Via Metal Miner

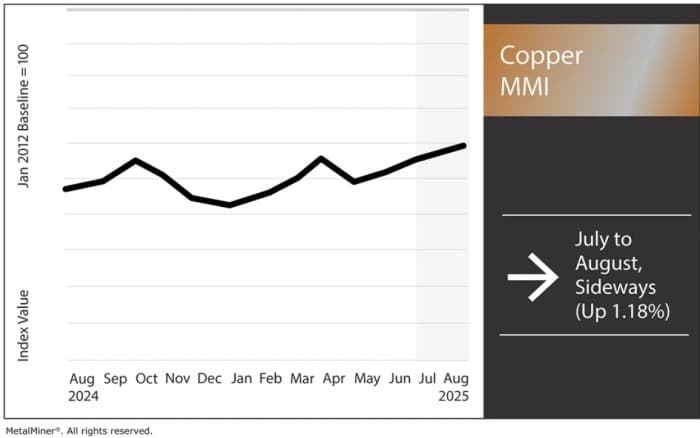

The Copper Monthly Metals Index (MMI) moved sideways, rising 1.18% from July to August. This puts the price of copper today just slightly above its April lows.

Comex Copper Prices Plummet After Tariff Surprise

July proved the most volatile month yet for Comex copper prices. As market surprises often do, the White House’s decision to water down copper tariffs to affect copper products saw the index’s prices plummet in the final days of the month.

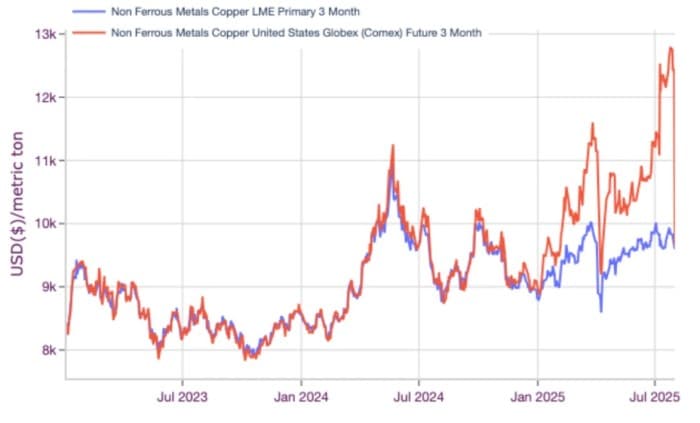

Markets first began to price in potential tariffs around the start of the year. In late February, rumors hinted at copper duties and the eventual investigation into copper imports, which most expected would result in tariffs on all forms of copper (refined copper, copper input materials and copper products). This proved exceptionally bullish for the Comex contract, causing Comex and LME prices to bifurcate.

In July, Trump not only confirmed tariffs but also set the expected duty rate at 50% with an effective date of August 1. This is both higher and earlier than most anticipated.

Exemption Relief Follows Tariffs Panic

The news added more fuel to Comex copper prices, which quickly spiked far past the previous all-time high seen in May of 2024 as buyers rushed to secure material within the short buying window. The price of copper eventually peaked on July 25 at $12,790 per metric ton, a 41.74% increase from where the metal started the year.

By comparison, LME prices rose by a more reasonable 11.55% during that same period. Only days later, the bull trend was disrupted when refined copper and copper input materials were exempted from duties. In a matter of days, prices dropped 24.56% from their peak, essentially ending the staggering split between Comex and LME prices.

Investors Post Big Losses on Copper Price Drop

Traders made significant profits throughout the year as they took advantage of the widening arbitrage. Some, including ever-bullish Goldman Sachs, assumed the Comex uptrend would continue post-tariffs as U.S. duties, combined with strong fundamentals, would offer steady support to prices. This resulted in a major “mea culpa” after the firm advised clients to go long on copper a day prior to the sharp sell-off.

There were more than a few reasons to be skeptical that the promised copper duties would last. As MetalMiner noted in its previous Copper MMI, “Since it has yet to be formally announced, there’s also a chance the current 50% duty could change. If the U.S. decides to lower it, markets would have to unravel their expectations, which would mean a downside risk for prices.”

The U.S. requires copper imports to meet demand. There is no way to bridge that gap from either a refined or raw material perspective. According to the USGS, imports accounted for 45% of U.S. copper consumption in 2024. From discovery, new mines can take over two decades to begin production, depending on regulations. Beyond that, mining is often met with environmental concerns, particularly as it relates to capturing and controlling wastewater.

