Like the computer revolution, which brought sweeping changes to the Indian banking industry, AI threatens to rewrite the rules of banking and finance. But the risk in AI-led transformation of fintech and banking is much greater than any tech adoption in the past.

Artificial intelligence (AI) is on everyone’s minds across sectors these days, but the Reserve Bank of India’s (RBI) report on Framework for Responsible and Ethical Enablement of AI (FREE-AI) has turned the spotlight on AI in India’s fintech and banking ecosystem

In its 103-page report, the RBI urged India’s financial sector to focus on building a strong AI infrastructure, including indigenous financial sector-specific AI models, to responsibly embrace developments in the realm of AI.

“Whenever new technology comes in, jobs are seen as the first victim. The same kind of concerns were raised when computers were introduced in the banking system around 1984,” said Rishi Agrawal, cofounder and CEO of TeamLease Regtech that assists companies adhere to regulatory compliance.

Like others in the banking and financial services industry, Agrawal also believes that upskilling is the need of the hour as the nature of jobs are going to change, and that the impact of AI needs to be addressed by all stakeholders and regulators. “Rather than constantly feeling threatened that existing jobs are at stake, we have to evolve, become more efficient, effective, and move in line with the way the world is morphing to adopt AI.”

And that’s the spirit behind the RBI report, which encourages companies to expand their horizons when it comes to AI but with certain caveats. Interestingly, the RBI does not mandate the use of sovereign AI models, but is looking to enable all AI innovation but within a responsible and ethical AI framework.

So amid the debate on whether India should build sovereign AI and foundational models, or if it should only focus on applications and smaller language models, the regulator’s opinion is clear — build it all, but responsibly.

The RBI’s AI Vision

The RBI committee has called for building foundational large language models (LLMs) that can accurately represent the “linguistically and operationally diverse” BFSI ecosystem. At the same time, the committee has also emphasised the need for building small language models specific to tasks, BFSI domains, as well as those designed around a single use case or a narrow set of tasks, and for fine-tuning existing open-weight models.

The RBI report is important for large financial institutions, which have already progressed in their AI journey despite having massive legacy processes in place. “We need a balance here: the scope of AI adoption shouldn’t be highly regulated, nor so loose that people misuse it. And everybody is evolving, so the regulatory draft circular gives us the ability to go back and engage with them, point out the issues and then evolve,” said SBI Mutual Fund digital technology and strategy head RS Srinivas Jain.

He added that internal discussions with the regulator have already begun, but did not divulge specifics. But it’s critical for BFSI players to see where their AI strategy meets the report’s recommendations and where it diverges.

For instance, SBI Mutual Fund (MF) has already deployed AI to streamline customer interactions and transactions, for data analysis purposes by its portfolio managers and research analysts, and is also developing models for various use cases.

The RBI’s latest report offers more clarity after the consultation paper floated by SEBI last month, which highlighted data transparency and security as key areas of concern in an AI-first world.

Jain said that the SBI mutual fund has already started drafting an internal AI policy, as recommended by the RBI and SEBI earlier. It recently hired a head of data science, too.

RBI regulated entities (REs) have been on their toes for a while now as many expect AI to transform key domains. Inc42’s interactions with multiple stakeholders make it clear that AI adoption is no longer seen as an option but a necessity. However, there are sections of the industry that seek more clarity even as they acknowledge the positive aspects of the RBI’s report.

That said, the RBI recommendations are quite new, so a lot of them are likely to be reshaped as the regulator seems to be open to consultation and feedback from the industry.

