Vancouver, British Columbia–(Newsfile Corp. – August 19, 2025) – Pacific Empire Minerals Corp. (TSXV: PEMC) (“Pacific Empire”, “PEMC” or the “Company”), a British Columbia copper-gold explorer, is pleased to announce that it has received a multi-year Mines Act Permit authorizing exploration activities at its 100%-owned Trident property in north-central British Columbia.

Permit details: Mines Act Permit MX-100000345, issued by the Ministry of Mining and Critical Minerals is valid until September 30, 2028, and authorizes:

- Construction of a camp and staging area

- Surface diamond drilling from 20 permitted drill sites

- Exploration access and construction or modification of access roads

- Fuel storage

The permit includes comprehensive environmental, cultural heritage, and reclamation requirements, including the protection of watercourses, caribou-interaction mitigation measures for work above 1,100 m, progressive reclamation, as well as invasive species control. These commitments align with Pacific Empire’s approach to responsible exploration and early-stage project stewardship.

Brad Peters, President and CEO of Pacific Empire, commented, “Securing this multi-year exploration permit is a significant milestone for Pacific Empire and clears the way for our inaugural diamond drilling program at Trident this September. This is the first time in over 50 years that this target area will be tested, despite extensive historical work in the region. With road access now in place and drill sites approved, we are in an excellent position to advance this gold-enriched copper porphyry project.”

The Trident property lies within the prolific Quesnel Terrane, immediately south of the Hogem Plutonic Suite contact with volcanic rocks of the Chuchi Lake Succession – a geologic setting known to host several producing and past-producing copper-gold porphyry deposits in British Columbia. Historical work on the property includes soil geochemistry, geophysics, and diamond drilling that confirmed widespread copper-gold mineralization but left the main target area untested due to historic access challenges.

Pacific Empire’s 2025 program will be the first modern drill campaign to directly test this high-priority target, following recent re-assay results collected from historical drill core and the acquisition of new high-resolution LIDAR data that will aid in more accurate drill collar placement.

Other Matters

The latest President’s Newsletter, along with updated maps and Corporate Presentation, are now available at www.pemcorp.ca.

