Since the start of 2025, US copper prices have surged to unprecedented highs, fueled by the market anticipation of the 50% tariff on imported copper goods under President Trump’s administration trade agenda. The market rally was largely triggered by the fears of possible supply disruptions and increased costs of copper raw materials for the US manufacturers after the tariffs would come into force starting August 1. However, the current US administration’s erratic trade policy has once again put the markets into a state of bewilderment: the White House announcement on July 30, exempting raw copper materials from the 50% tariff, has sent US spot prices spiraling downwards and buried expectations of US miners that their industry will at last see bumper profits.

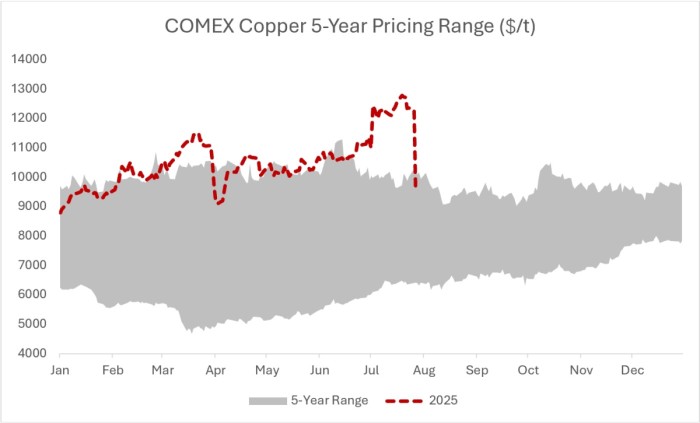

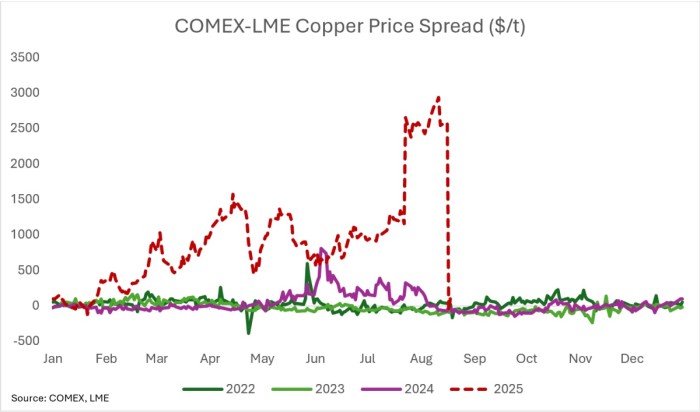

Whilst previously China’s copper madness had made copper prices largely dependent on what’s going on across the Asian continent, in 2025, it was the United States that dictated the pricing of the transition metal. The US price rally was inextricably linked to the wider metal market, expecting copper to be subject to punitive import tariffs. From April 1 to July 29, COMEX copper futures jumped from $9,667/t to $12,355/t, marking the highest pricing level since the COVID-19 recovery period began. In contrast, LME copper prices remained relatively stable throughout the same period, even if trading at the upper bound of its five-year range – around 9,600/t. This transatlantic price gap resulted in a striking 28% U.S. copper premium, sparking an unprecedentedly lucrative arbitrage trade between LME and COMEX contracts.

The striking price gap has provoked an exodus of copper inventories from the LME markets toward US buyers, leading to significant drawdowns in regional inventories across Europe and Asia. This arbitrage-driven exodus was reflected in the Shanghai market copper inventories too, making it no exception to the effects of the US copper fever. The COMEX copper stocks have gone from 97,524 tons on April 1 to 257,915 tons by July 31, while LME stocks were drained from 213,275 to 138,200 tons. Suggesting that most of US-bound copper flows were sourced from Asia, stocks held in the Shanghai Exchange plunged from 235,296 to 72,573 tons in the same period.

Related: BP’s Big Bet on Oil Pays Off in Brazil

Then came July 30, the day of disappointment for large swaths of the metal markets, as the White House announced a critical exemption for raw materials from the sweeping 50% import tariff on copper imports. The market reaction was immediate – copper futures on COMEX fell sharply, losing more than 20% in just one day (from $12,282/t to $9,548/t). This was the single largest daily drop in the history of copper prices in the US.

