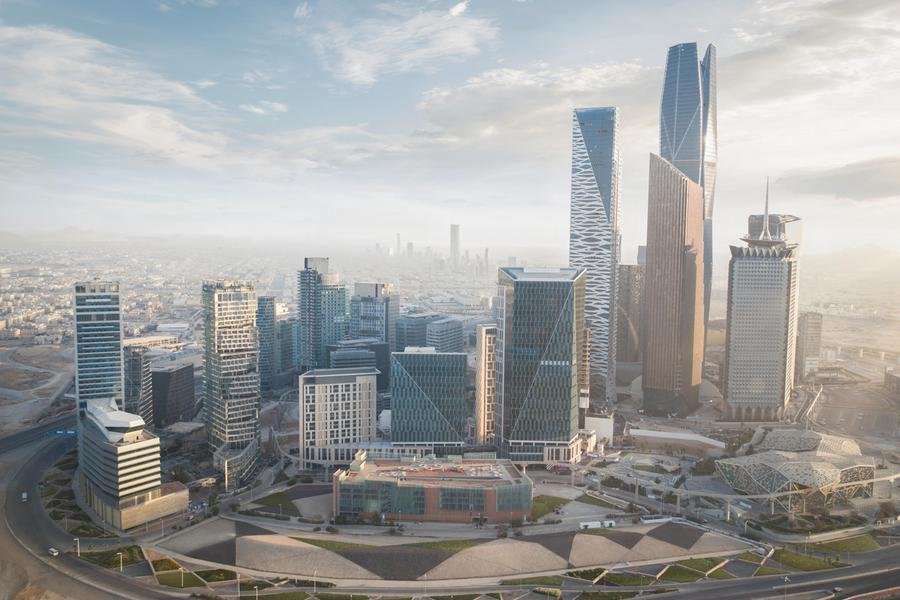

Saudi Arabia, Riyadh – CBRE Middle East, a global leader in commercial real estate, released its Q2 2025 Saudi Arabia Real Estate Market Review, highlighting strong growth across key sectors.

Saudi Arabia’s robust economic growth, driven by a 4.9% expansion in non-oil GDP, is fueling strong performance across the real estate market. Real GDP in Q1 2025 expanded by a robust 3.4%, though the full-year forecast has been adjusted to approximately 3.5% due to a more conservative outlook for the oil sector. The Kingdom remains committed to its Vision 2030 initiatives and fostering sustainable economic growth.

The second quarter of 2025 witnessed a dynamic and evolving real estate landscape in Saudi Arabia, driven by a combination of policy adjustments and strategic initiatives. The implementation of the Real Estate Transaction Tax (RETT) and strategic realignments within the construction sector shaped the market dynamics. Moreover, the Kingdom’s logistical prowess improved, with a rise in the Agility Emerging Markets Logistics Index. The Hail region attracted substantial investment, demonstrating its strategic importance, while several major mixed-use developments, such as OSUS EYE in Riyadh, the Pulse Wadi District, and the ongoing advancement of the Dar Al Hijra project in Madinah, underscored the Kingdom’s commitment to economic diversification and urban growth.

The Office market in Saudi Arabia thrived in Q2 2025, characterized by key trends. The demand for office space, especially Grade A properties in Riyadh, remains high, leading to rising rental rates and exceptionally high occupancy levels. The government’s Regional Headquarters (RHQ) Program continues to drive demand, attracting international companies. The rise in the flex sector and the preference for smaller, efficient office spaces are also notable. Although a limited new supply in 2025 is expected to exacerbate the market dynamics, the outlook is positive, with increased supply anticipated in the coming years, along with strong performance in Jeddah.

Looking at the Residential real estate market in Saudi Arabia significant growth and investment were witnessed in Q2 2025, particularly in Riyadh. Driven by strong demand, transaction volumes were substantial, with land sales leading the way. Government support and initiatives are actively promoting development and attracting both local and international investors. New project launches, such as Azure’s Lamara project and ROSHN Group’s ALDANAH community, alongside new investment funds, are fueling the sector’s expansion and commitment to addressing the Kingdom’s housing goals.

Q2 2025 saw a dynamic Retail sector in Saudi Arabia, marked by the rise of Retailtainment and the expansion of entertainment hubs. The increasing integration of entertainment into malls and the substantial investments by Saudi Entertainment Ventures (SEVEN) are key drivers of this transformation. Despite a slight dip in sales during the Eid holiday, the sector is navigating challenges like oversupply and e-commerce through innovative projects and strategic adaptations. Stable rents and occupancy rates in super-regional malls and the addition of new developments are adding to the evolving retail landscape.

The Hospitality sector in Saudi Arabia experienced remarkable growth in the second quarter of the year, solidifying its position as a leading global travel destination. Driven by a combination of leisure, cultural, and religious tourism, the sector saw a 48% increase in international visitors compared to Q2 2024. The upcoming mega-events, including major sporting tournaments and Expo 2030, are poised to generate substantial demand for accommodation. The pipeline of new hotel projects is also expanding, particularly in Riyadh, and new brand debuts, such as IHG’s EVEN Hotel, are adding to the diversity and appeal of the sector, creating a strong outlook for sustained growth.

Significant developments in Saudi Arabia’s Industrial and Logistics sector supported the country’s economic diversification efforts in Q2 2025. Robust demand for warehousing continues, despite challenges in finding immediately available, high-quality facilities. A major investment in a USD 7.0 billion cross-country rail corridor will enhance logistics capabilities. Average warehouse rents are increasing, reflecting strong demand. The launch of the Advanced Manufacturing and Production Center and collaborations like the one between Saudi Aramco Technologies and BYD are driving industrial transformation and innovation.

Matthew Green, Head of Research MENA, comments: “This groundbreaking regulation marks a pivotal moment for Saudi Arabia’s real estate market. By welcoming foreign investment, we anticipate a transformative shift, driving substantial growth in inbound capital over the next five years. This will not only support the ambitious FDI targets but also stimulate private sector development, further diversify the non-oil economy, and generate wealth for landowners. Furthermore, it will foster long-term population growth and economic stability by enabling foreign residents to participate in homeownership, a significant social milestone”.

About CBRE Group, Inc.

CBRE Group, Inc. (NYSE:CBRE), a Fortune 500 and S&P 500 company headquartered in Dallas, is the world’s largest commercial real estate services and investment firm (based on 2024 revenue). The company has more than 140,000 employees (including Turner & Townsend employees) serving clients in more than 100 countries. CBRE serves a diverse range of clients with an integrated suite of services, including facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services. Please visit our website at www.cbre.com