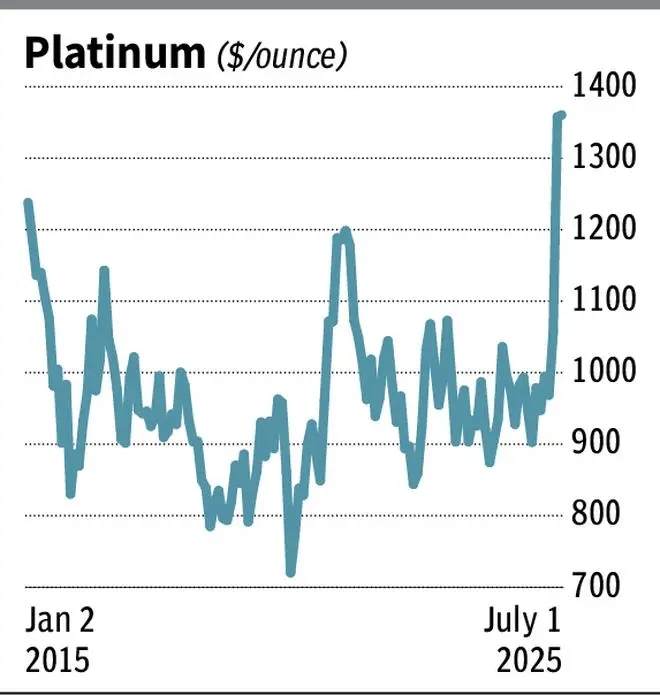

Platinum reached a 11-year high of $1,435.22 per ounce on June 27. Currently priced at $1,398, this rare metal has surged 55 per cent so far this year, outperforming gold ($3,355.70/ounce) with a 28 per cent increase and silver ($38.40/ounce), which rose 33 per cent. This marks a remarkable rebound for platinum after more than a decade of stagnation.

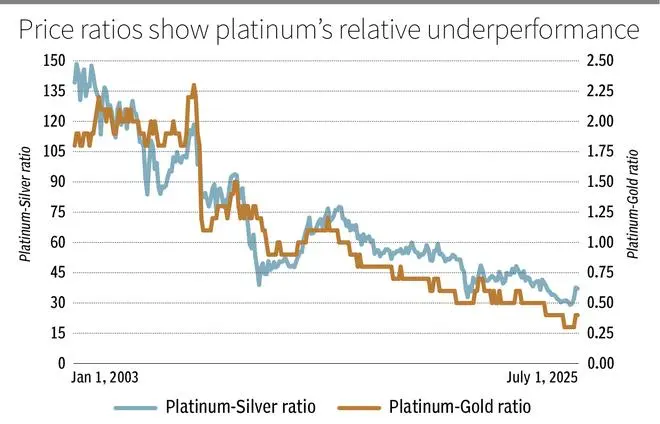

Like gold and silver, platinum belongs to the precious metals category, with jewellery being one of the key drivers of its demand. However, platinum is more closely aligned with silver than gold, as a significant portion of its demand comes from industrial applications. This trend is evident from the price movements over the past 25 years. The correlation coefficient between platinum and silver is 0.64, while the correlation between platinum and gold is only 0.34.

Although platinum is classified as a precious metal, gold remains the benchmark. Since the beginning of 2016, gold has seen an absolute gain of 216 per cent, while silver has risen 178 per cent. In comparison, platinum’s return during this period stands at a lower 58 per cent.

While platinum prices have stayed higher than gold prices in the past, since 2015, gold has consistently remained above platinum.

The ratio of platinum to gold prices has been steadily declining since 2008, and similarly, the ratio of platinum to silver has been falling since 2003. Thus, platinum has been losing ground relative to both gold and silver.

That said, the recent rise is an above-average performance, which was driven by favourable shifts in both supply and demand. In this piece, we explore the factors behind this rally and analyse whether it can be sustained.