The Seven Pillars For Responsible AI

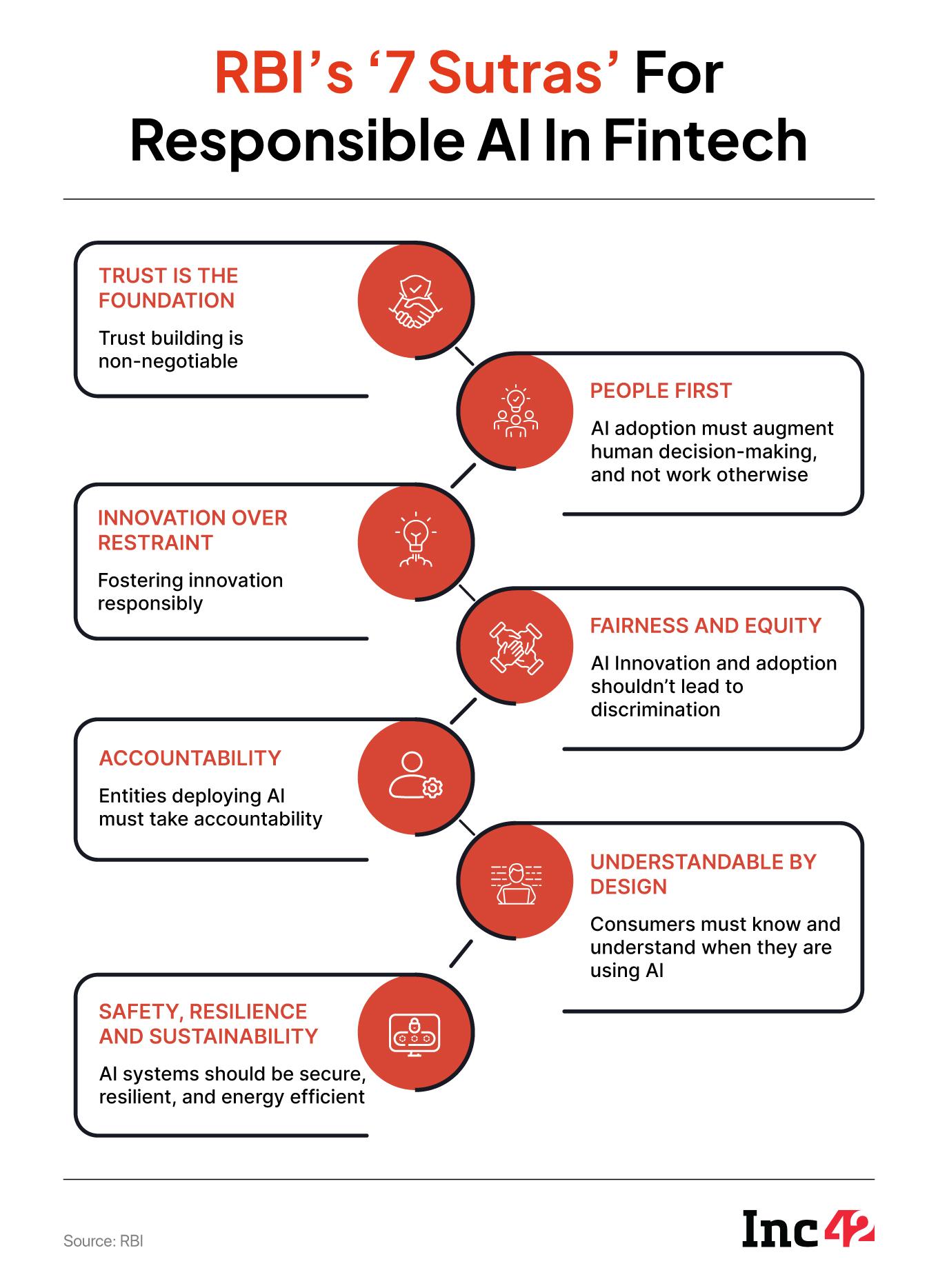

RBI’s call for infrastructure building is one of the key strategic pillars among seven guiding principles or ‘7 Sutras’ which together offer 26 actionable recommendations designed to foster trust and ensure safe, resilient, and sustainable AI adoption in BFSI.

The central bank has recommended six core visions to establish these seven guiding principles. These are: infrastructure, policy, and capacity to foster innovation, and governance, protection, and assurance for risk mitigation.

Among other recommendations, the RBI proposes establishing a shared infrastructure to democratise access to data and compute, and the creation of an AI sandbox similar to the existing regulatory sandbox for fintech.

It calls for building indigenous AI models tailored to the financial sector and framing an AI policy to guide regulation. For regulated entities, the RBI recommends the formulation of a board-approved AI policy and inclusion of AI-related aspects in operations in audits.

The RBI has stressed on standardised cybersecurity practices, incident reporting, governance frameworks and consumer awareness as other core tenets for AI adoption in fintech.

GenAI is poised to improve banking operations in India by up to 46%, the RBI stated, only to follow this up with caution on cybersecurity and other risks.

