Uranium prices may have dropped recently, but the long-term outlook for this critical energy resource is glowing. With game-changing technologies on the horizon and new uranium projects underway, the market is on for an exciting comeback.

The uranium market has seen recent short-term pressure, with spot prices falling below $80 per pound after peaking at $107 in February. Despite this decline, uranium prices remain 30% higher than last year, providing significant returns for producers, according to new analysis from BMO Capital Markets.

The World Nuclear Association Symposium in London has highlighted mixed market signals, particularly supply chain issues and delays. These are currently affecting the overall sentiment, noted BMO analyst Alexander Pearce in a market commentary.

Uranium Spot Prices Dip, Long-Term Demand Surges

Although spot prices have softened, BMO Capital Markets projects a strong outlook for uranium demand. The investment banking subsidiary of BMO projected it to grow at an annual rate of 2.9% through 2035. This increase is largely driven by China’s aggressive push to build new nuclear reactors and the potential for reactor restarts in North America.

China, which is investing heavily in nuclear energy as a cleaner alternative to coal, is expected to be a major player in the global uranium market.

Pearce emphasized the long-term demand outlook noting that they foresee a potentially higher uranium demand over the medium to long term. This optimism is fueled by several factors, including:

- geopolitical shifts,

- growing global demand for clean energy, and

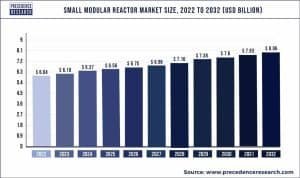

- new nuclear technologies such as small modular reactors (SMRs).

Supply Chain Challenges and Growth Projections

On the supply side, BMO anticipates 2024 will see the first significant increase in uranium supply in years. This growth is expected to come from older uranium projects catching up with rising demand.

While uranium prices remain below the peak seen earlier in 2024, the general trend suggests a robust market with significant upside potential, particularly as nuclear energy plays an increasingly vital role in global energy strategies.

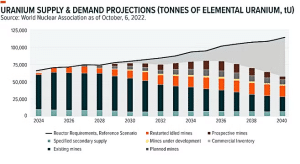

The World Nuclear Association estimated that demand will continue to increase by 2040 while supply will be limited. Thus, there would be a big gap between the metal’s supply and demand requirements by that year.

The Role of Advanced Nuclear Technologies

Oklo, a Sam Altman’s nuclear power startup, is spearheading the development of SMRs. The California-based nuclear company highlighted the growing importance of advanced nuclear technologies in meeting rising energy needs.

In an interview, Brian Gitt, Oklo’s head of business development emphasized the urgent need for reliable, clean energy sources, particularly for energy-intensive industries like data centers and manufacturing. Gitt specifically stated that:

“We’re seeing two big trends: rising power demand and the need for clean energy.”

SMRs are emerging as a flexible and efficient solution for power generation, particularly in areas with high energy demand. By placing SMRs close to energy-hungry facilities, companies can avoid the long waits associated with grid expansion, providing faster and more localized energy solutions.

While still in the development phase, SMRs hold promise for revolutionizing how nuclear energy is deployed, offering a cleaner and more sustainable option compared to traditional power plants. However, the widespread commercial adoption of SMRs is still a few years away.

Gitt acknowledged this, stating that while the technology shows great promise, its impact remains largely theoretical at this stage. Yet, the continued development of SMRs is seen as crucial to addressing future energy needs. This is particularly true as traditional energy sources like natural gas and coal face increasing regulatory challenges and environmental concerns.

The U.S. Revives Its Nuclear Future with Oak Ridge Mega Project

While the debate over energy policy continues, it is clear that nuclear power—both in its traditional form and through new technologies like SMRs—has a crucial role to play in the future of global energy.

Just recently, in a significant development for the energy sector, French company Orano USA announced plans to build a multibillion-dollar uranium enrichment facility in Oak Ridge, Tennessee. This investment marks the largest single capital infusion in Tennessee’s history that can revitalize the region’s role as a leader in nuclear innovation. Commentators considered this as reminiscent of the Manhattan Project during World War II.

Orano USA specializes in the uranium supply chain and nuclear fuel cycle services. This new Oak Ridge facility will focus on producing low-enriched uranium for commercial nuclear reactors, unlike the highly enriched uranium once used for weapons. The 920-acre site will house a 750,000-square-foot multi-structure plant.

The facility will be transferred from the U.S. Department of Energy (DOE) to Orano USA through a tax incentive agreement. The plant is a critical part of the U.S. government’s strategy to secure its nuclear future.

Congress recently allocated $2.8 billion to support domestic uranium enrichment, and Orano USA will tap into these funds. The company’s investment symbolizes the beginning of what many are calling the “second Manhattan Project,” as Oak Ridge once again takes center stage in the race to advance nuclear technology.

Oak Ridge, often referred to as the “Secret City,” is now a hub for more than 150 nuclear companies. These include NANO Nuclear Energy and Kairos Power, both of which are building advanced reactors in the area.

Uranium and Nuclear at the Forefront of Clean Energy

The announcement comes amid growing concerns over the U.S.’s ability to compete with China and Russia in both nuclear power and weapons technology. While China continues to expand its nuclear capabilities and Russia remains a dominant player in uranium enrichment, the U.S. has seen a resurgence in nuclear research and development.

As countries look for ways to meet their growing energy needs while reducing carbon emissions, uranium and nuclear technology are likely to remain at the forefront of this conversation.

BMO Capital Markets’ analysis shows that the demand for uranium will continue to rise. While supply-side challenges remain, the potential for significant uranium production growth offers hope for balancing demand. With recent market development, the future of uranium looks bright, offering solutions to the world’s energy challenges.