AI, defence tech and hardware startups to grab investors’ attention in the second half of 2025

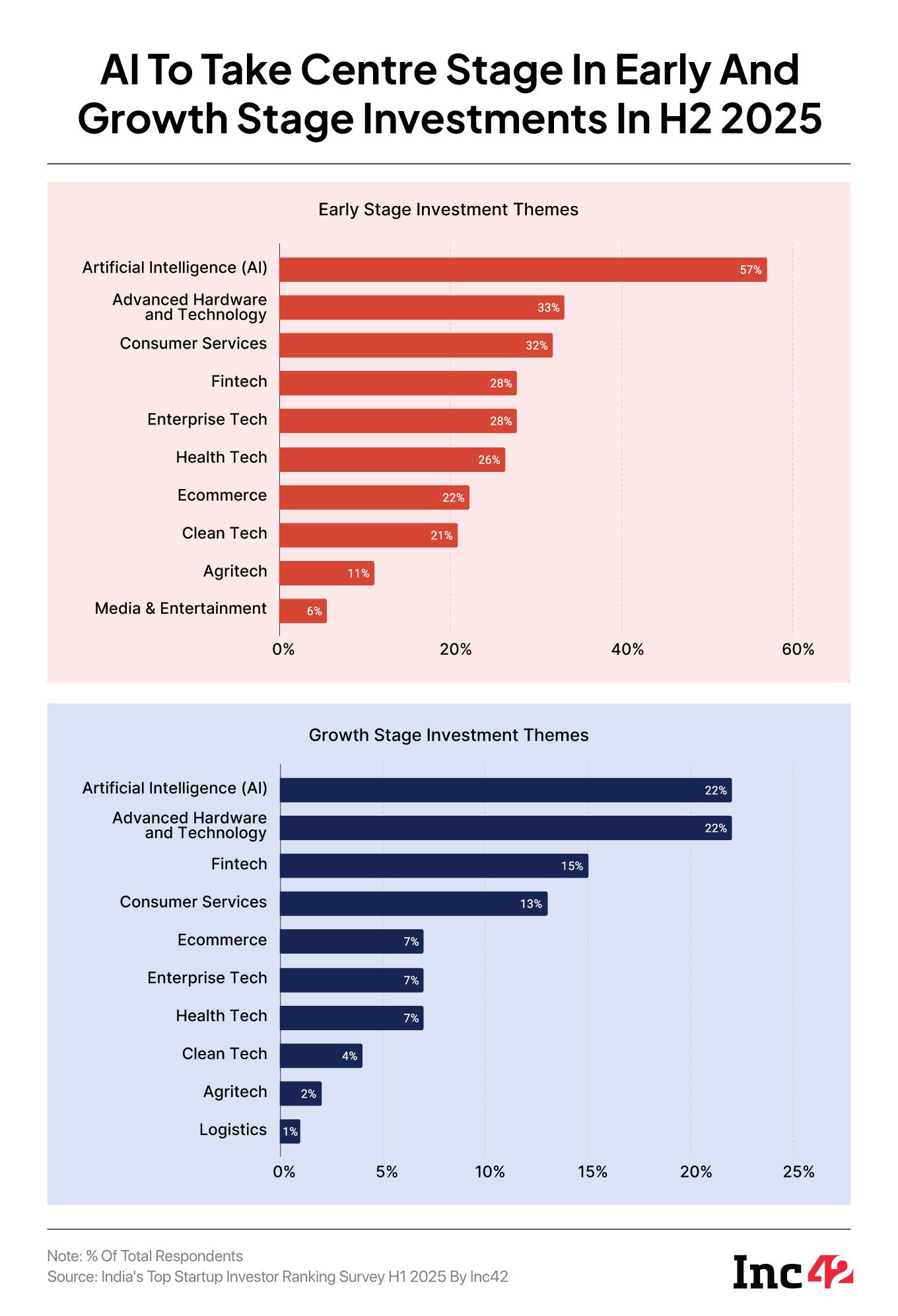

As per Inc42’s investors survey, 57% of the 80+ respondents are looking for early-stage AI investments and another 22% are eyeing growth-stage bets in either AI or advanced hardware

Almost 60% of investors foresee a positive impact from the IndiaAI Mission on startups

Backed by rising investor interest and strong government support, AI and defence tech sectors are poised to emerge as the most sought-after sectors in India’s startup ecosystem for the second half of 2025.

