By QUINTON SMITH/YachatsNews

It may not feel like it when you write the check, but property values in Lincoln County rose substantially less than they have the past three years.

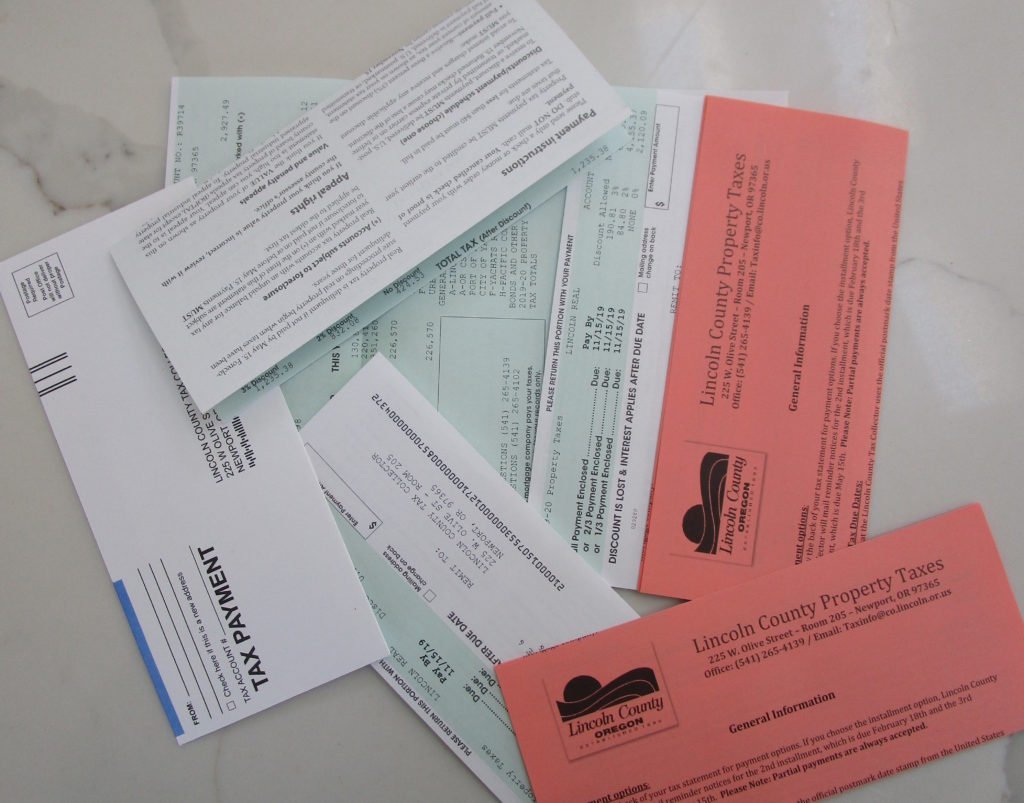

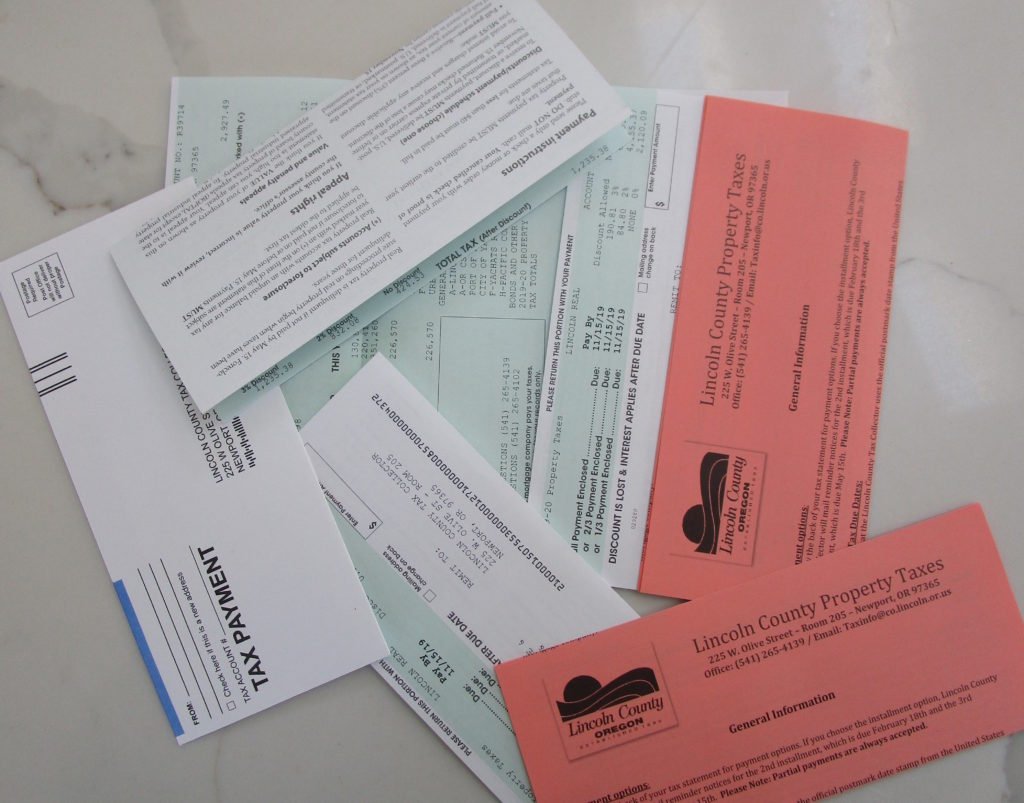

Property tax statements were mailed Thursday to 47,261 accounts, meaning homeowners and businesses should see them in their mailboxes early next week. More than 9,500 of the statements were mailed to mortgage companies, which pay the taxes for people with loans.

Real market value of all property in Lincoln County increased by 3.9 percent in 2023, said county assessor Joe Davidson. The assessor’s real market value figure is based on real estate sales in 2023, including residential, multifamily, commercial and industrial properties.

That’s down substantially from the 16 percent increase in real market values in 2023 and a record spike of 24 percent in 2022.

“It increased, but at a much less of a rate than previously,” Davidson said.

Luckily for check writers, property taxes are based on assessed value, not what a home or other property actually sells for. This year, Lincoln County property owners in areas where voters did not approve new taxes, will pay an average of 52 percent of real market value – their property’s assessed value.

Davidson said most property owners – unless they live in Toledo or three small service districts where voters approved a levy or bond — will see a typical 3 percent increase in their taxable assessed value due to Ballot Measure 50, the property tax limitation measure approved by Oregon voters in 1997.

There are 85 taxing districts in Lincoln County, including education districts, health districts, city, county, port, fire protection, water, road, special assessment districts and urban renewal districts.

All of them have distinct and different tax rates and most have different geographic boundaries, Davidson said, so overall tax rates for individual properties vary by location.

