Taking stock of the Stock/Bond Ratio (reviewing technicals, sentiment, valuations, macro, and strategic asset allocation perspectives)

Stock/Bond Ratio: All the warning signs are there…

(p.s. skip to the end if you just want the bullet point summary + conclusion)

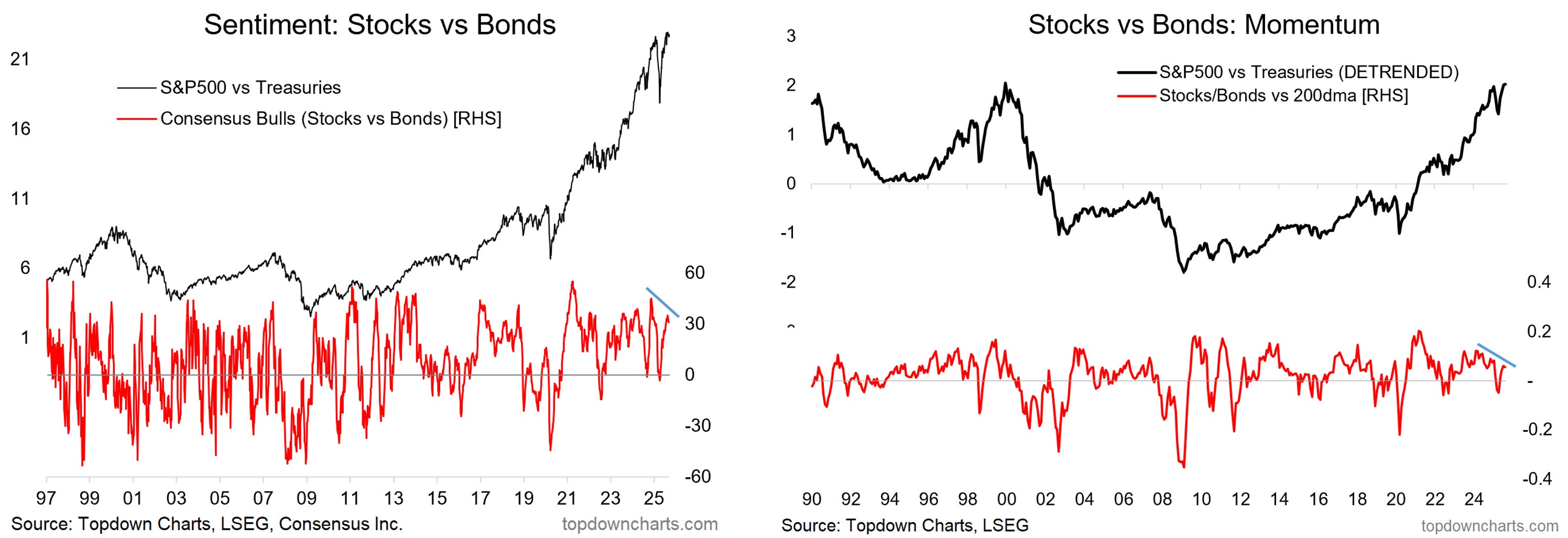

Sentiment & Technicals

While we did see a sharp correction in the stock/bond ratio back in April, this has since been unwound with a big rebound. But momentum is now fading as bonds begin to make a comeback of sorts.

On the technicals, 2 points of note are the higher high in the index vs lower high in relative sentiment (and rolling over from bullish levels), and lower highs in stock/bond ratio vs its 200-day moving average (i.e. fading momentum).

These are early warning risk flags.

