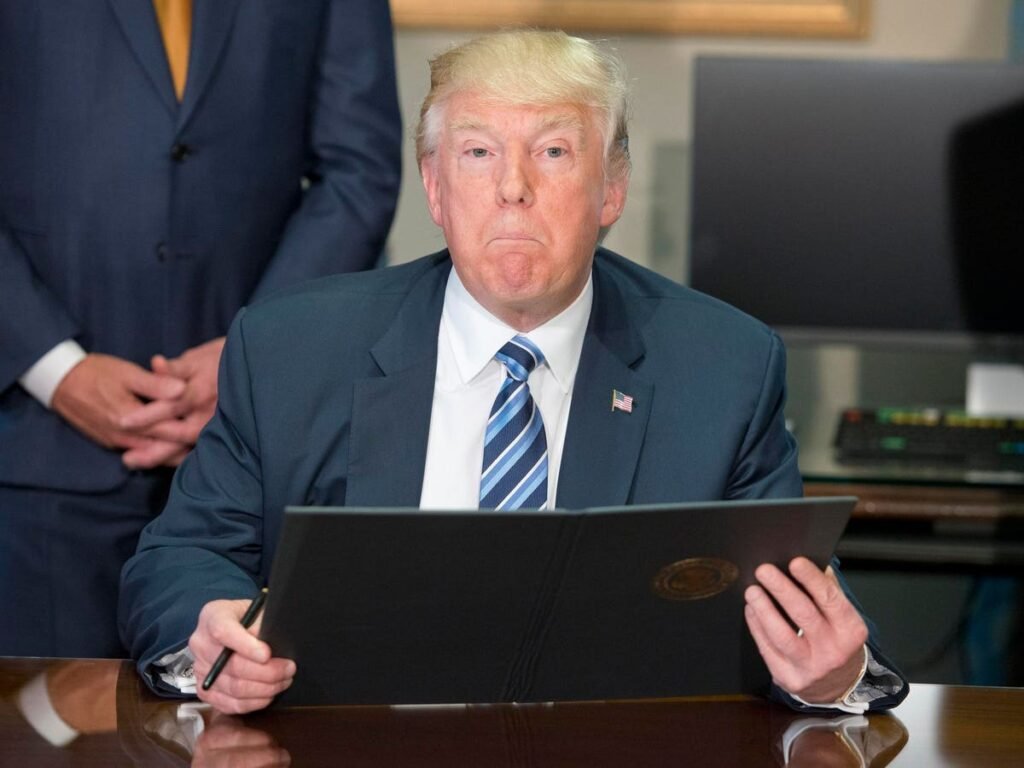

Trump signs the Executive order allowing investment in crypto, and more digital asssets (Photo by Ron Sachs – Pool/Getty Images)

Getty Images

I was waiting for this moment when Trump signed the order to allow 401(k)s to invest in crypto, private equity, and real estate.

Why?

In Q1 2025 Americans were holding approximately $8.7 trillion in 401(k) assets, according to the Investment Company Institute. These accounts are by far the largest single retirement savings account in the country. Approximately 70 million Americans participate in 401(k) plans – with options and decisions within them so important to the financial future of households.

On August 7, 2025, President Donald J. Trump signed an Executive Order that has the potential to alter those savings. For the first time, 401(k) plans will be able to invest in alternative assets such as private equity, real estate, and cryptocurrencies. This policy will put some of the most exclusive investments in the financial world in the retirement portfolios of everyday Americans.

Crypto Added: A Significant Policy Change

The Executive Order directs the Department of Labor to review its rules on how fiduciaries should handle alternative investments in retirement accounts covered by the Employee Retirement Income Security Act (ERISA). The Department must work with the Treasury, the Securities and Exchange Commission (SEC), and other federal agencies to ensure that all related regulations align with the goals of the order (Executive Order 14075).

The SEC will be responsible for modifying its regulations to permit 401(k) participants to select funds that have alternative assets. The action is designed to break down barriers that have historically prohibited workers from accessing these investments. In the past, those types of possibilities were almost exclusively available to institutional investors and public employee pension plans.

The Trump administration frames this change as a means to enhance retirement security by diversifying investments, creating a narrative that is linked to both economic growth and fairness.

Why it Matters that Cryptos Are Included

Until now, the vast majority of 401(k) plans have provided only a limited menu of asset classes as options for participants: mutual funds, index funds, bonds, and company stock. While these types of assets can be liquid (and are well regulated), they do not provide the same level of upside that some alternative asset classes may provide.