According to Inc42’s latest investor survey, nearly 57% of the 80+ respondents are actively scouting for early stage AI investments, while another 22% are eyeing growth-stage bets in either AI or advanced hardware and technology — a category that includes most defence tech startups.

In H1 2025, Indian startups raised $5.7 Bn across 470 deals, up 8% from $5.3 Bn in H1 2024, according to Inc42’s Indian Tech Startup Funding Report H1 2025.

While fintech and ecommerce continued to rule the sectoral funding trends on the back of big-ticket deals, investor interest in enterprise tech and advanced hardware and technology startups has been prominent in the past six months.

For context: Enterprise tech startups saw an investment of over $484 Mn across 50 deals, and advanced hardware and technology startups netted $311 Mn.

Imperative to mention that AI startups like Atomicwork (which raised $25 Mn in January) and TrueFoundry (which bagged $19 Mn in February) drove the fresh capital infusion for the enterprise tech sector.

The advanced hardware and technology segment received a major boost when drone tech soonicorn Raphe mPhibr secured $100 Mn in June.

While the numbers clearly paint a bullish picture of Indian startups’ AI and defence tech dreams, what is propelling the investor interest? Here’s what investors have to say…

IndiaAI Mission Sparks A New Wave Of Investor Optimism

While the GenAI boom in the country’s evolving startup ecosystem has been an ongoing phenomenon over the past few quarters, the Indian AI ecosystem seems to be maturing now.