The trigger

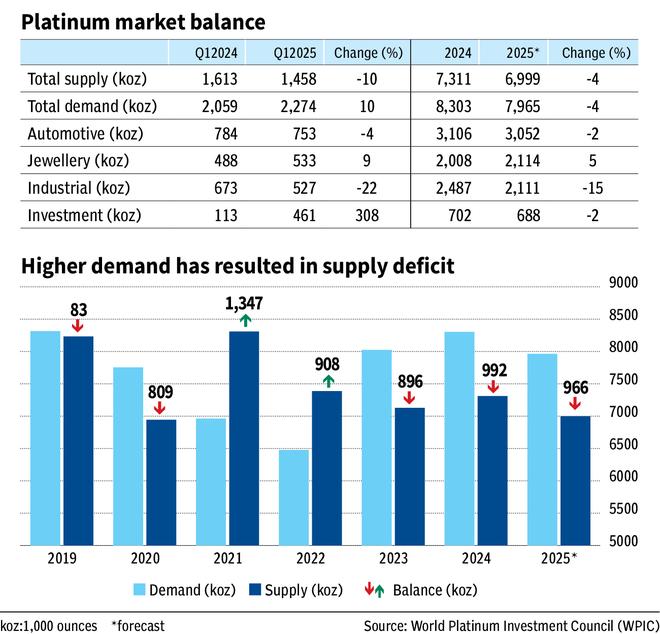

The recent sharp surge in platinum prices was driven by a supply deficit of 816 koz (816,000 ounces) in Q1 2025, the largest single quarterly deficit in six years. This shortfall resulted from both a reduction in supply and a rise in demand, as seen from the data released by the World Platinum Investment Council (WPIC).

Total supply decreased 10 per cent year-on-year for the quarter, totalling 1,458 koz. South Africa, the world’s largest platinum producer (accounting for around half of global output), faced disruptions due to heavy rainfall and power outages. Consequently, the country’s production dropped 10 per cent to 715 koz for the quarter.

On the demand side, there was a notable increase. Total platinum demand grew 10 per cent, reaching 2,274 koz in Q1 2025, compared with 2,059 koz in Q1 2024. This led to the supply deficit of 816 koz (1,458 koz of supply minus 2,274 koz of demand).

While industrial consumption fell 22 per cent to 527 koz, this decline was more than compensated by a massive increase in investment demand, which quadrupled to 461 koz. Notably, platinum stocks held by trading exchanges rose 372 koz, driven by tariff-related uncertainties that led to higher platinum inflows into the US.

Platinum jewellery demand remained strong across most regions, with a 9 per cent increase to 533 koz, except in India.

Despite these supply deficits, which have occurred in five out of the last seven years, platinum prices had remained stagnant. Thus, the recent uptick has been long overdue, and as in typical inefficient markets, it took some time for the price to reflect the fundamentals.

The year 2025…

For the full year of 2025, both supply and demand are expected to decrease 4 per cent, with supply projected at 6,999 koz and demand at 7,965 koz.

Recycling, which accounts for nearly a quarter of total platinum supply, could see a slight increase to 1,573 koz. However, mining output is anticipated to fall 6 per cent, dropping to 5,426 koz, mainly due to reduced activity in South Africa.

On the demand side, industrial demand is expected to remain weak throughout the year, with a 15 per cent decline to 2,111 koz, largely driven by a 58 per cent drop in demand from the glass industry, a significant consumer of platinum.

In contrast, jewellery demand is forecast to grow 5 per cent, reaching 2,114 koz, fuelled by platinum’s price discount relative to gold. Since March 2015, platinum has consistently traded at a discount to gold. At its peak in April 2025, the price of gold was 3.4 times (based on monthly closing price) higher than platinum.

Thanks to the relatively lower price, strong gains in jewellery demand are expected in China, with an anticipated 15 per cent increase to 474 koz, while demand in Europe and North America is expected to grow 7 per cent and 8 per cent, respectively. However, demand in India is forecast to soften, falling 10 per cent to 240 koz.