Besides, the RBI is also considering allocation of INR 5,000 Cr initially as a corpus towards the creation of shared data and compute infrastructure as public goods, which could be extended to INR 10,000 Cr over the next five years to support initiatives related to infrastructure build-up.

Agrawal of TeamLease Regtech believes it is time for larger financial institutions to make AI a priority and publicly document the experimentation, case studies, product development timelines and workflows so that lower-tier banks can also gradually implement AI for their operations.

“If MeitY provides the relevant compute infrastructure and data centre capability, RBI can provide regulatory oversight, and some of the top banks can start creating some success stories; this can become a widespread adoption story in India’s fintech digitisation and automation journey,” Agrawal, who leads the compliance and regulatory tech solutions wing of TeamLease, added.

SBI MF’s Jain said that while it’s good that regulators are intervening in the matter, putting their points out there, and asking stakeholders to hold conversations, there has to be flexibility given that if anything goes wrong during the experimentation phases, REs would be more liable. “There has to be a proper structure to mitigate the possible risks; otherwise, nobody will take the risks.”

Ethical AI: A Double-Edged Sword?

As hinted above, the RBI’s report has divided the stakeholders.

Bank employees’ trade union body, the All India Bank Officers’ Confederation (AIBOC), has already written to the RBI denouncing the proposal and demanding dialogue before taking any unilateral decision.

“While AIBOC acknowledges the framework’s aspiration to make AI trustworthy, fair and accountable, the Confederation warns that a top-down, time-bound imposition, absent social dialogue, risks legal uncertainty, consumer harm, exclusion of vulnerable segments, and fresh stresses on already stretched Public Sector Banks (PSBs),” the letter to the RBI read.

It has also pointed to possible job losses, saying automation without guarantees on redeployment, upskilling, and noncoercive transitions will “fracture morale and service quality”. “AIBOC demands a no-forced-redundancy covenant, a funded national upskilling mission for bank employees…”

While some of the top companies in the financial sector acknowledged concerns about job losses that have already shaken multiple sectors, they are also of the opinion that the world has to move forward, technology will evolve, and companies need to rethink job positions.