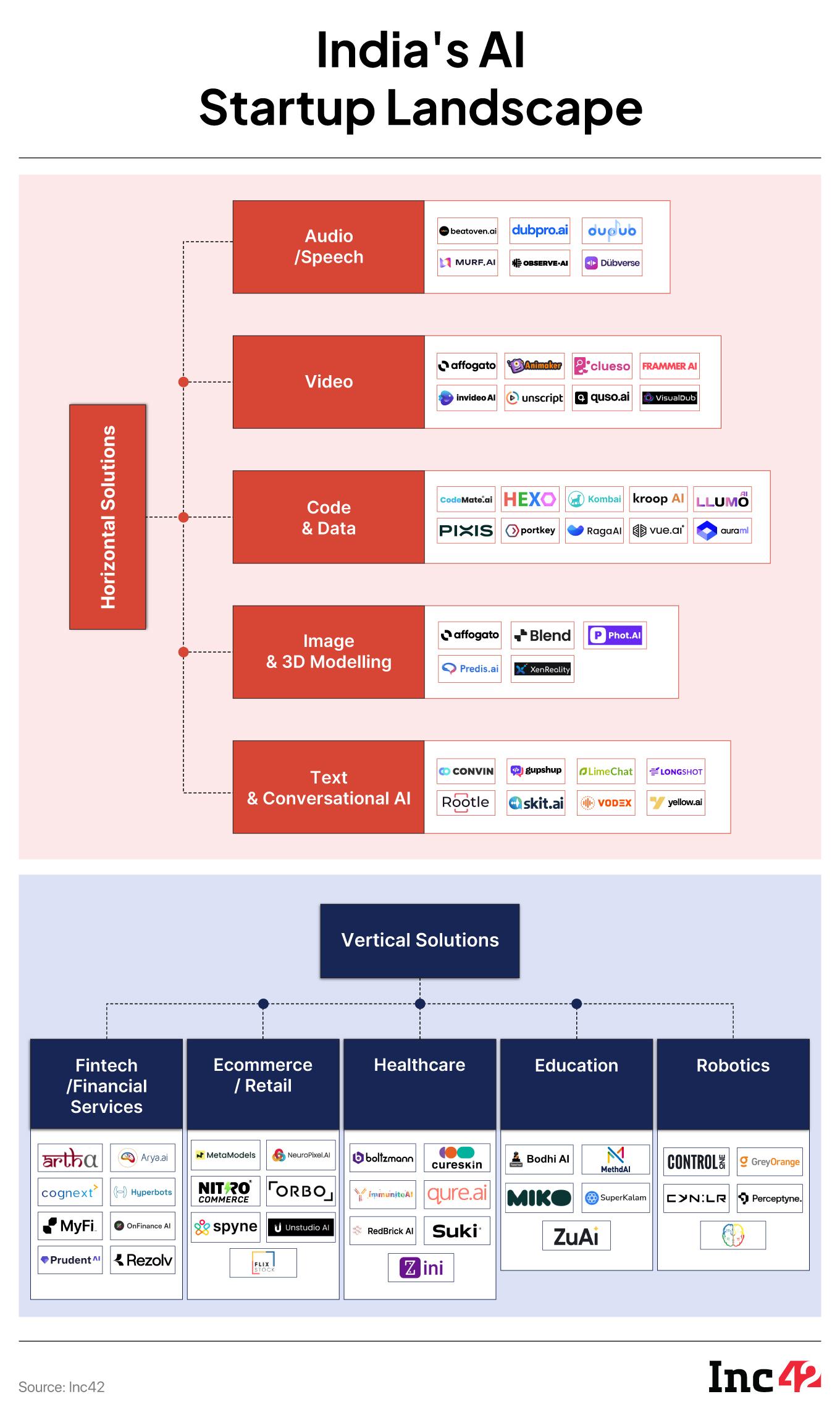

Currently, the country’s AI startups are increasingly focussed on leveraging the technology to solve local challenges and create solutions tailored for the domestic market.

Nurturing this environment is the IndiaAI Mission. Launched with an outlay of INR 10,372 Cr, the step is aimed at making India an AI hub. Under this, the government wants to create a comprehensive ecosystem, encompassing foundational models, compute capacity, safety standards, and talent development initiatives.

The green shoots are already visible.

“AI is clearly gaining ground… From credit checks to personalised shopping to faster diagnosis, it’s everywhere. The startups that will stand out are the ones using it to solve real problems, not just add it for the sake of it. And investors are taking notice,” IAN Group’s founder Padmaja Ruparel said.

As per Inc42’s survey, almost 60% of investors foresee a positive impact from the IndiaAI Mission on startups. Out of 80 institutional investors who participated in the survey, 17% think that the IndiaAI mission will significantly boost AI startup funding and development. Another 13% investors feel that the mission is helping in building an AI talent pool beneficial for startups.

According to 3one4 Capital’s Pranav Pai, the IndiaAI Mission has created institutional support for innovation and signals policy clarity around data, compute, and public-private collaboration.

“Startups building foundational tooling or AI-native workflows will benefit from this early scaffolding. Sustained impact will depend on execution—especially in flow of capital, compute, and customers. Done right, it can seed long-term advantages for Indian startups to be competitive globally,” he said.

To unlock its full potential, India’s AI models and strategies must align with global benchmarks in terms of both performance and standards.

A New Dawn For Indian Defence Tech?

Indian advanced hardware and technology startups have historically struggled to attract venture funding. Since 2014, the hardware startups have raised $1.1 Bn, only 1% of the total $164 Bn funding secured by Indian startups until H1 2025.

The first half of 2025 saw early signs of change. The segment attracted $311 Mn in funding — nearly one-third of the cumulative capital raised by Indian hardware startups to date.

This surge was led by Raphe mPhibr. Other big-ticket deals, such as Sanlayan Technologies’ $22 Mn round, also contributed to the uptick.

Speaking with Inc42, Sanlayan CEO Rohan Mukesh Gala, “India’s defence sector is at a once-in-a-generation inflexion point, which is being driven by geopolitical realities, border tensions, and a strong government push for “Atmanirbhar Bharat” in defense”.

In line with the founder’s observation, investors also see a massive market being created for indigenous defence solutions. This momentum is reflected in Inc42’s investor survey, where hardware emerged as the second-preferred growth-stage sector after AI for H2 2025.

Notably, the momentum is also being driven by increasing domestic demand and government policies. Dharana Capital’s founder Vamsi Duvvuri believes that India’s rising defence spend and push for indigenisation have opened a rare window to build world-class defence tech locally.

“Hardware is gaining tailwinds from manufacturing policy, rising domestic demand for indigenous products, and geopolitically driven supply chain shifts. India’s efforts in semiconductors, electronics, and robotics are attracting credible founders and institutional interest. While capital intensity remains a constraint, there is growing comfort with investing in IP-led or product-first companies, particularly in frontier categories like robotics, industrial automation, and energy systems,” Pai of 3one4 Capital noted.

All in all, India’s startup landscape is entering a pivotal phase, with generative AI and defence tech emerging as key sectors driving investor confidence in H2 2025.

Backed by strong policy support such as the IndiaAI Mission and rising domestic demand for advanced tech, both sectors are well-positioned to attract significant capital going ahead.