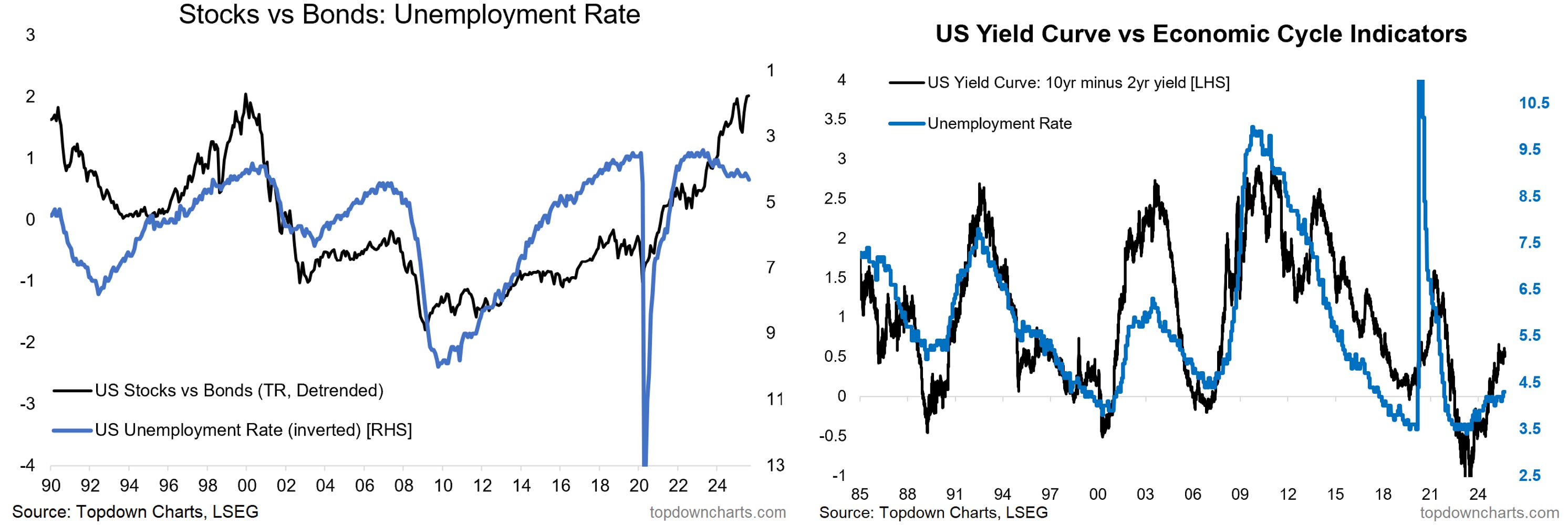

Macro

The other recent development of note for this theme is the tick up in the (and likely further upside if the historical linkage with the yield curve is anything to go by), and general softness in the labor market.

Of course, the real signal here is “recession: yes or no” – which is a lot of what it all comes down to when trying to guess the path of the stock/bond ratio (and hence its importance in active asset allocation).