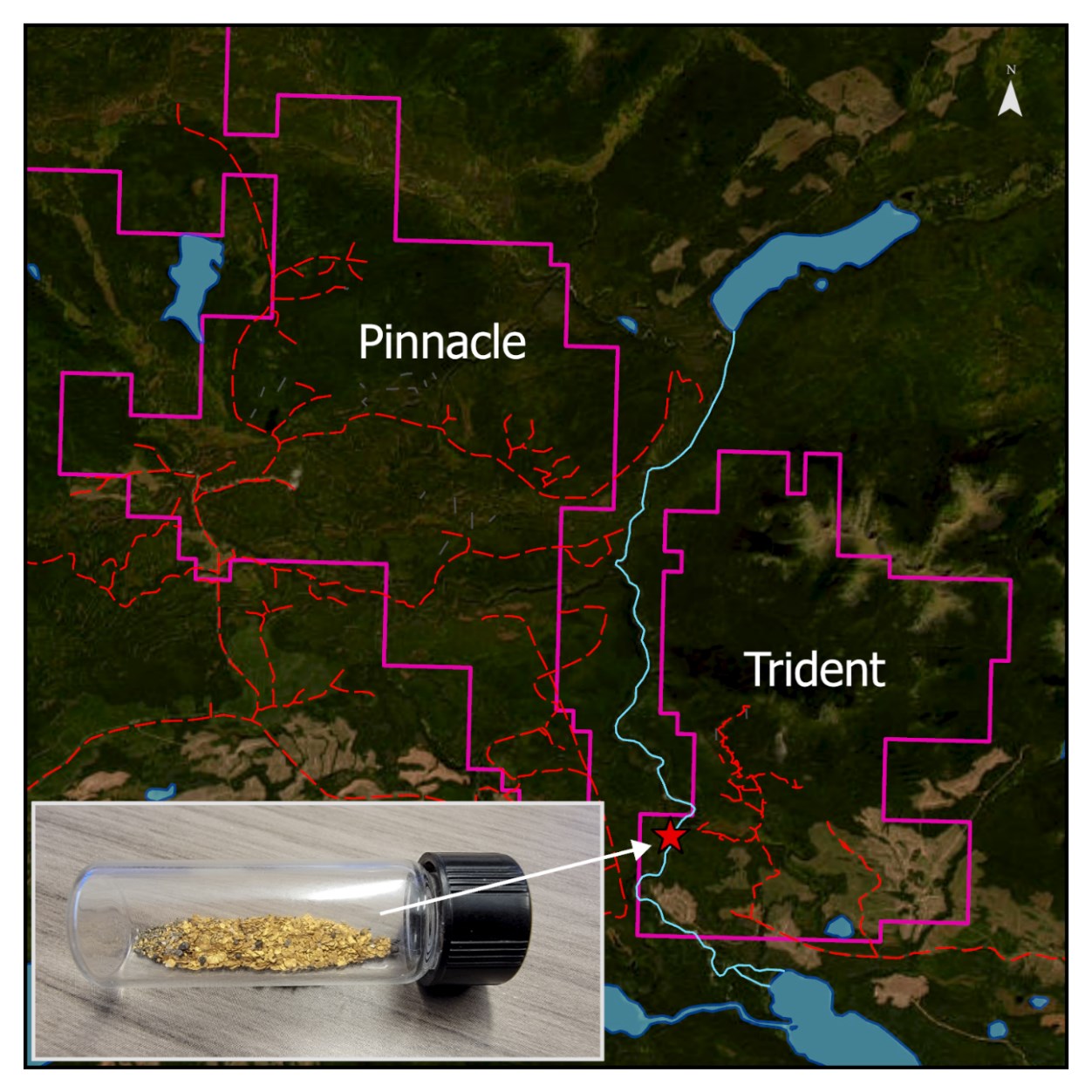

Figure 1 – Multi-Year Area-Based Permit Work Area

Figure 1 – Multi-Year Area-Based Permit Work Area

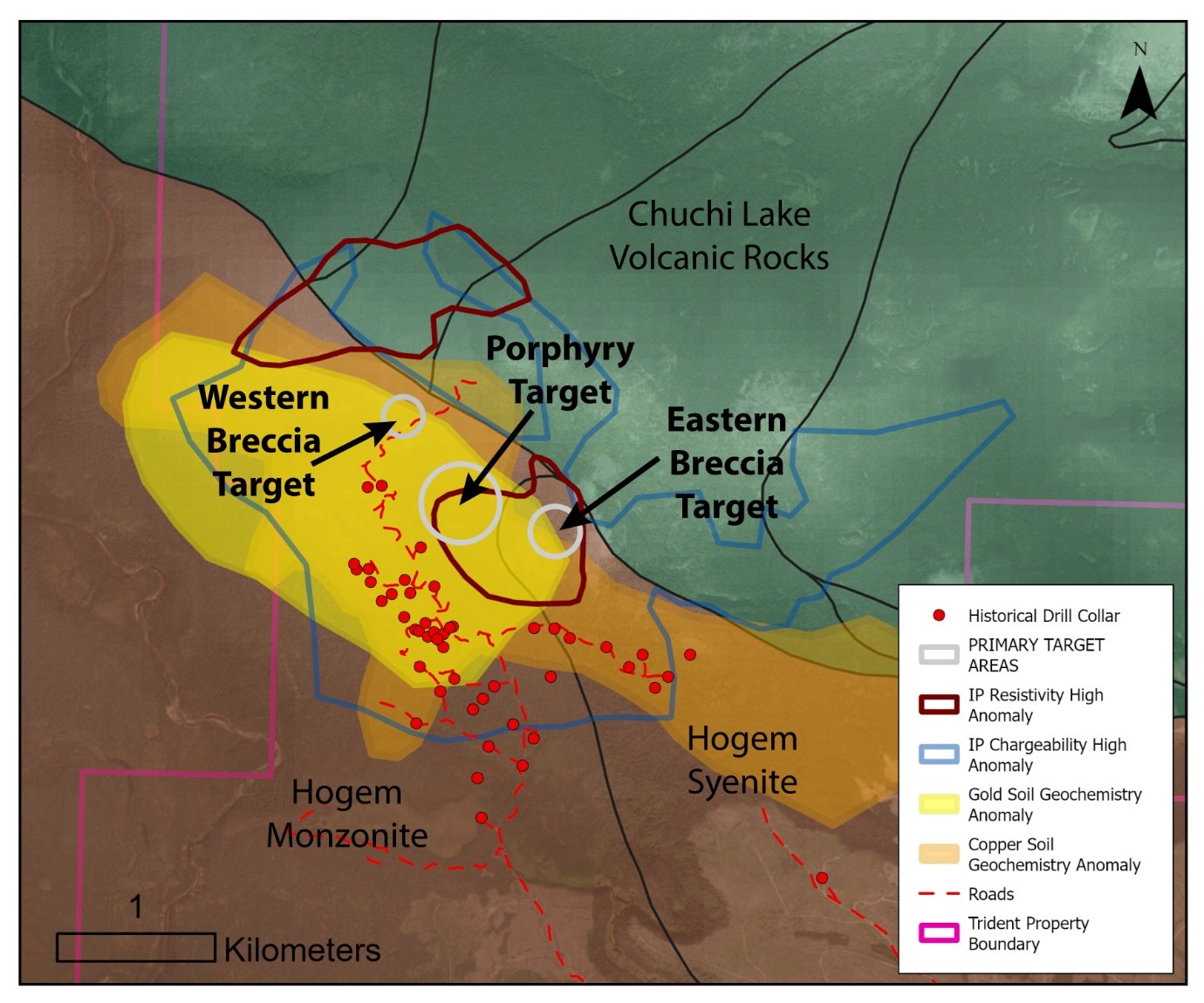

Trident Project: Priority Target Areas

The Trident Project is currently the primary focus for Pacific Empire. The main exploration target is a gold-enriched copper porphyry system, supported by robust copper, gold, and zinc soil geochemistry and multiple coincident geophysical anomalies.

Geochemical Support:

