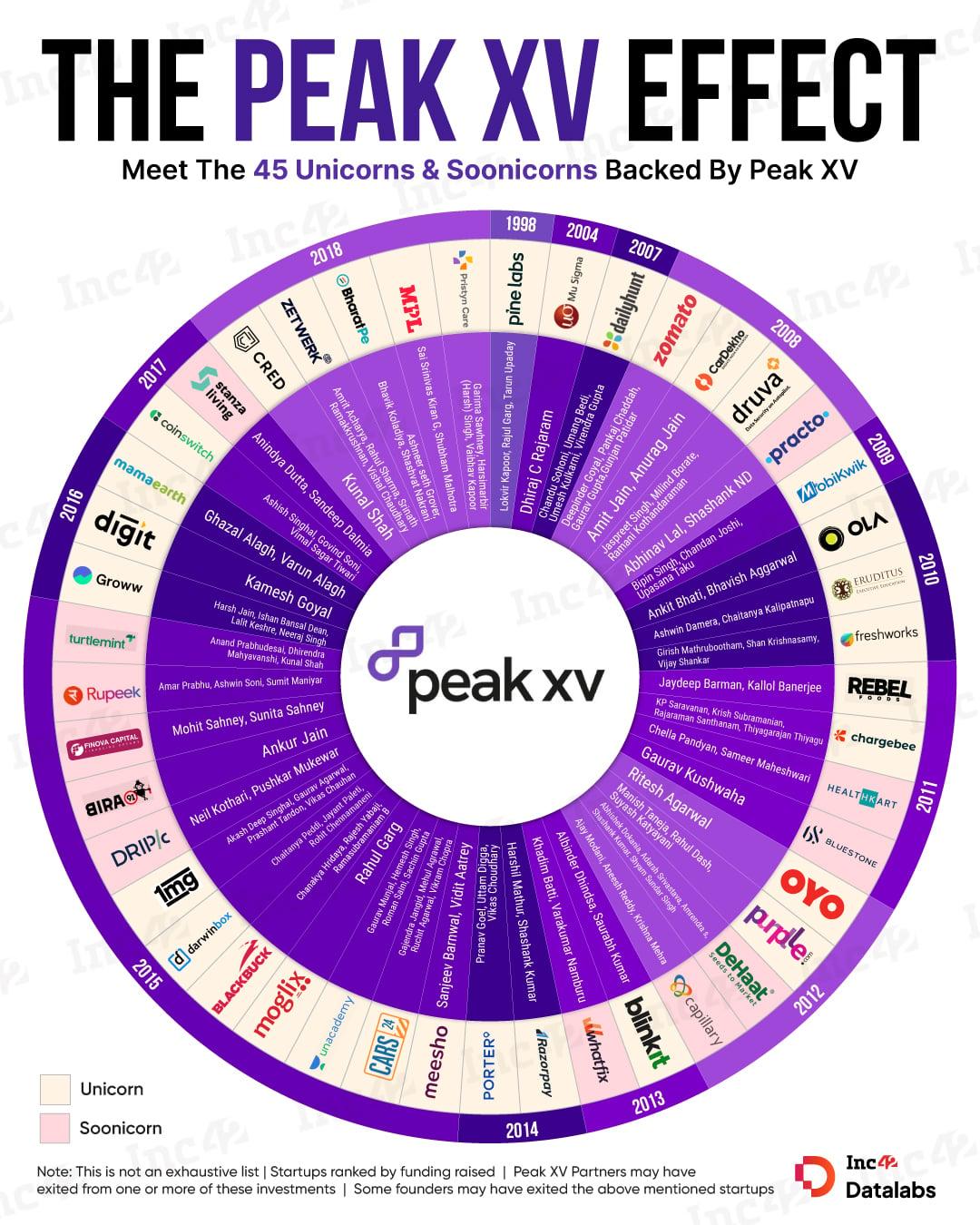

From Zomato to CRED and Mamaearth to Meesho, Peak XV Partners has been behind some of India’s biggest startup success stories.