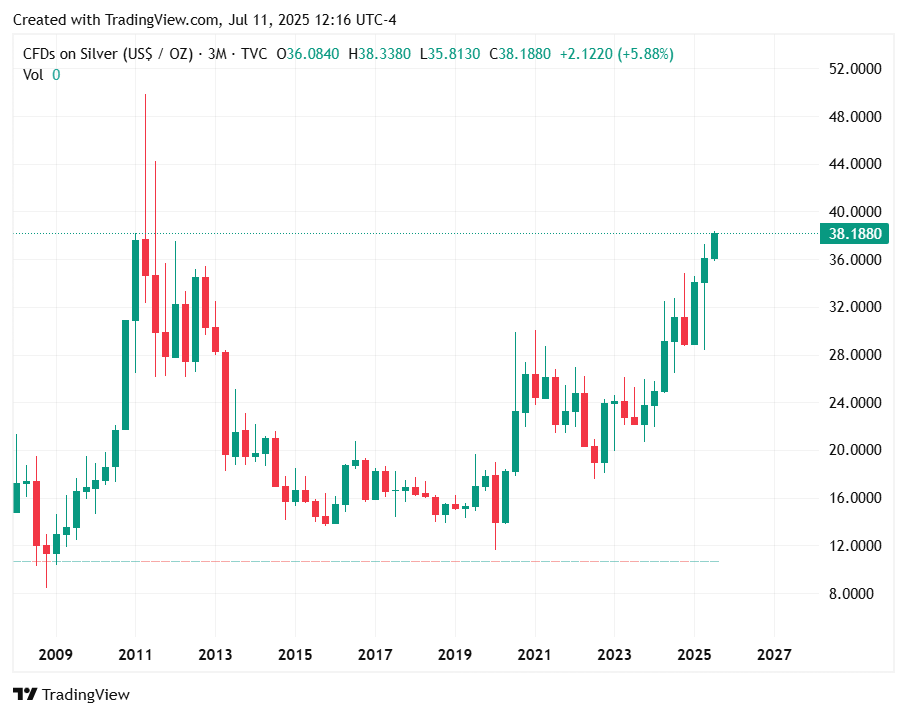

Silver jumped to a near 14-year high Friday amid signs of a short squeeze on the precious metal in the London market that led to a surge in US premiums.

Spot silver rose as much as 3% to $38.34 per ounce, the highest since September 2011. US silver futures climbed even higher at nearly 4%, with September contracts touching an intraday high of $39 an ounce.

Such a wide price gap between the two major markets is unusual, as it is typically eliminated quickly through arbitrage. Earlier this year, silver experienced a similar price dislocation amid speculation of US tariffs on precious metals.

That arbitrage opportunity also pushed leases up, as traders looked to secure metal for shipment to COMEX-linked warehouses in New York. However, the rush to move silver ended quickly once the White House exempted bullion from the levies.

Higher lease rates normally indicate a tightening market. On Friday, the implied annualized one-month borrowing costs for silver in London jumped to approximately 4.5%, well above the typical near-zero rate.

Most of the silver in London is held by exchange-traded funds (ETFs), meaning it is not available to lend or buy. The metal has recently been bolstered by solid inflows into ETFs, with holdings up by 1.1 million ounces on Thursday, according to data compiled by Bloomberg.

Daniel Ghali of TD Securities has argued that the outflow of silver caused by the tariff arbitrage opportunity has left inventories of freely available silver in the market critically low.

“Our estimates of LBMA silver’s free-float now stands at its lowest levels in recorded history,” Ghali wrote in a note Thursday. “Silver’s illusion of liquidity tells us that silver markets will only rebalance through some form of a squeeze on physical.”

Silver has risen 27% this year, with gains recently outpacing its sister metal gold. Silver has a dual character, valued both for its uses as a store of value and an industrial input.

Due to its importance in clean energy technologies, in particular solar panels, demand for silver is expected to remain strong in the coming years, with the market facing another year in deficit, according to industry group the Silver Institute.

(With files from Bloomberg)