Some Nations Seek Exemptions

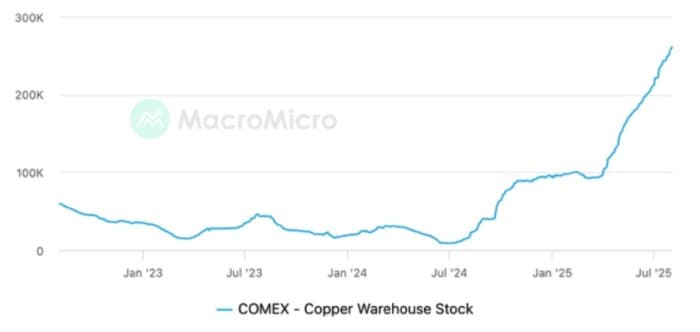

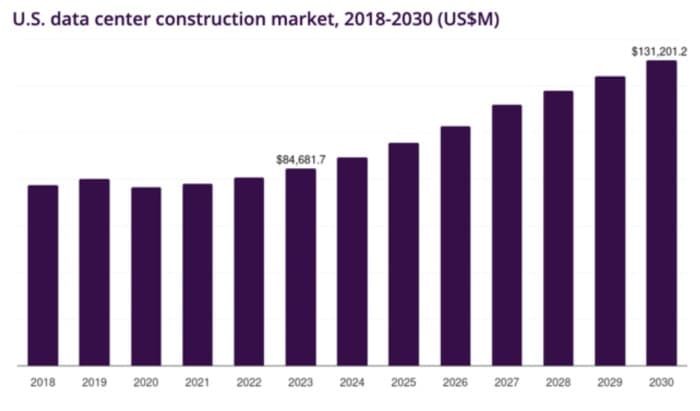

It seemed plausible to assume that, should copper duties occur, at least some countries would be granted exemptions. Even with the significant build-up in Comex copper stocks, ongoing electrification efforts will require significant volumes of copper, particularly as data centers are anticipated to see substantial growth in the coming years.

Chile, the largest refined copper supplier to the U.S., accounted for around 65% of imports between 2020 and 2023. Unsurprisingly, the country reportedly requested exemptions as part of its ongoing trade talks with the U.S.

Source: MacroMicro

Source: Grand View Research

Meanwhile, copper products were not spared from 50% tariffs. The Federal Register recently released a complete list of affected products, which Bloomberg estimates will impact over $15 billion worth of imports. This will incentivize buyers to source domestically and keep the import supply at bay.

As suppliers spent most of the year preparing for duties, there appears to be no immediate shortage concerns. Additionally, the newly implemented duties will be offset by more reasonably priced Comex copper prices, which reflect the price of refined material.

Make every data dollar count. MetalMiner Select allows you to stop paying for unnecessary price points, focusing your investment on data that drives informed purchasing decisions.

White House Still Considering Tariffs

While volatility has been tamed for now, the door remains open for broader tariffs down the road. Days after the White House shocked markets with the pared-down tariff, it released findings from the investigation into copper imports from the Secretary of Commerce.

The July 30th announcement noted, “In light of these findings, the Secretary recommended a range of actions to adjust the imports of copper so that such imports will not threaten to impair national security. For example, the Secretary recommended an immediate universal 30% import duty on semi-finished copper products and intensive copper derivative products.

The Secretary also recommended a phased universal tariff on refined copper of 15% starting in 2027 and 30% starting in 2028. The Secretary further recommended a domestic sales requirement for copper input materials starting at 25% in 2027, a domestic sales requirement of 25% for high-quality copper scrap and export controls for high-quality copper scrap.”

The Price of Copper Today and in the Future

It remains to be seen whether any of these recommendations will come to fruition. The proposed tariff rates on refined copper sit far beneath the 50% duty threatened, but based on the time frame, would fall within President Trump’s final term in office.

This may help maintain and potentially partially rebuild the Comex over LME premium, as their respective forward curves show a rising arbitrage between the two contracts. Traders and investors are likely to remain cautious considering the recent bloodbath, especially as the market would be given years to price in the changes. Meanwhile, this is plenty of time for the White House to change its opinion once again.

Biggest Copper Price Moves

Read what’s next for copper prices in this month’s Monthly Metals Outlook. The report provides both short-term and long-term forecasts plus buying strategies, giving you the edge to navigate market volatility and maximize cost savings. See a free sample report.

- U.S. copper producer prices for grades 110 and 122 saw the largest increases of the overall index, jumping 10.82% to $6.66 per pound as of August 1.

- U.S. copper producer prices for grade 102 rose by a similar 10.38% to $6.91 per pound.

- Korean copper strip prices moved sideways, with a 2.76% increase to $11.97 per kilogram.

- Meanwhile, Chinese copper wire prices slide 2.83% to $10,879 per metric ton.

- Indian primary cash copper prices fell 3.84% to $10.10 per kilogram.

By Metal Miner

More Top Reads From Oilprice.com