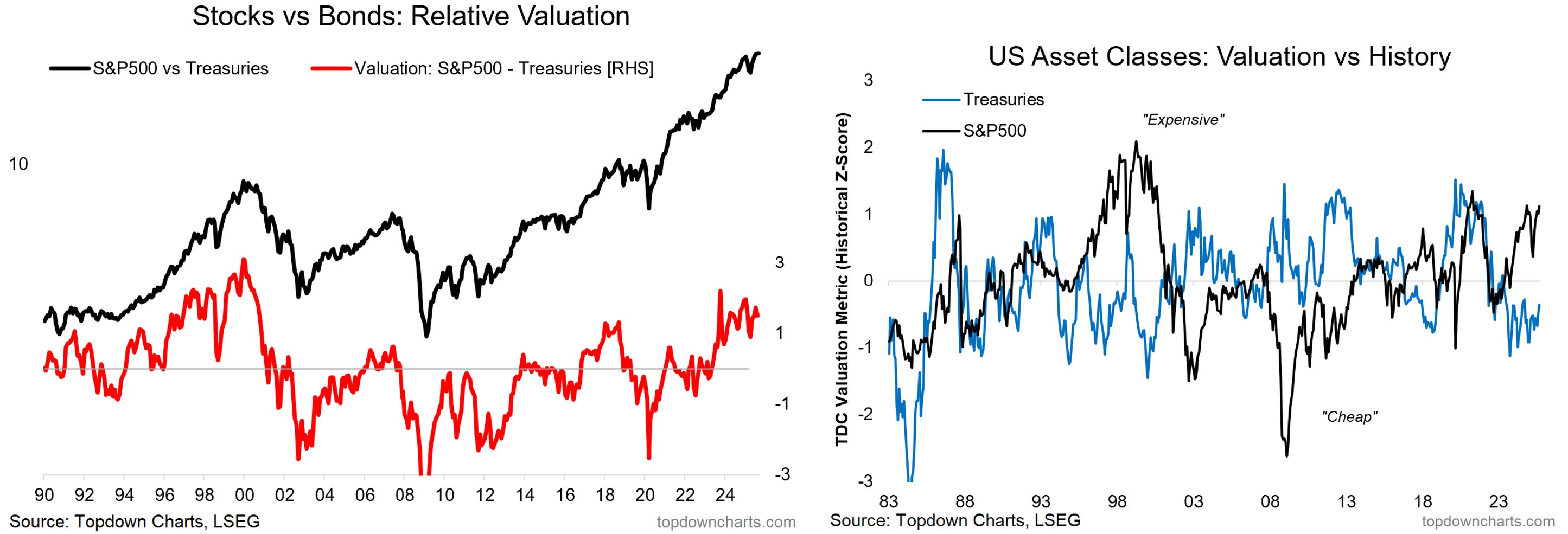

Valuations

In the background, meanwhile, valuations also caution of the potential for a peak: stocks are expensive outright, bonds are cheap outright (and turning up), and stocks are expensive relative to bonds – the combination of this and the macro/technical warning signs makes it begin to become a bit more tactically relevant.

