Kevin PeacheyCost of living correspondent, BBC News

Getty Images

Getty ImagesGas and electricity prices will rise by 2% for millions of households under the latest cap announced by energy regulator Ofgem.

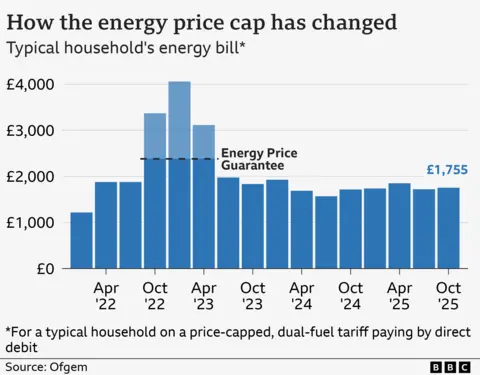

The increase, which is slightly more than analysts expected, means a household using a typical amount of energy will pay £1,755 a year, up £35 a year on the current cap.

It will kick in at the start of October, which campaigners say will mean another winter of relatively high energy bills.

Higher bills are the result of extra financial support for those on benefits, and costs involved in matching the supply of energy with demand, which includes switching generators such as windfarms on and off.

For a typical household, bills will rise by about £2.93 a month.

- About £1.42 a month of the increase will fund the government’s extension of the Warm Home Discount, giving money off winter bills for people on some benefits

- About £1.23 extra a month will go to the cost of ensuring a stable electricity supply, to balance when there is too much and too little power in the system

- Fixed costs to run the gas network have also risen and will take up another 72p a month

Some other costs have fallen slightly.

Ofgem uses the idea of a typical household, using 11,500 kWh of gas and 2,700 kWh of electricity a year, paid for by direct debit, to illustrate its calculations.

Finances under pressure

Ofgem’s cap sets the maximum price that can be charged for each unit of gas and electricity for millions of households in England, Scotland and Wales.

Individual households can calculate their estimated specific change by adding £2 onto every £100 they spend at the moment on energy each year.

The increase comes as families are also facing rises in other basic costs. The British Retail Consortium said that food costs were rising at their fastest rate since the February of last year, with the price of chocolate, butter and eggs soaring.

The energy cap sets the maximum price for each unit, but not the total bill which depends on how much energy you use.

The change comes into force at the start of October and lasts for three months.

Ofgem changes the cap, largely based on the cost of energy on wholesale markets.

However, the rise in bills this time is partly the result of the higher-than-expected costs to transmit energy to where it is needed in the country according to demand. This may include costs to switch off wind farms due to grid capacity issues and also firing up gas-fired power plants when supplies are short.

Extra support measures for consumers, previously announced by the government and in place this winter, have also contributed to higher bills.

Anyone on means-tested benefits will automatically receive the £150 Warm Home Discount on their bills. Some previously did not qualify owing to the size of their property, but that condition will be scrapped.

All billpayers will chip in to fund this extra support, mainly through higher standing charges – the fixed cost of connecting to the supply. It means standing charges will typically rise by 4% for electricity and 14% for gas, with the latter rising from 29p a day to 34p.

‘Healthier market’

The consumer group Which? said it could be a good time to shop around for a fixed-price deal, but billpayers should be alert to exit fees.

“Some contracts charge large fees to leave early, which would cancel out any savings,” said Emily Seymour, from Which?.

Ofgem said that more than a third of billpayers were now on fixed deals, where the price of each unit is fixed for a year and unaffected by the price cap.

Tim Jarvis, director general of markets at the energy regulator, said this was a sign of a “healthier market”.

He accepted that people would still feel the impact of a price rise, but added some could do things to save themselves money, such as paying via direct debit each month rather than receiving a bill every three months – called standard credit.

Around 20 million households pay by direct debit, with eight million on standard credit, and six million on prepayment meters.

Campaigners say many households are still struggling to pay bills, as well as repay £4bn of energy debt that built up during a period of high prices.

Simon Francis, coordinator of the End Fuel Poverty Coalition, said this would mean another winter of high prices.

“The average family still paying hundreds of pounds more than they did just a few years ago,” he said.

Some support comes from local communities. Staff at Parc Primary School at Cwm Parc in the Rhondda Valley provide extensive help for families struggling with everyday costs, including their energy bills.

The school is partnered with the Fuel Bank Foundation charity, providing vouchers to low-income families to meet energy costs.

“We’ve got a high level of need, and over the last couple of years we’ve seen that more and more. People are really struggling. And not only with the fuel, but life in general,” said Leanne Gough, the school’s family engagement officer.

“Sometimes you issue a fuel bank voucher and you can see the relief on their face, but it is a short-term. People are proud, so it takes a lot for them to come to ask. They will do everything they can beforehand.”

The government, which earlier this year made a U-turn on winter fuel payments, said it was determined to help vulnerable families by expanding the Warm Home Discount.

Energy minister Michael Shanks said the government wanted more clean energy produced domestically to bring down prices.

Energy UK, which represents suppliers, said the Warm Home Discount expansion should only be a temporary measure and targeting those most in need was a better long-term requirement.

The Conservatives said that energy bills were going up owing to government ministers’ choices, rather than wholesale costs.

Liberal Democrat leader Ed Davey said “the last thing” families and pensioners needed was higher energy bills this winter.