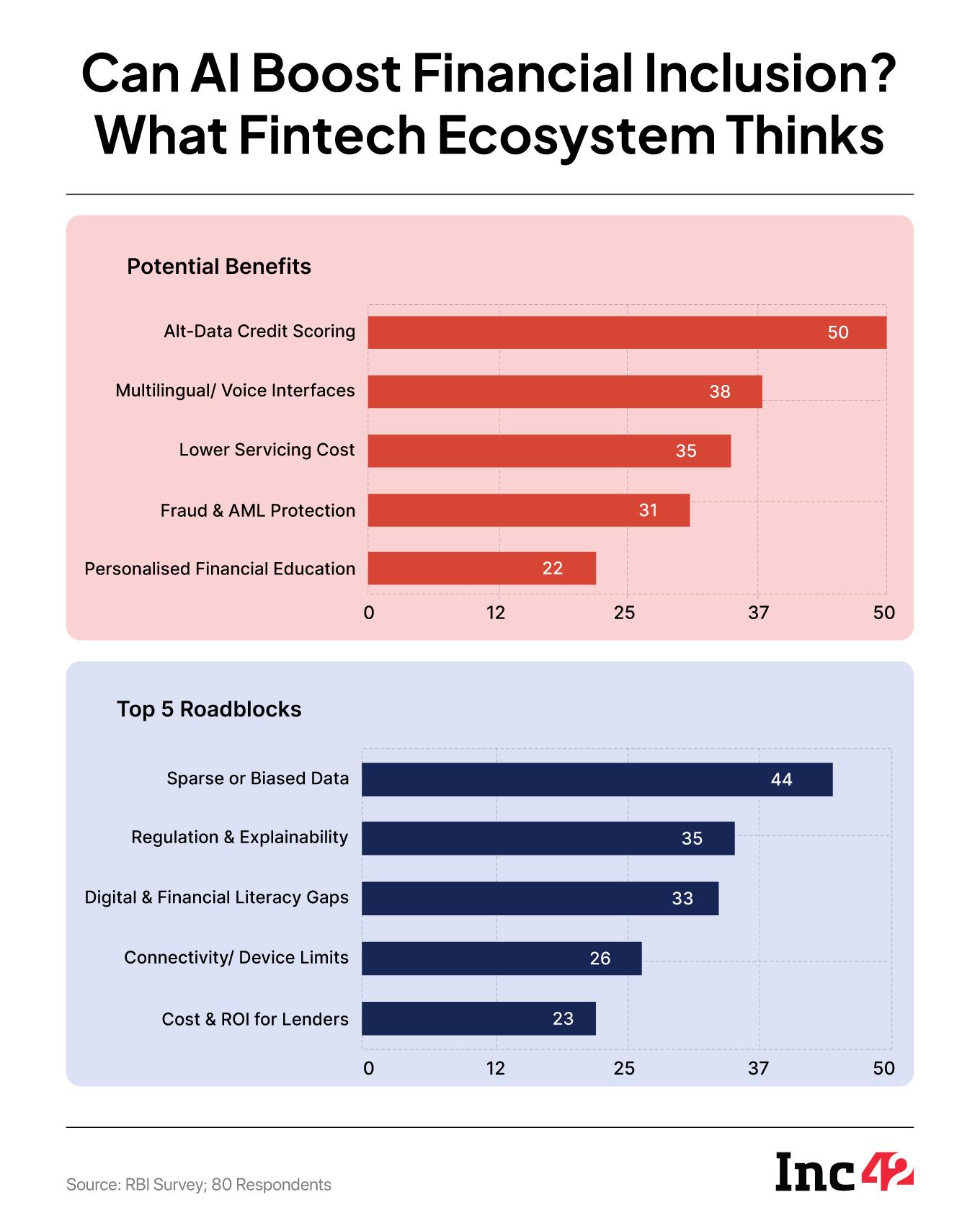

Experts are of the opinion that there needs to be more concern pertaining to the ethical use of AI and that data is not used for discrimination, given that it’s now going to touch the lives of people across every social and economic stratum.

While AI has biases and can pose certain dangers, the key to improving it is experimentation, innovation, and building sector-specific SLMs.

Sameer Mathur, MD and founder of payments solution company ROINET, also said that given that AI is so new and keeps evolving, every stakeholder will have to keep learning along the way as well.

“I think the regulator can play a huge role in getting different entities like the big banks and fintechs together and help them start working on pilot projects. We can’t just jump into it and start doing something at a massive scale. Fintechs and regulators can work together in cohesion to test out some of these models, create solutions, and then scale them that are better for the consumers,” Mathur added.

Why Responsible AI Is Critical

If we go back to the analogy offered by Jain, just in the last two decades, India’s financial landscape has gone from just computers to digital banking and now AI. This has coloured the new picture for fintech in India — starting with the UPI revolution to digital lending, merchant services, payment aggregators, wealth management, and neobanking.

While banks, NBFCs, and fintech startups have begun the AI adoption to optimise processes and costs, we are still in the early days. Larger banks and BFSI enterprises are said to be slower in shifting their processes towards AI because of the scale and sensitivity of data.

As these hurdles are eliminated, more and more large banks, AMCs and financial institutions will embrace AI to fast-track onboarding, credit and insurance underwriting and improve inclusion. The RBI is looking to ensure that data security, privacy, ethical and fair use of AI is at the heart of these changes.

But founders and fintech operators are worried that despite this report, the RBI and even SEBI are slow to react to AI. As ROINET’s Mathur said, “The pace at which AI is evolving and technology is changing in weeks and not in years, the next such report should not come after five years.”

Recommendations need to keep up with the times and scale of BFSI, and India still has to do a lot of catching up with the US, China, and the UK, he added.

Meanwhile, as the regulators take fast decisions and make due changes in order to ensure responsible AI adoption, larger entities are trying to put processes in place to adhere to the guidelines more seamlessly.

For instance, SBI Mutual Funds is trying to leverage AI to parse regulatory language and databases to give actionable insights to its internal teams to improve its compliance quotient and keep up with the tide of regulatory changes.

Everything said, a big question still remains about building the large language models, as no fintech firms or banks are yet interested in venturing into it.

Most of these companies are building SLMs on top of OpenAI, Llama, Claude, Gemini or other widely available LLMs or fine-tuning them for different use cases. Amid the talk of sovereign AI and cutting dependency on foreign players, India’s fintech and banking ecosystem also needs to reflect on this potential risk and whether this will necessarily align with the RBI’s proposed best practices.

[Edited by Nikhil Subramaniam]