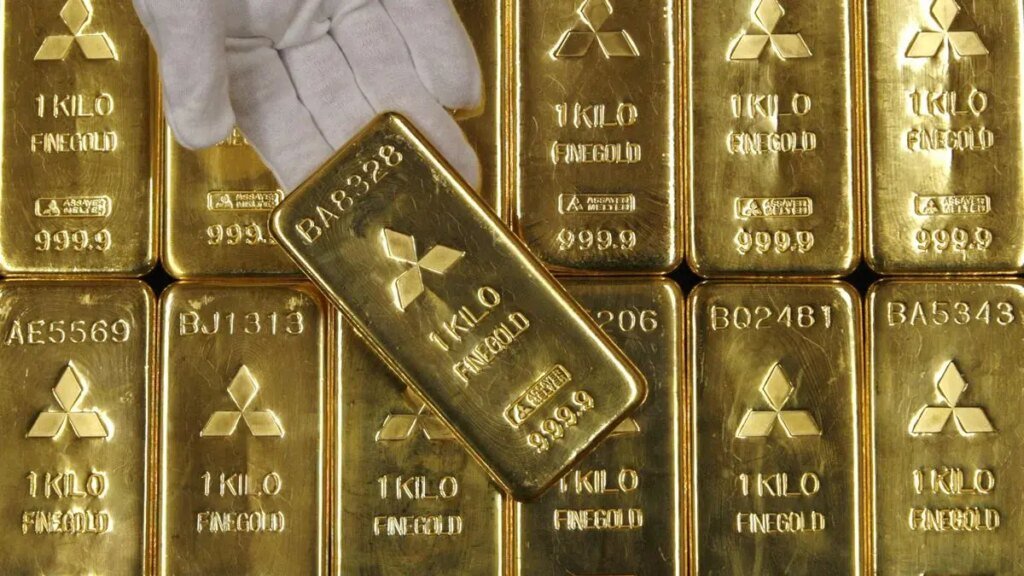

As gold soared to a new high of over $3,580 an ounce on Friday, prices of the precious metal will likely remain elevated for the rest of the year and could rise if the US lowers the Fed interest rates.

Analysts see gold’s sensitivity to US real interest rates rising as Western investors, particularly in the US, take a more active role. Goldman Sachs, on the other hand, has set a $4,000 per ounce target for mid-2026.

In India, there is more swing towards gold ETFs, while lightweight jewellery is gaining ground.

Fears over Fed independence

On Friday, spot gold was quoted at $3,584.28 an ounce at 1845 hours IST. Gold futures were ruling at $3,640.85. In Mumbai, spot gold (999 fineness) ruled at ₹1,06,340 per 10 gm. On MCX, gold October futures ended the first session at ₹1,06,711.

Renisha Chainani, Head-Research at Augmont, said gold could run-up to between $3650 and $3700.

Goldman Sachs, in its Commodity Views, said if private investors continue to diversify more into gold they would be a “potential upside to well above $4,000/oz mid-2026”.

This could be true if the Fed’s independence is damaged. This will lead to higher inflation, lower stock and long-dated bond prices. Besides, it will result in the erosion of the dollar’s reserve currency status, it said.

Up in all currencies

Research agency BMI said gold prices have returned to record-breaking territory “amid mounting bets of a September Fed rate cut and growing concerns over the Fed’s independence, against the backdrop of ongoing geopolitical uncertainties”.

The World Gold Council said the yellow metal gained in all major currencies, despite a much weaker US dollar in September. “And the positive momentum has carried on in early September,” it said.

“Over the next few months, we anticipate gold prices will remain elevated and only rise further if the US Fed lowers interest rates,” said BMI, which earlier said gold will be neutral to slightly bullish for the remainder of 2026.

Kotak Securities’ Commodity Research – Metals and Energy team said gold was holding above $3.550 amid political uncertainty, including Fed autonomy concerns and Trump’s tariff disputes. “With attention turning to the upcoming payrolls report, gold remains underpinned by rate-cut bets and haven demand,” it said.

Shifting relationship

The WGC, an organisation of gold producers, said the relationship between the price of gold and its core drivers is shifting, reflecting who is most active in the market.

Initially, central banks and Asian investors drove gold higher. “With a rise in inflation that is concurrent with a slowdown in economic activity and weakening labour markets, signals we are increasingly flirting with a stagflationary environment. And this tends to favour gold,” it said.

BMI said gold’s upside could be limited up to $3,600/oz as the market has already priced in a potential rate cut in September. “In the event that the US Fed holds interest rates steady, gold prices would likely suffer a setback down closer to $3,000,” it said.

As regards India, Prithviraj Kothari, Managing Director of RiddhSiddhi Bullions Ltd, said urban young and educated consumers, who are digitally savvy, are increasingly buying gold ETFs, sovereign gold bonds, and digital gold, which do not involve making charges and storage costs, as a means of wealth.

Stagflation worries

He said lightweight jewellery is the flavour of the day with rising prices for gold, creating an opportunity for weight-conscious buyers. “Gold coins and bars are especially popular among conservative households and small investors wanting to invest in a tangible asset,” he said.

The WGC said gold’s sensitivity to US real interest rates may increase as Western investors, particularly in the US, take a more active role amid softer demand from emerging markets.

“While rates in the long end remain sticky, this reflects growing stagflation concerns – an environment that has historically supported gold. Among US investor segments, ETF holders show the strongest response to stagflation risks and have picked up their pace of investment over the last few weeks, not just in the US but in Europe too, suggesting risk drivers are offsetting rates-based drivers,” said the council.

Traders in the futures market appear more focused on rate dynamics. “As the yield curve steepens (driven by lower front-end rates) and inflation fears persist, the interplay between macroeconomic signals and investor behaviour will be key in shaping gold’s next move,” said the WGC.

Published on September 5, 2025