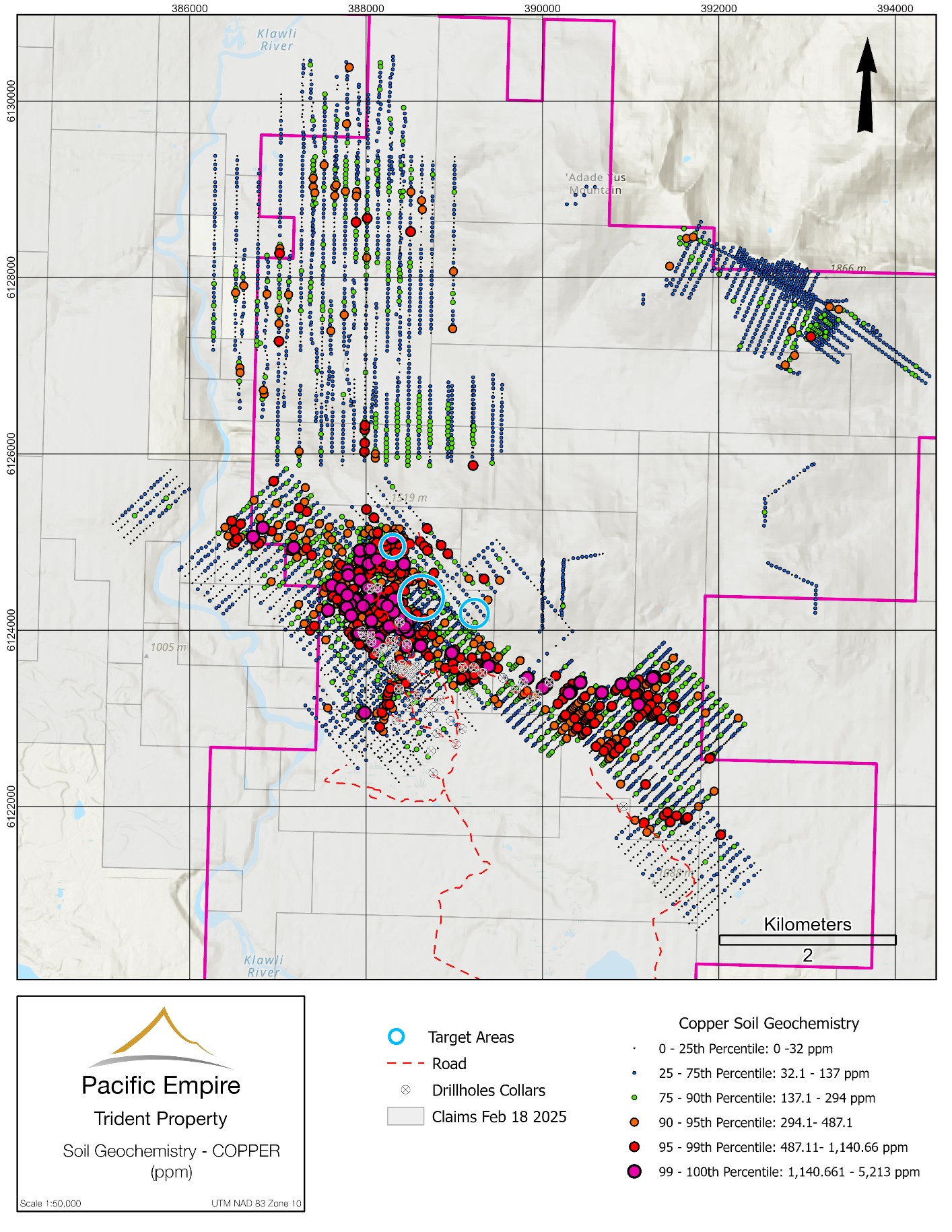

- Copper-in-soil anomalies with values up to 5,213 ppm Cu define a 2 km (N-S) by 4 km (NW-SE) zone (Figures 2 & 3).

- The anomaly lies on a significant slope, with drilling to date not yet testing the upslope source area.

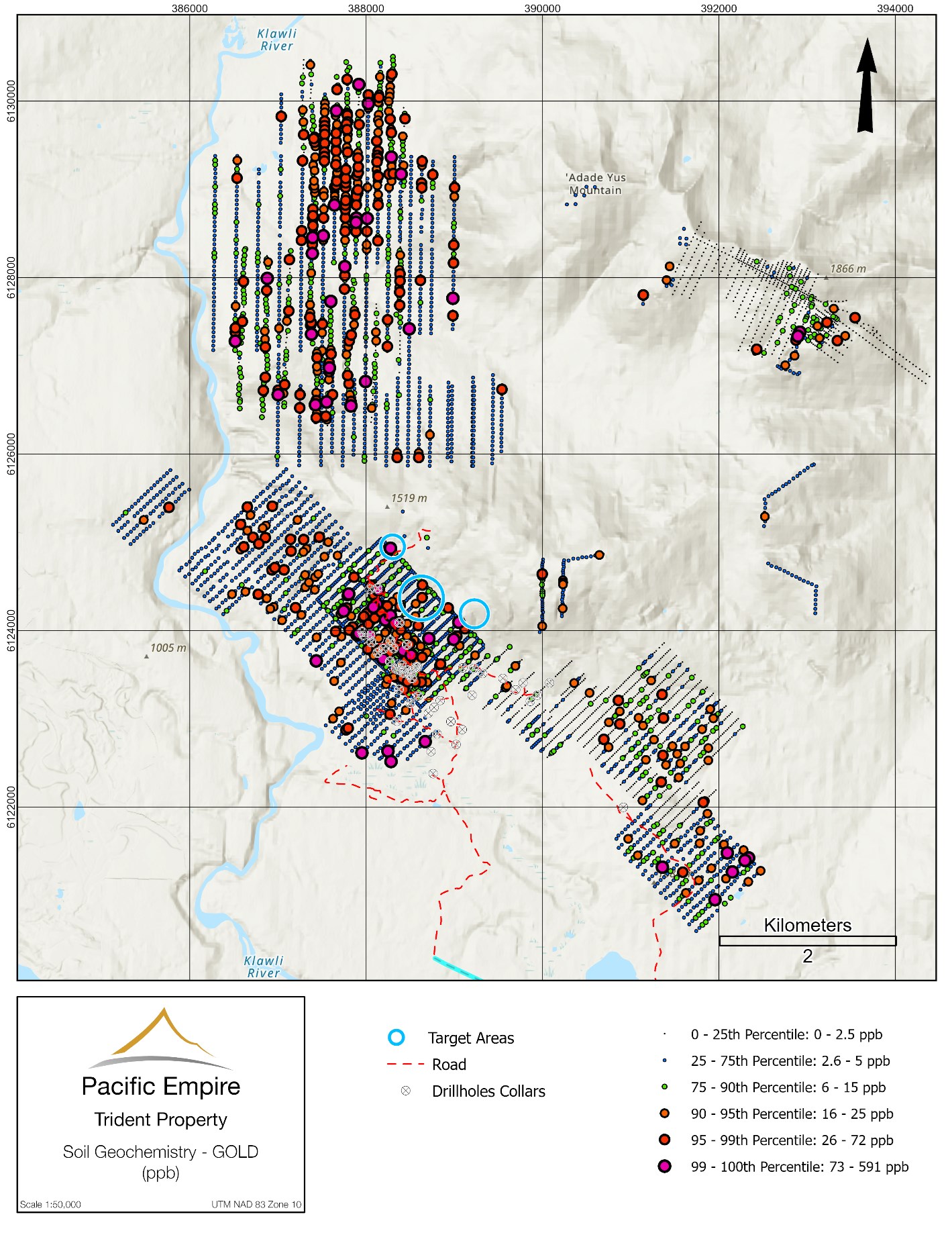

- Gold-in-soil anomalies up to 591 ppb Au characterize a 2 km by 1.5 km zone overlapping the copper anomaly (Figures 2 & 4).

- A strong distal zinc anomaly may be indicative of an outer halo of a robust copper-gold porphyry system.

Geophysical Support:

The porphyry target aligns with (Figure 2):

- An airborne resistivity high

- A chargeability anomaly from ground IP

- A resistivity high from ground IP

- A strong apparent resistivity anomaly from airborne Mobile Magnetotelluric (MT) data

Historical and Future Drilling:

- South of the main target, historical drilling (1970s, 2007) intercepted mineralized hornblende-feldspar monzonite porphyry dikes dipping north.

- Previous drilling was oriented north-to-south, away from the interpreted main porphyry zone.

- Future drilling will be oriented south-to-north from permitted sites located north of historical hole collars to directly target the inferred core of the system.

Breccia Targets:

- Eastern Breccia Target: Strong conductivity anomaly, float samples yielding up to 3.3% Cu, 3.6 g/t Au, 56.6 g/t Ag; barite vein sample returned 6.0% Cu, 6.0% Zn, 1.5 g/t Au, 5.0 g/t Ag.

- Western Breccia Target: A robust copper-in-soil anomaly coincident with a significant conductivity high.

Figure 2 – Compilation of geochemical and IP geophysical data with 2025 drill targets at Trident

Figure 2 – Compilation of geochemical and IP geophysical data with 2025 drill targets at Trident