Trump calls this an “opportunity gap” that creates a divide between “everyday” savers and the tools wealthier investors and larger institutions utilize to grow wealth. The intention of allowing alternative investment options into 401(k) plans is to enable participants additional opportunities to pursue higher long-term returns and better retirement results.

The opportunity gap is one of the reasons Trump signed the Executive Order allowing crypto, private equity, and real estate to be used in 401K(s).

getty

This policy also aligns with Trump’s broader economic agenda, notably promoting the U.S. as a leader in cryptocurrency innovation and encouraging free-market access to wealth-generating opportunities.

Crypto Matters

Of all of the newly permissible assets, cryptocurrency has generated the most excitement. Bitcoin, Ethereum, and other digital asset classes provide investment possibility for high returns and diversification benefits that do not always correlate to the traditional markets.

Cryptocurrencies operate on blockchain technology, trade 24/7, and are being adopted by both retail and institutional investors. We are seeing crypto wallets now being managed by AI Agents invading everyday life as well.

However, there are challenges remain. Digital assets are volatile and can move substantially (up or down) in a very short time frame. The regulatory climate is still unsettled, and custodial and security questions are not all answered.

In order to add cryptocurrency to 401(k) plans, administrators may need to work with regulated custodians, establish distinct index funds related to cryptocurrency, or have crypto and other alternative classes in a managed portfolio. Any such products need to ensure sufficiently rigorous protections for investors.

Crypto Advocates See Opportunity

Proponents of the change would argue that adding investment choices can create better outcomes for workers, citing the well-documented performance of alternative assets within large endowments and pension funds over the long-term, and noting the diversity of portfolios as a way to potentially limit risk for the long haul.

Offering these opportunities to all workers, rather than only accredited investors, signals greater equality in investing. For many years, only high-income individuals, family offices, or other investors with significant managed assets could participate in certain private equity funds, venture capital deals, or investment vehicles.

There has been support for the order from proponents of both private equity and digital asset industries, indicating there is the potential to release new capital to existing, exciting work in the space financially.

Critics Raise Concerns About Crypto

Critics raise cautions that alternative assets are not without risk.

Private equity can have expensive structures, excessive fees, long lock-up periods, and valuations that are notoriously stale—making liquidity (getting money out), and performance (assessing the actual performance) more opaque for investors.

Investing in cryptocurrency creates another layer of risk through its volatility and exposure to cybersecurity threats.

Consumer behavior advocates expressed concern that that many retirement savers may not have the expertise to manage these investments effectively. When individuals do not receive adequate education, participants may take more risk than they can appropriately afford. That’s why the announcement of Perplexity teaming up with Coinbase to provide more crypto education is so important.

There are also fiduciary considerations to contemplate. Even if proposed regulatory changes are authorized, the cost of compliance for plan administrators must act in the best interest of participants. Inadequate performance or products unsuitable for retirement plans can open them to legal ramifications.

What’s Next For the Executive Order Around Crypto and Beyond

The Executive Order establishes expected direction, but agencies will determine the what, how, and when. The Department of Labor must produce updated guidance on fiduciary duties when providing alternative asset classes to retirement savers. The SEC and Treasury are expected to formulate regulation to allow for alternative assets to fit as qualified default investment alternatives.

How quickly regulatory changes will occur is unknown.

Some technology-focused 401(k) platforms may act quickly to adopt alternative asset options in their offerings, however, traditional plan sponsors may wait until more is known around compliance, fee, and fiduciary considerations.

The Bottom Line For Crypto and more

President Trump’s Executive Order represents the potential most significant change to U.S. retirement policy in several decades. This policy opened nearly $9 trillion dollars of 401(k) accounts that only had access to asset classes typically reserved for institutional and affluent level investors, and this presents opportunity and risk.

For approximately 90 million Americans, this provides the opportunity to access private equity, real estate, and cryptocurrency investments within a tax-advantaged retirement savings plan context. However, these opportunities also requires due diligence. Alternative assets can provide growth, but can also lose dramatically.

Ultimately, the value of this policy will hinge on how regulators enact clarity through regulation, how sponsors incorporate alternative asset offerings to retirement products, and how quickly individual savers comprehend the assets in which they choose to invest.

For retirement investors, taking the promise of diversification and growth is a balance between prudent risk management and being invested with a long-term view.

Did you enjoy this story about crypto and 401K’s ? Don’t miss my next story: Follow my writing use the blue follow button at the top of the article next to my byline so you don’t miss any of my content.