In a recent interview, Fitts cautioned that these central bank digital currencies (CBDCs) are not merely a technological advancement but a vital shift towards a centralized financial system that endangers personal freedoms.

This strategy hinges on the gradual transformation of money into a tool of surveillance, enabling institutions to monitor and influence individual behavior—a mechanism reminiscent of authoritarian regimes.

According to Fitts, between 1998 and 2015, approximately $21 trillion disappeared from public oversight, funneled into a covert network of 170 underground government bases. These facilities, concealed from prying eyes, are suspected to house clandestine operations that raise questions about governmental transparency and accountability.

The Bank for International Settlements (BIS), often dubbed the “central bank of central banks,” poses a grave threat. Operating with sovereign immunity and without scrutiny, the BIS has the ability to move vast sums of money between accounts devoid of legal oversight. Fitts argues that this institution can effectively rewrite the rules governing how money works—rules that could infringe on the economic rights of everyday citizens.

A chilling example of this potential for control can be seen in the recent Canadian trucker protests. The government cut off financial support to demonstrators, illustrating how CBDCs could facilitate punitive actions against individuals who dare to dissent.

Rising health concerns may further exacerbate this situation. Fitts points out that increasing rates of chronic disease among the population lead to escalated healthcare costs, ultimately creating a climate of dependency where citizens find themselves reliant on government assistance. This state of reliance diminishes personal freedom and enhances government control over individual lives.

As such, it becomes imperative for individuals to take proactive measures to safeguard their financial futures. Fitts emphasizes building personal resilience—knowing your local food sources, minimizing debts, and developing community bonds. Central banks may be pushing for greater control, but it’s essential that Americans reclaim their agency in the face of these developments.

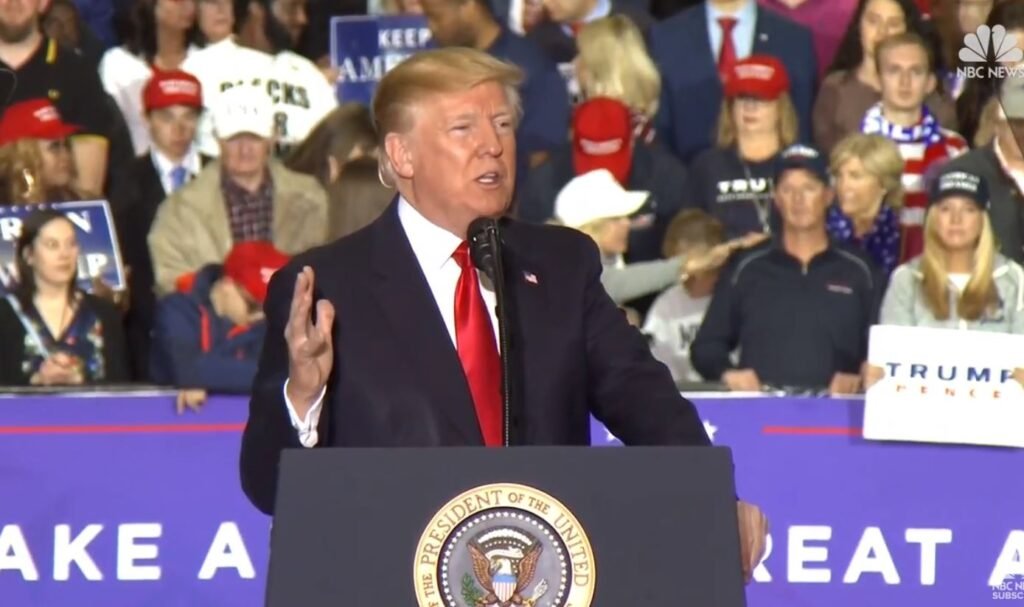

The potential imposition of a digital “control system” merits serious reflection, particularly as we witness attempts to reshape our understanding of economic freedom. With an administration led by President Trump, who has historically championed individual liberties and economic sovereignty, there remains hope for a pushback against this troubling trend.

By staying vigilant and informed, Americans can work to dismantle the mechanisms of control being quietly constructed and ensure a robust defense of their financial autonomy.