Dear Reader,

Over the past few years, my colleagues and I have been imploring you to ignore the herd and shift your investments to hard assets like commodities, real estate, and precious metals. We were also the first to get you in on nuclear power stocks. And, again, we did that several years before anyone else was even talking about a nuclear renaissance.

We got you into gold before it went on its recent historic rally. We got you into real estate before rate cut bets sent those stocks soaring as well. Now, we’re practically begging you to get some exposure to the “other” precious metal, silver. So if our track record is any indication of our future performance, you’d be smart to pay attention to these top silver stocks…

Because every single indicator out there says silver is poised for a meteoric rally over the coming years. And investors who own silver stocks now are going to reap the lion’s share of the profits. So let’s talk a little bit about why silver stocks are poised to soar. And then let’s give you a list of top silver stocks to start your portfolio…

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they

hit Wall Street. Become a member today, and get our latest free report: “Why You Need to Fire Your Money

Manager.”

It contains full details on why money managers are overpaid and provides you with

tools for growing your wealth.On your own terms. No fees, no comission.

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox

daily.

Silver Stocks Are Set to SOAR!

There are a lot of reasons silver stocks are set to soar in the coming years. And many of them are the same reasons that gold is likely to continue rising in value, too. We’ve got two wars that keep getting hotter and hotter in eastern Europe and the Middle East. The South China Sea is heating up too. So we’ve got rising geopolitical tensions driving precious metals prices higher.

We’ve also got global central banks cutting interest rates and loosening financial conditions. Lower interest rates make for weaker currencies. And weaker currencies make for more expensive precious metals. That’s going to drive both gold and silver stocks, too.

General economic slowing combined with sticky inflation is a good combination for precious metals, too. Gold and silver stocks represent safety in the face of economic uncertainty.

- Geopolitical tensions

- Central bank loosening

- Economic contraction

- Sticky inflation

Those are all reasons for both gold and silver stocks to rally. But there are also factors that suggest silver stocks are poised to outpace their golden counterparts…

You see, gold and silver have historically moved in tandem. When one goes up, the other does too. And vice versa on the downside. But these movements aren’t in lockstep. It’s more of a dance where gold leads and silver follows. So gold prices move up first, and then silver prices follow suit. But like any partner who follows, silver’s moves are more exaggerated.

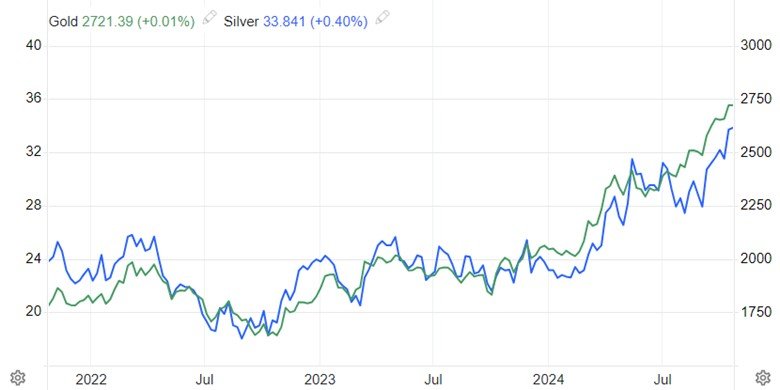

That hasn’t happened in this cycle yet. So far, gold and silver are keeping pretty good pace with each other. And over the past three years that I’ve been imploring you to get invested in gold, the yellow metal has outperformed:

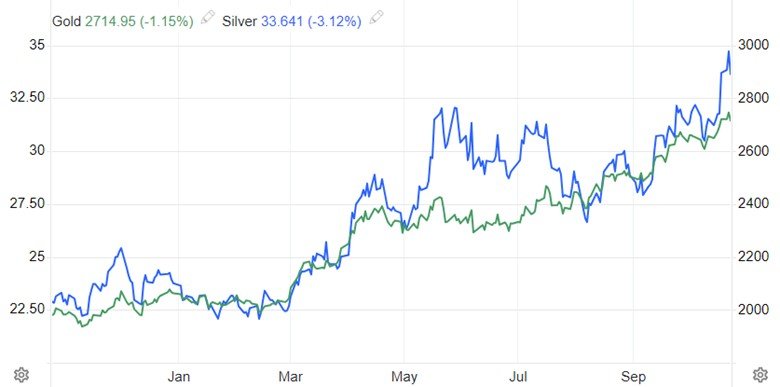

But silver is starting to show its historic outperformance. After lagging gold for the first two years of the rally, silver started to catch up and outpace its sister metal. But as you can see from the chart below, silver prices still have a lot of swing to go before they rebalance the relationship:

That’s not the only thing suggesting a surge in silver stocks, though. There’s also a ratio that’s pointing to a MASSIVE move in silver stocks. And it’s another relationship between the prices of silver and gold…

The gold-silver ratio describes how many ounces of silver it takes to purchase one ounce of gold. It’s a good judge of how the two metals are being valued compared to each other (as opposed to the U.S. dollar). And right now that ratio is sitting around 80, meaning it takes 80 ounces of silver to pay for 1 ounce of gold.

