The U.S. government’s investigation into Tether (USDT) shocks the cryptocurrency market. After a positive trend following the Federal Reserve’s interest rate cut, cryptocurrencies quickly decline in response to the news.

U.S. Federal investigators are scrutinizing cryptocurrency company Tether for possible violations of sanctions and anti-money laundering regulations, according to information obtained by The Wall Street Journal (WSJ).

The criminal investigation, led by prosecutors in the Manhattan U.S. Attorney’s Office, examines whether Tether’s cryptocurrency has been used by third parties to finance or launder proceeds from illegal activities such as drug trafficking, terrorism, and computer hacking.

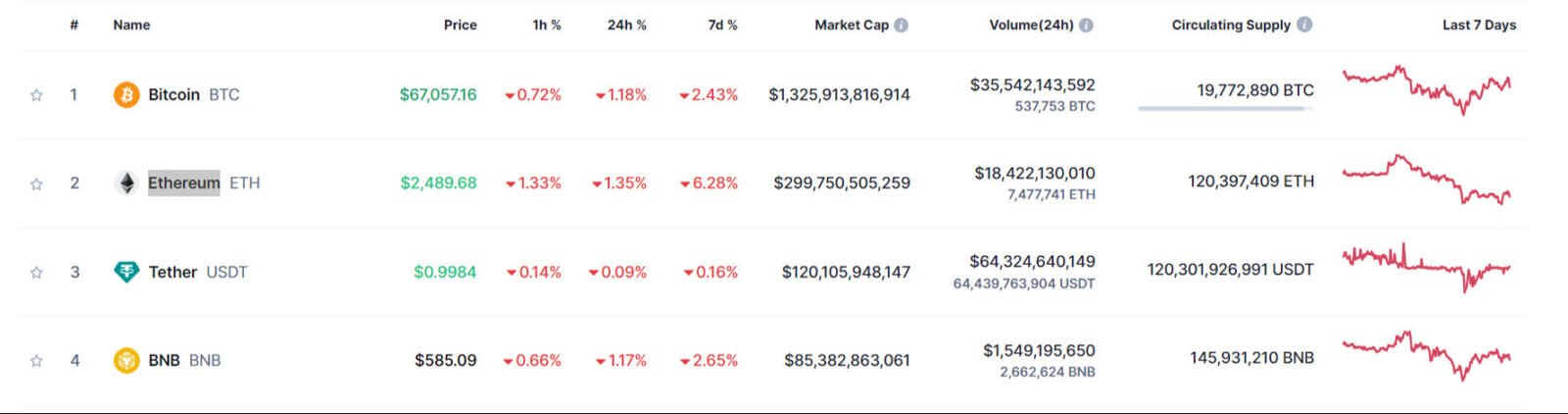

Tether (USDT), pegged to the U.S. dollar, drops 0.16 percent to $0.99 following the investigation. Bitcoin, previously above $68,000, falls to $66,770, reflecting a 2.35 percent loss. Ethereum declines over 6 percent to $2,492.

Potential sanctions on Tether

The U.S. Treasury Department is considering imposing sanctions on Tether due to concerns about its widespread use among individuals and groups sanctioned by the U.S., including Palestinian resistance group Hamas and Russian arms dealers.

If enacted, such sanctions would prohibit Americans from conducting business with Tether.

Tether: Most traded cryptocurrency

Tether, the world’s most traded cryptocurrency, boasts a value pegged to the dollar, making it a popular alternative in regions where the use of U.S. currency is restricted.

With daily trading volumes reaching as high as $190 billion, it has become a crucial financing tool for several U.S. national security challenges, including North Korea’s nuclear program, Mexican drug cartels, Russian arms manufacturers, Middle Eastern terrorist organizations, and Chinese producers of fentanyl precursors.

Tether CEO Ardoino denies investigation claims

Meanwhile, Tether CEO Ardoino states on social media, “As we told WSJ, there is no indication that Tether is under investigation. WSJ is regurgitating old noise. Full stop.”