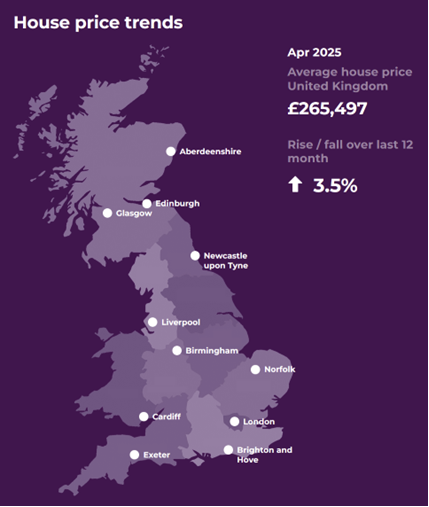

Based on the latest data, changes in stamp duty have already made a noticeable impact on the UK property market. Upon the reduction of exemption thresholds for the Stamp Duty Land Tax (SDLT) implemented back in April 2025, average home prices nationwide rose slightly by 3.5% compared to the prior month.

Although, transaction volumes declined saw a slight decline. Rather than triggering a steady decline in the housing market, this recent stamp duty change may merely be putting the brakes on price appreciation in the near-term.

With this, prospective home sellers may want to consider using a free home valuation service, such as Purplebricks, to assess how recent SDLT changes have affected what their houses can sell for in today’s market environment.

A Higher Nil-Rate Threshold and its Impact on UK House Prices

Back in 2022, the UK Government temporarily increased the SDLT nil-rate threshold for residential property, for both existing and first-time home buyers. For existing homeowners, the nil-rate threshold was raised from £125,000 to £250,000.

First time home buyers were subject to an even higher nil-rate threshold, as the First Time Buyers’ Relief SDLT nil-rate threshold was raised from £300,000 to £425,000, on properties worth up to £625,000. However, as of 31 March 2025, this temporary threshold increase has come to an end.

For property sales after 1 April 2025, the old nil-rate thresholds are back in effect. In other words, the nil-rate threshold for existing homebuyers is now back down to £125,000. The First Time Buyers’ Relief nil-rate threshold has in turn fallen back to £300,000, on properties worth up to £500,000, with 5% SDLT applied on the portion of home prices between £300,000 and £500,000.

Given how many home buyers rushed to close transactions ahead of the 31 March 2025 sunsetting, it’s no surprise that both home prices and home sales fell during April. Per data released by the HM Land Registry on 18 June 2025, home prices fell 3.7% on a sequential, or month-over-month, basis. Although, when looking at annual year-over-year data home prices have still increased.

Price Trends Have Varied Regionally

Again, while SDLT changes did negatively impact home prices during April, more recent data compiled by the property industry suggests that prices have normalized, and that subsequent declines, if any, will be far less severe than those reported for April.

That’s not all. While home prices fell in April on a nationwide basis, results varied by region. Regions such as North East and North West England experienced far greater levels of month-over-month home price declines, with prices falling 8.1% and 6.4%, respectively. In contrast, prices in Greater London during April increased 2.6% compared to March.

Furthermore, on a year-over-year basis, home prices remain up, especially in markets like Greater London. Nationwide, the average property value came in at £286,000, a 2% increase compared to April 2024. In Greater London, prices were up 3.3% year-over-year, with properties like Detached and Semi-detached homes experiencing year-over-year price appreciation in excess of 7%.

What This Means for Home Prices Moving Forward

SDLT changes, alongside other factors like economic uncertainty, may suggest further challenges ahead for the property market, but industry experts remain optimistic about home prices for the full year 2025.

In fact, regions where home prices are more affordable, such as in regions of the UK outside of southern England, may be poised to experience far greater increases in average home selling prices. A big factor that will likely drive prices moving forward will be possible upcoming changes in interest rates.

Since August 2024, the Bank of England has already lowered the official Bank Rate by 100 basis points, from 5.25% to 4.25%.

As lower rates increase home affordability, additional cuts from the central bank could spur a further increase in demand, in turn helping to increase average home selling prices.