Historically, this ratio swings between two extremes: overvalued and undervalued. At 80, we’re sitting at the undervalued end of the scale where silver is undervalued compared to gold. But the other end of the spectrum is in the 40s, where gold is undervalued in terms of silver.

Silver has a lot of catching up to do in terms of its relative value to gold. And as all signs point to gold continuing its record-setting climb, that means silver will have to climb even faster to reset the equilibrium. That means silver stocks are going to absolutely FLY 💸.

Top Silver Stocks — The Funds for Your Funds

So, now that you understand why silver is poised for massive gains, let’s talk about how you can take advantage of that by investing in silver stocks. And the first silver stocks I want to share aren’t actually stocks at all. But they behave just like stocks and can deliver solid profits, too.

I’m talking about funds that help you invest in a basket of silver stocks or just in a basket of silver itself. And the biggest one of those out there is the iShares Silver Trust ETF (NYSE: SLV). It’s a fund that invests directly in physical silver and gives shareholders exposure to the metal itself. So far this year, it’s up about 45% as it tracks the “other” precious metal’s ascent. But there’s a lot more room to run here.

And when you’re talking about funds that give exposure to silver stocks, you also have to discuss the ones that invest in the companies producing the metal. Fortunately there’s a fund for that as well. The Global X Silver Miners ETF (NYSE: SIL) gives investors exposure to silver stocks through its investments in the biggest silver mining companies in the world. And the thing about miners is that they move even more than metals when prices start to rise. So, while this one is also up 45% in 2024, it could have even bigger returns ahead of it.

Top Silver Stocks — The Major Miners

Now, those two ETFs are likely enough exposure to silver stocks for a lot of investors. But if you’re willing to take on a little more risk and bet on individual companies, then some of the major silver miners in that Global X ETF might make the best silver stocks for your investments…

In that field, you’ve got lots of great options to choose from. One of the bigger allocations of the fund and a big silver miner that’s done very well is Wheaton Precious Metals Corp. (NYSE: WPM). Wheaton is more focused on gold these days, but it’s silver investments and long history of success make it one of the top silver stocks for retail investors. Shares are up 41% this year.

There’s also a personal favorite of mine, Silvercorp Metals Inc. (NYSE: SVM). Now, Silvercorp isn’t one of the Global X top holdings, but it very well could be in the near future. So far this year, shares are up over 100% as the company capitalizes on the moves in precious metals prices. This is definitely one of the top silver stocks and could soon become one of the biggest, as well.

Another option if you’re looking for major miners to add to your list of silver stocks is Coeur Mining, Inc. (NYSE: CDE). Focused on the rich silver and gold fields of the western U.S., Coeur Mining is up over 170% in 2024 as investors have seen its untapped value among other silver stocks.

Top Silver Stocks — Minor Miners

We’ve definitely got a great list of silver stocks going here with our ETFs and individual major miners. But just like silver moves bigger than gold and miners move bigger than metals, junior miners move bigger than major miners. So let’s add some top minor miners to our silver stocks list…

First up on that list is a little company called Kuya Silver Corporation (OTC: KUYAF). Kuya explores for silver at its two projects in central Peru and northern Ontario. The company is still very small and speculative, but shares are up 60% as investors have taken notice of its progress.

Next is Silver One Resources Inc. (OTC: SLVRF) out of Vancouver. It primarily explores for silver and primarily explores in the United States. It’s currently working on developing two properties in Nevada and a third in Arizona. And shares have jumped over 90% in 2024 as investors have taken notice of the potential in those projects.

And rounding out our list of top silver stocks is perhaps my favorite minor miner. It’s a company called Apollo Silver Corp. (OTC: APGOF) that’s already given shareholders a 110% return this year. It’s focused on mining silver deposits here in the U.S. as well. And the management team is one of the best in the business, having already built several other very successful mining operations.

The Bottom Line on Silver Stocks

The bottom line here is that we were right about nuclear stocks. And we were right about gold stocks. We’re going to be right about silver stocks too. And we want you along for the extremely profitable ride.

Silver stocks are poised for a historic rally and fortunes are almost certainly going to be made as things all play out. Will you use these silver stocks to help build a family legacy? Or will you pass up another opportunity to be ahead of the crowd?

I sure hope you take the first option and ride the wave of profits these silver stocks are poised to deliver all the way to the top. I’m rooting for you. We’re all in this together.

To your wealth,

Jason Williams

After graduating Cum Laude in finance

and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private

sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team

responsible for billions of dollars in daily trading. Jason left Wall Street to found his own

investment office and now shares the strategies he used and the network he built with you. Jason

is the founder of Main Street

Ventures, a pre-IPO investment newsletter; the founder of

Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock

newsletter. He is also the managing editor of Wealth

Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube