Six UK-based property companies tied to Saifuzzaman Chowdhury, a former Bangladeshi land minister and close ally of ousted Prime Minister Sheikh Hasina, have collapsed into administration, marking a dramatic fall for a once-expansive real estate portfolio now entangled in a widening corruption scandal.

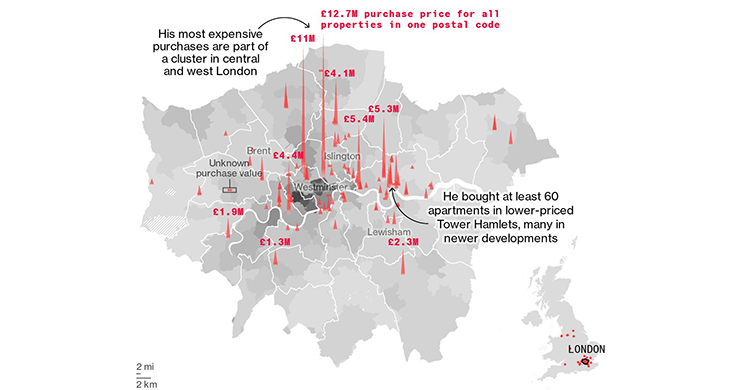

Chowdhury’s UK property empire, valued at approximately £170 million and comprising over 300 residential and commercial units across London and the South East, has unravelled following a freezing order issued by the UK’s National Crime Agency (NCA), reports The Telegraph.

The action came at the request of Bangladesh’s current government, which is conducting a sweeping anti-corruption crackdown targeting assets allegedly acquired through illicit means during Sheikh Hasina’s tenure.

Among the high-value properties seized is an £11 million luxury mansion in St John’s Wood, north London, and a multi-million-pound apartment block in Fitzrovia, central London.

Administrators from Grant Thornton have now been appointed to manage and sell off large portions of the portfolio to repay creditors, including Singapore-based DBS Bank and the British Arab Commercial Bank.

Bangladeshi authorities allege that Chowdhury laundered funds from Bangladesh into the UK property market. The Dhaka-based United Commercial Bank is also pursuing him for $350 million (£260 million), according to filings with UK Companies House.

Chowdhury has consistently denied any wrongdoing, calling the investigation a “politically motivated witch hunt.” He maintains that all his overseas investments were made with legitimate income earned during his time in public office.

The collapse of his businesses coincides with a broader probe into real estate holdings in the UK linked to former members of Sheikh Hasina’s government and her extended family. Hasina, who remains in exile in India, is among 27 individuals, including her niece, former UK City Minister Tulip Siddiq, recently indicted by Bangladeshi courts on corruption-related charges.

Siddiq, who resigned from her ministerial post in January amid mounting scrutiny, is accused of receiving a government-allocated land plot illegally during her aunt’s administration. She denies all allegations, describing them as “completely absurd.”

In a recent interview with The Guardian, Siddiq said she has not been formally informed of the charges against her and expressed bewilderment at being tried in absentia.

“I still don’t know what the charges are against me,” she said. “I feel a bit like I’m trapped in a Kafkaesque nightmare – put on trial without knowing what it’s about.”

The case has drawn international attention, highlighting concerns over the flow of allegedly illicit funds into the UK property market from foreign elites. Anti-corruption watchdogs have long urged stronger enforcement of transparency rules for overseas investors.

Chowdhury, once described as being treated “like a son” by Sheikh Hasina, now finds himself at the center of one of the most high-profile financial collapses linked to Bangladesh’s political upheaval.

As administrators move to liquidate assets, questions remain about how much of the alleged illicit wealth can be recovered, and what further revelations may emerge from the ongoing investigations in both Dhaka and London.