Figure 3 – COPPER Soil Geochemistry

Figure 3 – COPPER Soil Geochemistry

Figure 4 – GOLD Soil Geochemistry

Figure 4 – GOLD Soil Geochemistry

Pinnacle Project: Emerging Targets

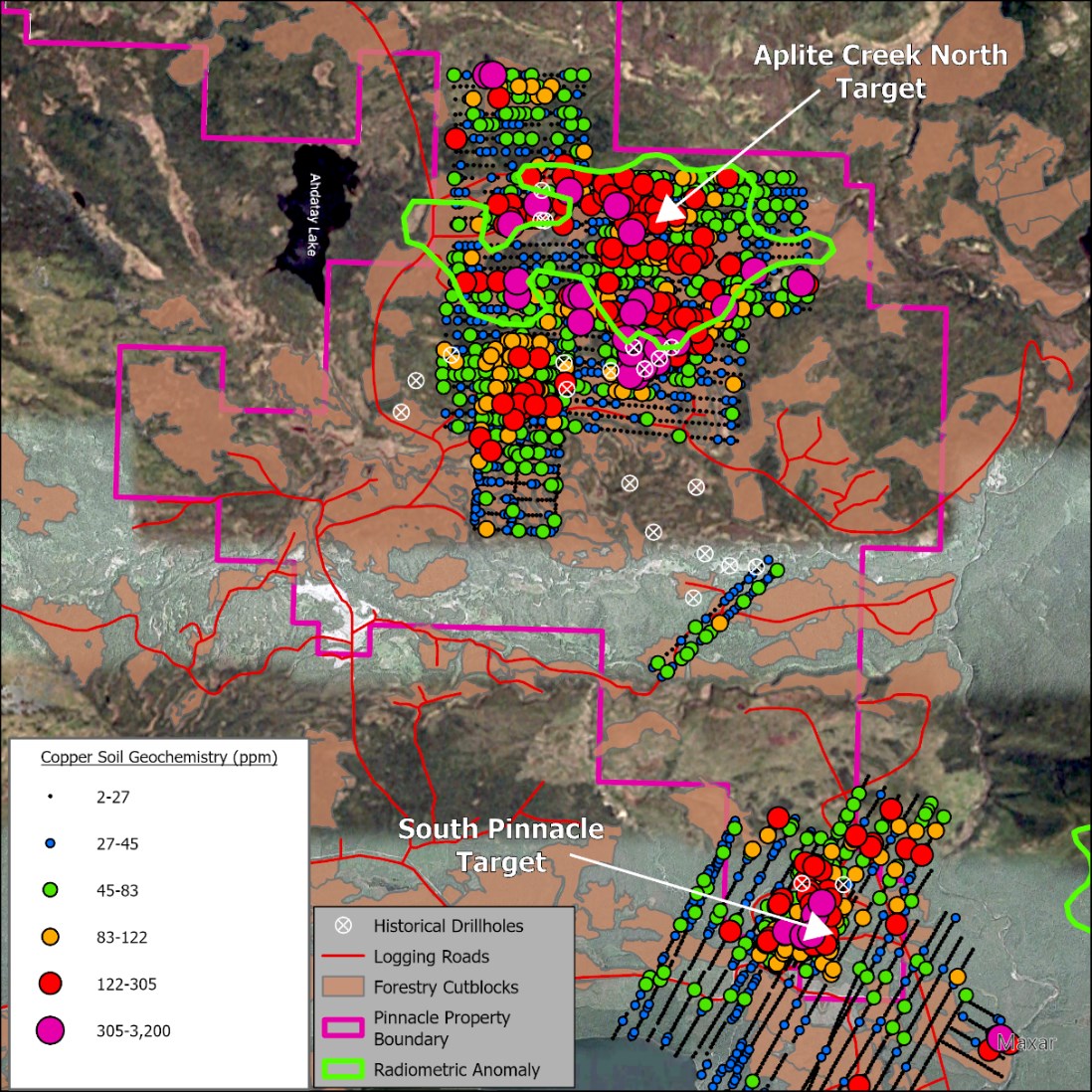

The Pinnacle property, located immediately west of Trident, has two primary target areas:

Aplite Creek North Target:

- Copper mineralization in outcrop is associated with known aplite dikes and quartz veining.

- Historical drilling (AH90-01) returned 6.0 m grading 6.4 g/t Au at Aplite Creek.

- Supported by a radiometric Th/K low (K/Th high), indicative of potassic alteration.

- Strong IP chargeability responses along target margins, coincident with copper-in-soil anomalies.

South Pinnacle Target:

- Copper-in-soil anomaly coincident with geophysical targets.

- Ovate magnetic and resistivity anomalies from 2007 Fugro airborne mag-EM survey.

- IP chargeability and resistivity highs from 2014 ground IP survey.

- Strong IP chargeability response along target margins, aligned with copper-in-soil anomalies.

Figure 5 – Exploration targets at Pinnacle with recent forestry cutblocks and new roads

Figure 5 – Exploration targets at Pinnacle with recent forestry cutblocks and new roads

Alluvial Gold in the Klawli River

The Klawli River, which divides the Trident and Pinnacle properties, has demonstrated proximal near surface gold occurrence potential. Panning in the river has yielded significant placer gold ranging from fine flour gold to flakes measuring approximately 1 mm thick and 2-3 mm in diameter. The presence of placer gold in the Klawli River suggests nearby hard-rock gold source(s) and further underscores the potential for additional discoveries in the region.

