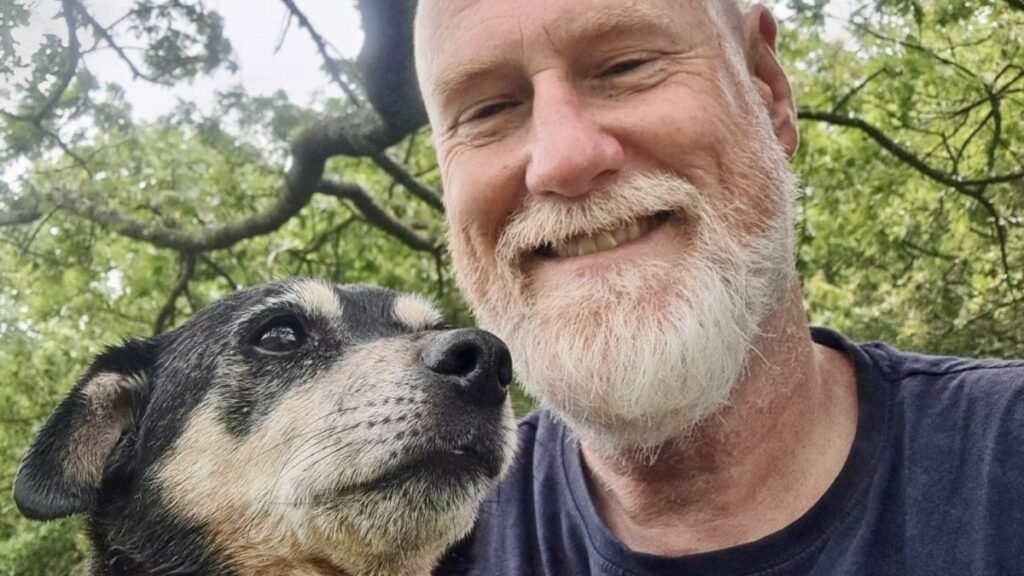

Chris Kelly and thousands of others across the UK put their savings into a project in the Scottish Borders which has gone ‘wildly off the rails’

People who put their money into a community-owned wind farm fear they have lost thousands of pounds each after the “disastrous” venture collapsed.

Around 7,000 residents from across the UK formed a co-operative to fund a planned wind farm at Whitelaw Brae in the Scottish Borders in the hope of lowering their own energy bills.

But their partner Ripple Energy – a renewable company believed to have gathered more than £10m from members – went into administration in March, leaving the plan in disarray.

Chris Kelly, who lives near Stoke-on-Trent, is “angry” that he put £2,000 into a wind farm in Scotland which Ripple Energy and the co-op did not build.

The 57-year-old has not been able to get his money back. “It’s been a disaster,” said the health and safety consultant. “It’s been very stressful and time-consuming to deal with it.”

The onshore wind farm, planned for a site north of Dumfries, was to be co-owned by members of the co-op.

As the co-op’s partner, Ripple Energy was supposed to arrange deals with the big energy suppliers, so that the power generated from the turbines led to discounts electricity bills for members.

“I’m [financially] comfortable – but I had hoped to save on bills,” said Kelly, who had expected to reduce his energy costs by between £350 to £500 a year.

He said Ripple Energy’s collapse has left him feeling “vulnerable” as he prepares for retirement.

Some co-op members have managed to reclaim their money from their bank after making a “charge back” request. But some – like Kelly – have not yet been able to recover their funds this way.

The payment platform that he used to transfer £2,000 to Ripple Energy has told him it needs more information about the administration process, he said.

Kelly added: “I’m not writing off the money yet. The money should be in the account the administrators are looking at. I still hope I, and others, can finally get our money back.”

Others who gave Ripple Energy their money are not so optimistic.

Judy Merchant, 42, who lives in the north-east of Scotland, put around £2,500 into the Whitelaw Brae project. “I’m not hopeful of getting it back,” she said.

The former renewables consultant was told by her bank that she would have to wait to see the outcome of the administration process.

“It’s been very stressful,” said Merchant. “I’m furious at Ripple Energy. At no point did they ever say they had any difficulties.”

“Our money should still be there [in an account held by the administrators]. Why are we having to fight the administrators for basic information and to get our money back?”

It is still not clear why Ripple Energy collapsed earlier this year. A preliminary report by the administrator – a firm called Begbies Traynor – highlighted cash flow problems and said there had been “significant level of accounting discrepancies” first identified in late 2024.

The company had raised £10.4m from the co-op’s members by the time in entered administration, the report indicates.

Around £6.8m still sits in a “ring-fenced” account, the document states. But it is not clear whether it will be used to return co-op members at least some of their money, or pay off other creditors.

Thomas Prior, a member of the co-op’s board – known as Ripple Co-op 4 – lost around £2,300 of his own money when Ripple Energy imploded. But he has been able to get almost of it back through his bank.

“Some have been successful, some have not yet been unsuccessful,” Prior said on the effort to help members recover money from their bank or building society.

“There’s been a lot of stress and sleepless nights for everyone involved,” he added.

“We want those unsuccessful with their bank to be able to get something through the administration process. We need answers.”

Prior said it was not clear exactly how many of the roughly 7,000 members are still owed money.

The administrators have not yet provided a full list of names or the amounts they put in to the project – information which had been held by Ripple Energy.

Sam Bayley, who became chair of the co-op after Ripple Energy’s collapse, said: “There could be thousands who are still owed money. The question is – is the money ring-fenced in trust for Co-op4? We believe it should be.”

Asked if members would ever get their money back, a spokesperson for the administrator Begbies Traynor said it was continuing to carry out all “legal and professional obligations,” with the aim of “achieving the best possible outcome for the company’s creditors.”

They added: “As this remains an ongoing matter, and in line with our firm’s policy, we are unable to provide any further comment at this time.”

Despite their frustration, co-op members who spoke to The i Paper are not bitter or cynical about wind power, or about community-led renewable energy projects.

“I’ve got solar panels on my house, I’ve got an electric car,” said Prior. “I thought I was doing the right thing by going further. But sadly, it went wildly off the rails.”

Merchant added: “I wanted to do my bit to help get us net zero and make my life easier when it comes to my bills.

“I still think it [community energy] is a brilliant model – but it’s probably the only thing like this I’ll ever do. I don’t have the money to do it again.”

Kelly added: “I still believe in the technology of wind power. But I would think again before putting money into any kind of similar project.”

An energy investment company called Thrive Renewables has acquired the rights to the same Whitelaw Brae site in the Scottish Borders and has its own plans to get a wind farm built there.

But it is not connected to Ripple Energy or with the co-op, which is solely focused on getting members their money back.

Former Ripple Energy chief executive Sarah Merrick declined to comment.