Investors are rushing to buy a slice of Iluka Resources, the company developing Australia’s second major rare earth project, despite first production being pushed out to mid-2o27 and some investment banks concerned about “rare earth mania”.

Over the last six months, as China has tightened its grip on the supply of rare earths, Iluka’s share price has risen by 120% to an 18-month high of A$7.45 even as its traditional business of producing titanium minerals and zircon, is buffeted by falling prices.

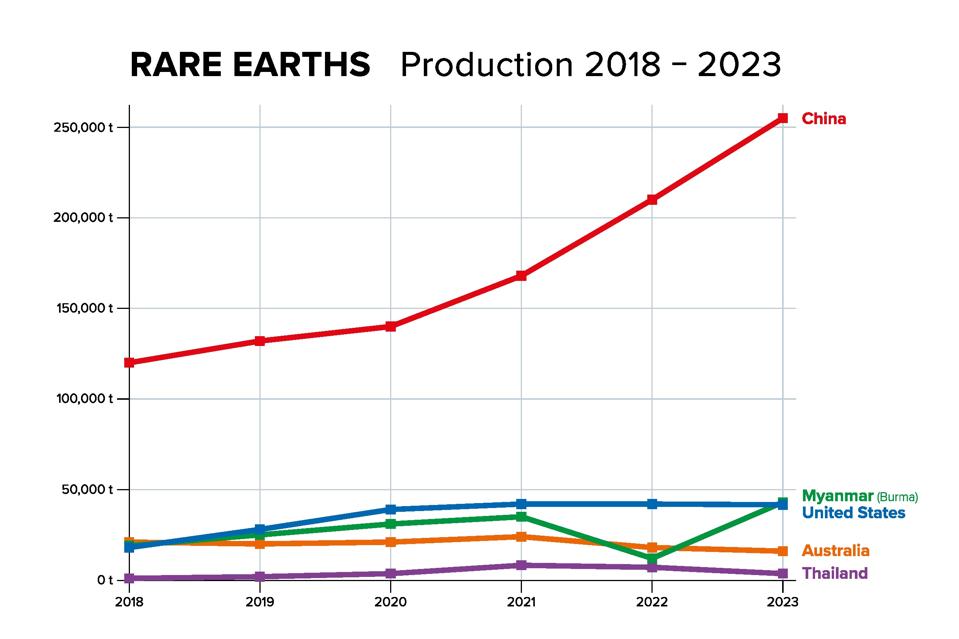

Rare earths production 2018 to 2023. China is by far the largest producer, followed by Myanmar, USA, Australia and Thailand.

getty

One of Australia’s oldest mining companies, Iluka is well known as a supplier of ilmenite and rutile which are used in making paint, and zircon which is used as a glaze on ceramics such as bathroom and kitchen tiles.

But also contained in the ore mined by Iluka in mineral sands deposits at several locations around Australia is a mildly radioactive mineral called monazite which contains high-value rare earths.

For the past 30 years Iluka has stockpiled its monazite in the belief that one day a use will be found for the mineral, which is now happening, offsetting the decline in demand for its ilmenite and rutile.

The switch from being best known as a zircon and ilmenite producer to rare earth supplier to rival Lynas Rare Earths, Australia’s better-known supplier of metals such as neodymium, praseodymium, and dysprosium, is being aided by generous Australian Government funding to build a plant costing an estimated $1.2 billion.

Demand for rare earths, which have growing commercial and military uses, coupled with Chinese controls on exports, has seen prices rise sharply. Neodymium is up 55% since April.

Investors have embraced the rare earth story even as investment bank analysts remain wary of the costs being incurred by Iluka to build its new rare earth processing factory at Eneabba on Australia’s west coast, and uncertainty about future prices for the material.

Rare Earth Mania

A visit by bank analysts last week to the Eneabba project generated cautiously positive reviews and at least one sell on Iluka because “rare earth mania” has seen the stock rise too far, too fast, with the effected likened to the fear-of-missing-out, or FOMO which is driving the gold higher.

Ord Minnett, a boutique brokerage, told clients that while it was confident of the technical achievement by Iluka at Eneabba the share price rally is unlikely to be sustained.

At its current level, the Iluka share price is said to imply a price of more than $110 per kilogram for the most commonly traded from of rare earths (a blend of neodymium and praseodymium known as NdPr). $110/kg is the price the U.S. government is paying for rare earths from the Mountain Pass mine in California.

Periodic table detail for the element neodymium.

getty

Other banks on the site visit were more positive but concerned about a slower than expected graduation from construction to production.

Morgan Stanley said the first production of NdPr was expected in mid-2027 while heavy rare earths such as dysprosium and terbium were not expected until the end of 2027 “a slight delay to our expectation,” the bank said.

Interestingly, Morgan Stanley has an overweight (or buy) rating on Iluka with a price target of A$6.40 which is A$1.16 below last sales of the stock.

Barrenjoey also has an overweight rating and price target of A$7.60 telling clients after the site visit it was impressed because the project was within budget despite time lost through design changes.