In conclusion, while supply is projected to remain in deficit for the third consecutive year, the 50 per cent price increase for platinum so far in 2025 seems justified. While a sharp price decline is unlikely in the near term, platinum is expected to stabilise at current levels through 2025, barring any significant fluctuations in the dollar, which could impact all commodities. Since all commodities are priced in the dollar in the global market, a rise in greenback can weigh on their prices.

… and beyond

Platinum’s major consumption comes from industrial sectors, which are closely linked to the performance of the global economy. According to the World Bank’s Global Economic Prospects report released in June, the growth forecast for real GDP (Gross Domestic Product) has been revised down.

For 2025, global real GDP growth is projected to slow to 2.3 per cent, down from 2.8 per cent in 2024, followed by a modest recovery in the next two years. Growth for 2026 and 2027 are expected to be 2.4 per cent (a reduction of 0.4 per cent from earlier projections) and 2.6 per cent (revised down 0.3 per cent) respectively.

Given these challenges, platinum faces some headwinds. However, the likelihood of a significant price decline remains low, as platinum has remained relatively stable over the past decade before recently experiencing a sharp rally, much like a bamboo shoot emerging after years of dormancy. Let’s look at the demand drivers.

Automotive: Developments in this industry, which accounts for nearly 40 per cent of platinum demand, will be crucial. It all boils down to the powertrain.

The primary use of platinum in the automotive sector is in autocatalysts (used in catalytic converters) for Internal Combustion Engine (ICE) cars, where it is used to reduce harmful emissions. While rising sales of battery electric vehicles (BEVs) presented a challenge in recent years, the adoption of BEVs has slowed globally due to issues like range anxiety and lack of charging infrastructure.

Consequently, automakers are gradually shifting their focus towards hybrid powertrains, which offer a solution to the shortcomings of BEVs while being less polluting than ICE vehicles. This shift is expected to drive demand for hybrid vehicles in the coming years, ensuring a steady need for platinum in autocatalysts.

Another emerging area in the automotive industry is hydrogen fuel cells, in which platinum is a key component. For comparison, while an ICE-powered vehicle uses about 3-7 grams of platinum per vehicle, a hydrogen fuel cell vehicle uses 30-70 grams. However, it’s still too early for hydrogen fuel cells to challenge traditional power sources in vehicles. Hydrogen fuel cells are also used in other applications such as energy storage systems, back-up power systems etc.

Industrial: Accounts for about one-fourth of total annual platinum demand. Within this, the major sectors of consumption are in chemical, glass and medical. While short-term economic factors and trade uncertainties may cause some slowdown, long-term growth is expected. As the global economy expands, industrial demand for platinum is likely to see steady increases.

Jewellery: While the demand is rising due to a higher price of gold, it may moderate as the price differential between platinum and gold decreases. However, the jewellery sector has shown consistent demand over the years, with an average demand of 2,163 koz over the past decade and contributing about 27 per cent of the total annual consumption.

Overall, in the near to medium term, platinum prices are expected to stabilise. However, as developments in the automotive sector, industrial growth and jewellery demand unfold, the price is likely to experience steady increases and is less likely to remain stagnant, as seen over the last decade.

Investors looking to diversify their portfolio and invest in this precious metal can consider platinum bars, coins and jewellery as avenues. Indians who are investing in US stocks through local stockbrokers can also check for platinum ETFs (Exchange Traded Funds) listed in the US.

For more price projections, refer to the technical analysis of platinum.

Technical Analysis

Platinum ($1,398 per ounce) was largely oscillating within the broad range of $800-1,200 for a little over 10 years. However, it surged in May and June, and decisively breached the barrier at $1,200, opening the door for further upside. The long-term price trend — a decline between 2011 and 2015 followed by a horizontal trend until recently and then a breakout — is a clear indication of bullish trend reversal.

From the current level of $1,398, there might be a price correction, possibly to $1,250-1,200 price range. However, a decline below this level is less likely, as this region will henceforth act as a strong base. A continuation of a rally from the current level or a rally after seeing a temporary dip, can take platinum to $1,800 over the next one year or so. Over the next three years, the upside might even extend to $2,000-2,150 levels.

Published on July 12, 2025