(Bloomberg) — A years-long supply crunch in platinum has come to a head, with banks scrambling for dwindling stocks in London as buyers in China and the US hoover up much of the available metal.

Most Read from Bloomberg

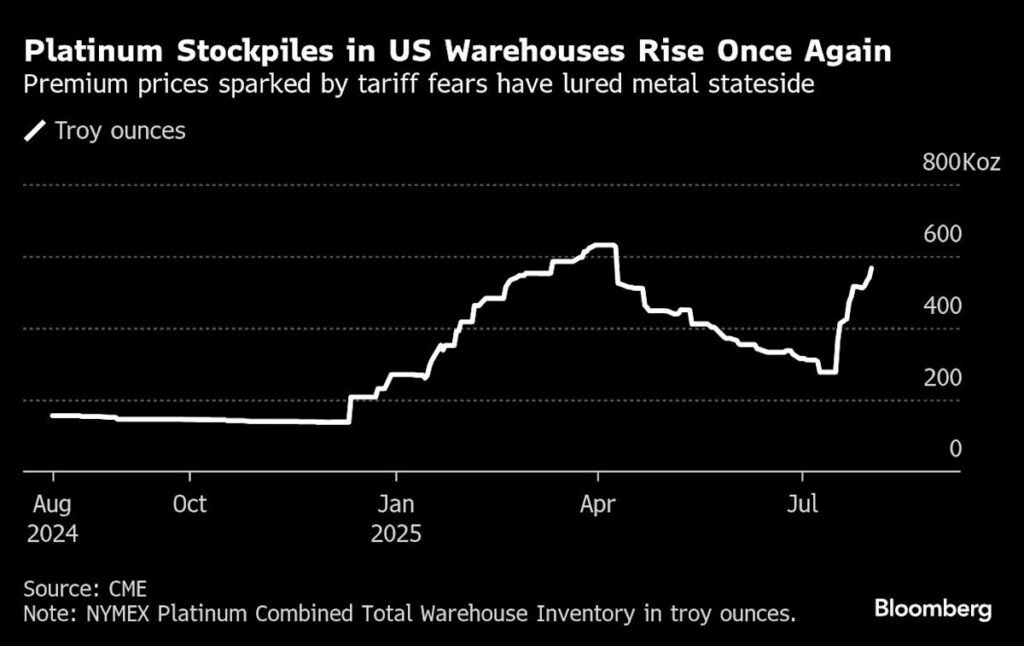

The market tightness has made platinum one of the best-performing commodities this year and fueled sky-high borrowing costs for the precious metal. Tariff fears have funneled large volumes to US warehouses, while Chinese imports continue to exceed estimated domestic consumption.

The upshot is a shortfall in the trading hubs of London and Zurich, pushing traders to guard supplies. Industry experts broadly agree on where the metal has gone, but the absence of reliable inventory data for London makes it impossible to accurately assess just how low stockpiles are.

“When a market tightens like this — whether it’s for good reasons, bad reasons, idiosyncratic reasons — it should pull material out of the shadows,” said Jay Tatum, who runs a metals fund at commodities-focused Valent Asset Management and has been bullish on platinum for about two years. Lease rates suggest the “acute tightness” isn’t over, he said.

The implied one-month lease rate remains above 10% — down from a spike to more than 35% in July, but much higher than the normal level of close to zero. The number reflects the annualized returns that holders of platinum in London or Zurich vaults can get by loaning their metal out on a short-term basis.

Gold, copper and other metals were shipped to the US as traders sought to capitalize on price dislocations sparked by tariff fears. But the resulting tightness in platinum markets has been exceptional.

While investors have dumped about 215,000 ounces from exchange traded-funds so far this year, in the last three weeks alone New York warehouses soaked up almost 290,000 ounces of the metal.

China scooped up a record 1.2 million ounces in the second quarter. The world’s largest consumer imports most of its metal but those shipments have been consistently higher than estimated domestic demand, according to data from Standard Chartered Plc.

Officials in Beijing have imposed strict export restrictions on precious metals, and, again, there is little visibility on stockpiles.

Most purchases are done by China Platinum Co., a state-owned company that’s the only entity allowed to import the metal without paying a 13% value-added tax. That makes it hard to discern the real buyers behind every purchase.

While China has shown a willingness to stockpile metals and control exports of commodities key to its economy, it’s unclear how much of the inflows end up in state inventories.

A further boost to the nation’s demand may come from the imminent introduction of the country’s first platinum futures.

Borrowing Pain

The biggest consumers of platinum are the auto and jewelry sectors, but the high cost of borrowing has been a particular problem for manufacturers that use the metal to produce goods ranging from chemicals and glass to laboratory equipment. Industrial users often go for the less capital-intensive option of leasing, rather than buying the commodity outright.

At times, liquidity has evaporated entirely as leasing rates surged into the double digits, pricing most borrowers out of the market, according to several traders at bullion banks and commodity trading houses who asked not to be be identified discussing private information.

“When you saw the lease rates spike at almost 40% at one point, that’s a crazy level for people who are borrowing metal, where that’s been their business strategy,” said Ed Sterck of the World Platinum Investment Council. “Pretty much every market participant has got some level of exposure to lease rates, on one side or the other.”

An average of roughly $2 billion of platinum was traded daily in London on a spot basis in recent weeks, less than a 50th of the gold market, according to April data from the London Bullion Market Association. That means speculative investors and hedge funds with sizable positions can potentially exert considerable pressure on the market.

Forecast Deficits

Platinum’s 45% gain this year came after it spent most of the past decade rangebound between $800 and $1,100 an ounce, as the rapid rollout of electric vehicles hit the outlook for consumption in catalytic converters, which still account for more than a third of demand. It was last near $1,320.

Sentiment has improved as the market heads for a third consecutive annual deficit, according to data collected on behalf of the WPIC. Soaring costs and supply disruptions in South Africa — by far the biggest producer — have also added to the bullish case.

The price recovery means that about 90% of the mining industry is now making money, compared with just 60% at the end of last year, according to Craig Miller, chief executive officer of Valterra Platinum Ltd. But that’s not enough to stimulate output.

“Prices would have to increase by about another 50% for you to incentivize new production,” the CEO said.

That, according to Marwan Younes, president of Massar Capital Management — a commodities hedge fund that manages about $1.6 billion in assets, can set the stage for “violent rallies.”

“Trying to figure out which spark is going to light up the market can be a little bit besides the point, because the structural conditions are such that there’s a lot of dry tinder,” he said, adding that the recent jump in Chinese imports was a key impetus behind this year’s price surge. “We’ve been very bullish on platinum.”

Like gold, the more scarce platinum is, the more people want it, said Thomas Roderick, a portfolio manager at hedge fund Trium Capital LLP.

“When the price was going lower, it was kind of a self-fulfilling decline, and now we have a genuine shortage,” Roderick said.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.