Figure 6 – Gold from the Klawli River. Did it come from Pinnacle or Trident or both?

Figure 6 – Gold from the Klawli River. Did it come from Pinnacle or Trident or both?

About Trident

The Trident property is an early exploration stage property hosting an alkalic porphyry copper-gold-silver prospect with district-scale potential that is accessible by vehicle. The property is located approximately 50 km southeast of the Kwanika deposit owned by NorthWest Copper Corp. and 50 km to the northwest of Centerra Gold’s Mt. Milligan Mine. The property covers 6,618 hectares endowed with well-established logging roads providing important efficient access to conduct exploration programs.

Copper mineralization on the property was first discovered in 1969, while exploration crews were following up on anomalous stream sediment samples. The following year, Falconbridge optioned the property and over the next two years completed IP and magnetic surveys, geological mapping, soil sampling and diamond drilling. This work ultimately led to the discovery of the A Zone.

Additional exploration programs were completed by Kookaburra Gold Corp. from 1988 through 1991, Solomon Resources Ltd., from 2006 through 2008. In 2013, PEMC optioned the property and in 2014, in turn, PEMC optioned the property to Oz Minerals which completed during that same year, an IP survey and completed a two drillhole, diamond drill program at Trident.

In 2022, Pacific Empire acquired a 100% interest in the property in exchange for granting the vendors a 2% net smelter return royalty (“NSR“). One-half (1%) of the 2% NSR which may be purchased for $500,000 by Pacific Empire.

Prior to 2014, known mineralization on the property was believed to be associated with fracture and/or shear zone structures striking 120 degrees and dipping 75 degrees towards the northeast. A review of historical drill core by the Pacific Empire exploration team has led to a much different interpretation with respect to the nature of known mineralization on the property. The most important observation made was the determination of the presence of hornblende-feldspar monzonite porphyry intrusions detected within drill core obtained from the A Zone. These types of porphyry intrusions are typically characterized by sheeted quartz sulphide veins hosting disseminated chalcopyrite and bornite residing immediately adjacent to and within the porphyry dikes. Other observations include the highest grades noted in historical drilling can be seen to be directly associated with intervals where such porphyry intrusions occur.

About Pinnacle

The Pinnacle project is located 60 km west of Centerra Gold’s Mt. Milligan Copper-Gold Mine and 30 km southeast of NorthWest Copper’s Kwanika Copper-Gold Deposit in a proven copper-gold porphyry district. Access to the Pinnacle is by road including a new and expanding network of logging roads and trails throughout the main target areas. This improved access is a significant development and is anticipated to contribute to cost effective drill support and provides additional bedrock exposure.

Qualified Person’s Statement

Kristian Whitehead, P.Geo., serves as a qualified person as defined by NI 43-101 and has reviewed the scientific and technical information in this news release, approving the disclosure herein.

About Pacific Empire

Pacific Empire is a copper exploration company based in Vancouver, British Columbia and trades on the TSX Venture Exchange under the symbol PEMC. The Company has a district-scale land position in north-central British Columbia totaling 22,541 hectares.

British Columbia is a “Green” copper jurisdiction with abundant hydroelectric power, access and infrastructure in close proximity to the end market.

ON BEHALF OF THE BOARD,

“Brad Peters”

President, Chief Executive Officer and Director

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Information set forth in this news release may involve forward-looking statements under applicable securities laws. Forward-looking statements are statements that relate to future, not past, events. In this context, forward-looking statements often address expected future business and financial performance, and often contain words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, and “intend”, statements that an action or event “may”, “might”, “could”, “should”, or “will” be taken or occur, or other similar expressions. All statements, other than statements of historical fact, are forward-looking statements. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: the need for additional financing; operational risks associated with mineral exploration; fluctuations in commodity prices; title matters; environmental liability claims and insurance; reliance on key personnel; the potential for conflicts of interest among certain officers, directors or promoters with certain other projects; the absence of dividends; competition; dilution; the volatility of our common share price and volume and the additional risks identified the management discussion and analysis section of our interim and most recent annual financial statement or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date that statements are made, and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable securities laws. Investors are cautioned against attributing undue certainty to forward-looking statements.