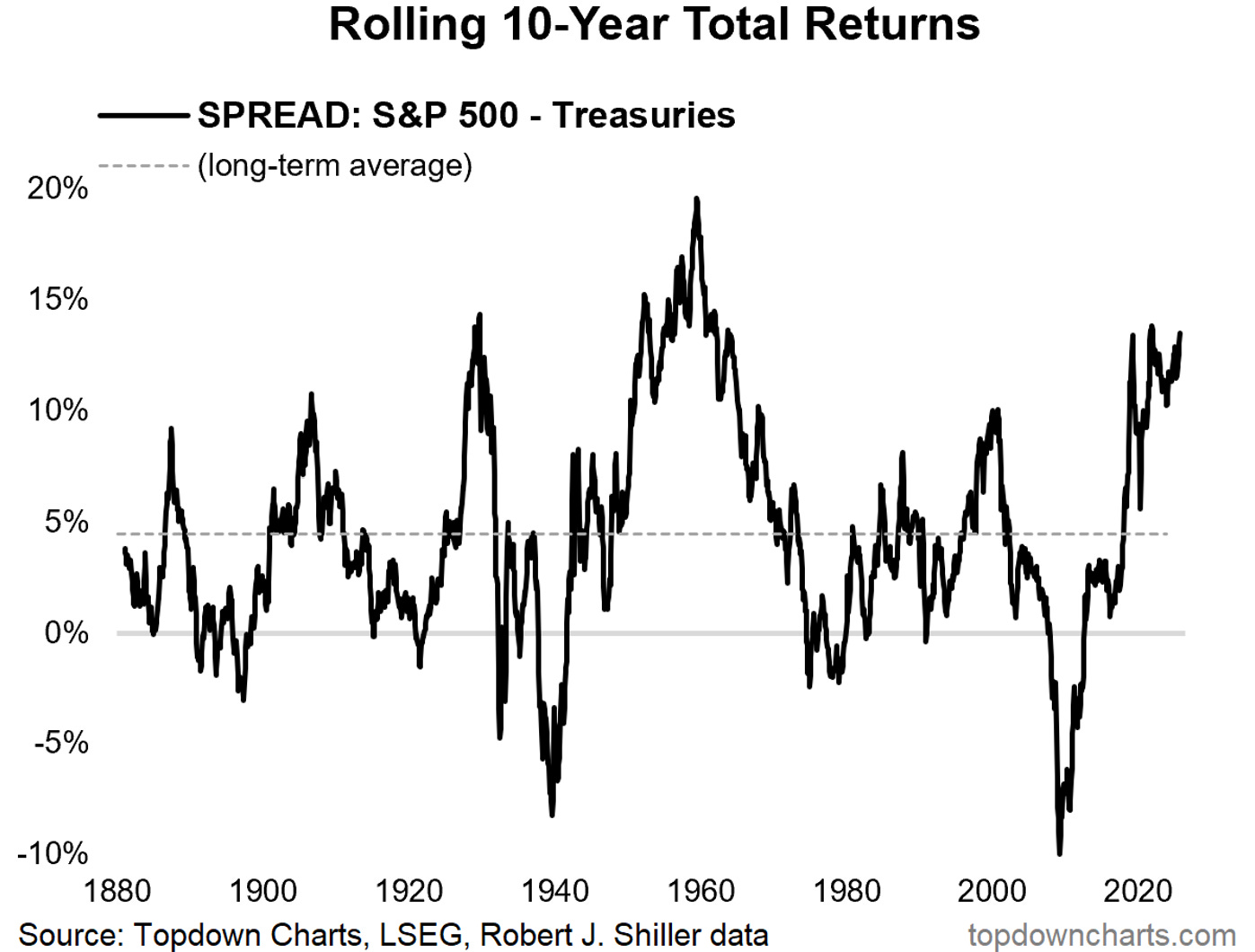

Long-Term Perspective & Cycles

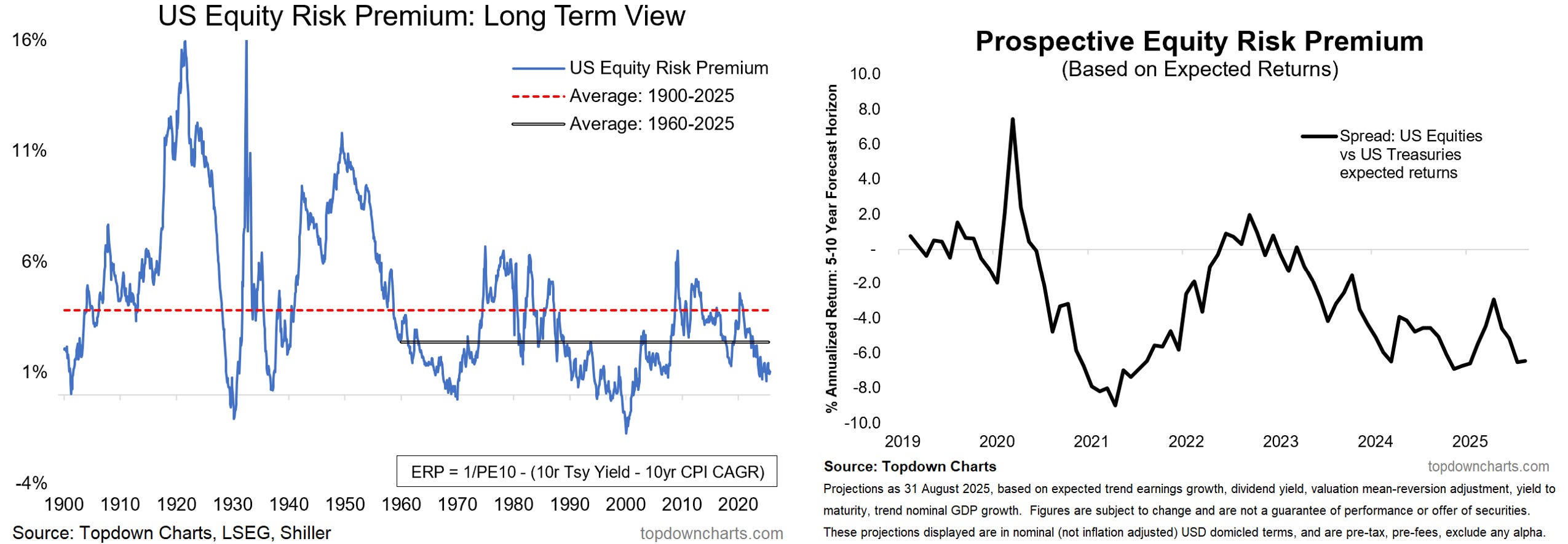

Meanwhile, zooming out to the strategic level, the rolling realized equity risk premium is looking stretched vs long-term average and cyclically well-aged.

Asset Allocation Strategy

The prospective equity risk premium (based on expected returns) is negative, and the ERP indicator from the Shiller data continues to track around 20-year lows.

All the warning signs are there, and we need to be paying closer attention to opportunities in bonds and risks in stocks, with the next logical step for asset allocators being a switch to underweight stocks and overweight bonds.

In Summary…

-

Sentiment & technicals are waving downside risk flags for the US stock/bond ratio (bearish divergences: higher high on the index vs lower highs in relative sentiment and price momentum, and relative sentiment rolling over from the highs).

-

Macro risk flags are also waving (weakening jobs market, higher unemployment rate; and prospect of it going higher based on the yield curve).

-

Valuations also highlight the potential for a peak in the stock/bond ratio (stocks are expensive, bonds are cheap, stocks are expensive vs bonds).

-

Bigger picture, the rolling 10-yr realized equity risk premium is stretched vs long-term average, and well-aged in the cycle; and forward-looking equity risk premium indicators point to negative/poor ERP going forward.

Bottom line: Seeing multiple warning signs for a downturn in the stock/bond ratio (sentiment, technicals, macro, valuations, and long-term cycles/strategic perspectives).