Each property tax statement displays total amounts imposed by individual taxing districts, along with current and prior year property values. Values for both years are categorized by land, structure, total real market value and total assessed value.

Making a payment

Initial property tax payments are due by Nov. 15. Full payments made by then receive a 3 percent discount and two-thirds payments receive a 2 percent discount.

For property owners making one-third payments, the second payment is due by Feb. 15 and the third payment is due by May 15.

Payments can be made electronically online, mailed with a postmark on or before Nov. 15, dropped off at a collection box in the county courthouse parking lot, or in person at the tax office located in Room 205 of the courthouse.

Davidson said property owners disputing their values are encouraged to contact the assessor’s office. Appraisal staff will be available to answer questions and review properties for possible adjustments until Dec. 31. Taxpayers also have the option to file value petitions with a special citizen appeals board until the end of the year – 22 people did that in 2023.

The county assessor’s and tax collector’s offices are open from 8:30 a.m. to 5 p.m. Monday through Friday. Davidson said most value and tax-related questions can be answered by phone or email and that all assessors will be in the office next week to help answer questions.

Year over year increase

This year’s 3.9 percent increase in real market value reflects the continuing slowdown in property sales – although the increases vary greatly by area. Through the first seven months of this year, there were 1,016 residential sales, Davidson said, compared with 1,593 in 2023 and 2,041 in 2022.

Properties sold in the Yachats area saw a 10-15 percent increase in prices in 2023, Davidson said. Newport had a 10 percent increase, Waldport 7 percent and riverfront property in Waldport a 13 percent year-over-year increase. But sales prices increased just 3 percent to 4 percent in Lincoln City, Toledo/Siletz and South Beach.

“Market values seem to be stabilizing,” Davidson said. “The rate of increase seems to be tapering off.”