The COMEX-LME spread dropped from $2,704/t to $29/t on the morning of July 31, completely obliterating the most profitable metal arbitrage of the year. US smelters that have been piling up inventories, betting that trade barriers would tighten supply and push domestic prices even higher (US imports of copper almost doubled this year to date) are now trapped in a deflated domestic market. The overhang of US copper inventories suggests that now the flows might reverse their course, heading back to the European and Asian markets.

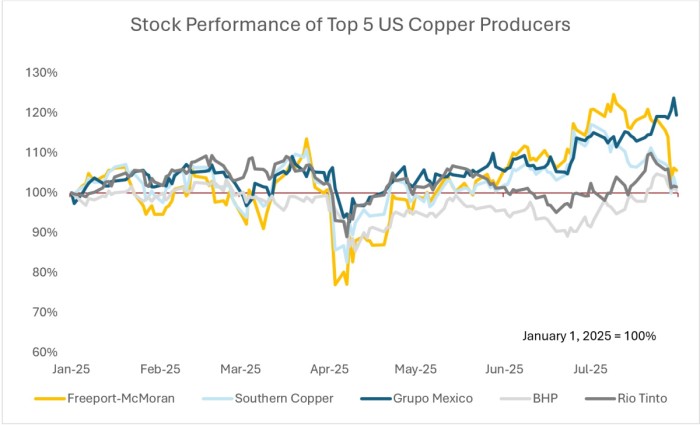

Among the most negatively impacted were US mining companies, which had been anticipating favorable prospects of soaring regional prices, boosting their profitability. The largest copper miner in the US, the Phoenix-headquartered Freeport-McMoran, had previously declared that it could have enjoyed a $1.7 billion boost in annual cash flow, were the premium in domestic copper prices remain in place. However, now the operator of the Morenci mine in Arizona needs to curb its appetite, having experienced a 11% fall in its share price since President Trump’s announcement (from $43.2 to $38.8 per share). In contrast, the turn of events must have been a considerable source of relief for key suppliers of copper ore to the US market, particularly for Chile. The world’s top copper producer has previously suggested that copper be included in US-Chile trade talks, now that seems to be superfluous as Chilean copper exports have been significantly de-risked.

President Trump’s announcement will leave the majority of US copper imports unaffected. The new tariff regime will focus on electronic conductors and copper pipes and fittings, which constituted approximately 28% of 2024’s US copper-related imports (equivalent to $4.7 billion). Given the specifics of the tariff targets, the new US tariff regime may have a slight anti-Chinese tinge to it: in 2024, 23% of the value of the targeted products was sourced from China.

Initially, exceptions in tariff policy were thought to help US copper smelters, affected by the past months’ price rally as their Chinese or Japanese peers could source the ore at a significantly cheaper cost. Hardly a surprise then that some US smelters have been warning the White House against blanket copper tariffs starting as early as April, when most of this was still unsubstantiated speculation. Now that Comex copper is on par with LME quotes, US copper miners seem to be on the losing end. That said, not all miners will bear the weight of Trump’s copper U-turn equally. Specifically, smelter operators would see some financial respite from lower raw material costs. The United States currently has only two primary copper smelters, one operated by Freeport-McMoran (located in Miami, AZ) and the other by Rio Tinto (Kennecott, UT).

US President Trump previously mentioned that he might impose further tariffs on copper if his administration deems it necessary. Barring any sudden US policy twists, overheated US copper markets are expected to flip to a discount against LME. First and foremost, COMEX inventories are overflowing – the 259,000 short tons of copper registered in the US exchange is more than triple of what is held in the Shanghai Exchange. Back in March, it was the exact opposite. Depleted LME and SHFE inventories will trigger a reverse arbitrage away from the United States, which might be interesting for major swing producers such as Chile. Second, hedge funds might drop the ball on the US copper trade completely. If the past week’s position changes are to indicate anything, long positions taken by money managers in the London Exchange were triple that of short ones. US copper markets, on the other hand, have seen a net weekly decline in net positions, probably the first of many to come.

By Natalia Katona for Oilprice.com

More Top Reads From Oilprice.com