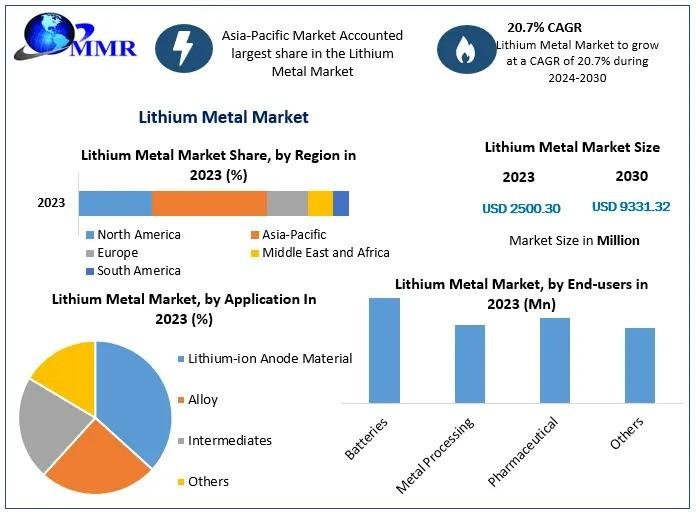

The Lithium Metal Market size was valued at USD 2500.30 Million in 2023 and the total Lithium Metal Market revenue is expected to grow at a CAGR of 20.7% from 2024 to 2030, reaching nearly USD 9331.32 Million.

Lithium Metal Market Overview

Lithium known for its light weight, excellent enery storage capabalities, and high reactivity is crucial in batteries. The Lithium-ion batteries are in high demand as the electric vehicle and grid energy storage solutions market grows.

Drivers in lithium metals industry

The growth of electric vehicles is driving the lithium market. As environmental sustainability is the prime target for governments around the world, adoption of electric vehicle is inevitable.

The next-generation lithuim batteries are adding a boost to already growing lithium industry. Industries such as consumer electronics, energy storage, and transportation electrification all have high demand for lithuim batteries. The production is a sustainable process resulting in smaller, lighter, and safer batteries.

Lithium batteries are the future of energy storage and electrification industry. As the solar and wind powered solutions are adopted at a high rate the demand for lithium batteries is expected to grow as well.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭:https://www.maximizemarketresearch.com/request-sample/201117/

Restraints in Lithium metal

Despite the poditives, high production cost is an important restraint on the market.

The highly reactive and flammable nature of Lithium makes it a safety risk in the market.

The various regulations and standards surrounding lithium metal adds another layer of complexity to the lithium metal market’s growth.

Asia Pacific leads the lithium metal industry.

With a 50% of market share in 2023, Asia Pacific dominates the global lithium metal industry. China is the leading manufacturer with high reserves is dominating the Asiatic market.

𝑨𝒄𝒄𝒆𝒔𝒔 𝒕𝒉𝒆 𝑭𝒖𝒍𝒍 𝑹𝒆𝒑𝒐𝒓𝒕 𝑯𝒆𝒓𝒆:https://www.maximizemarketresearch.com/market-report/lithium-metal-market/201117/

Analysis of recent development in the Lithium metal

Companies like Lyten are investing in large-scale production facilities, such as the planned lithium-sulfur battery gigafactory in Nevada. This emphasises the growth potential and high demand for advaned lithium batteries. Major players, like Rio, are actively pursuing M&A opportunities to expand their lithium portfolios. This highlights a competitive market dynamic in the lithium industry. This is also accompenied by MinRes pausing acquisition due to lower prices indicating fluctuating market conditions. Q2 Metals’ acquisition in Québec indicates strategic geological expansion by targeting important locations favorable towards growth. The Lithium metal industry is witnessing dynamic expnasion and technology-focused investments that is hsaping the industry’s upward trajectory.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐅𝐮𝐥𝐥 𝐏𝐃𝐅 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐑𝐞𝐬𝐞𝐚𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 :https://www.maximizemarketresearch.com/request-sample/201117/

Recent news about Lithium Metal

17/10/2024 Lyten Reveals Plans to Construct the World’s First Lithium-Sulfur Battery Gigafactory in Nevada

10/10/2024 Rio Muscles In on Lithium Market With M&A Splurge

28/8/2024 MinRes won’t undertake more lithium M&A in next year given low prices

19/8/2024 Iron ore junior tells Twiggy and Gina to take a look, more lithium M&A and McGowan to chair Frontier

14/6/2024 Q2 Metals pulls trigger on Cisco acquisition in Québec

𝐓𝐨 𝐆𝐚𝐢𝐧 𝐌𝐨𝐫𝐞 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐚𝐛𝐨𝐮𝐭 𝐭𝐡𝐢𝐬 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡, 𝐕𝐢𝐬𝐢𝐭 :https://www.maximizemarketresearch.com/request-sample/201117/

Lithium Metal Market Segmentation

by Source

Salt Lake Brine

Lithium Ores

by Application

Lithium-ion Anode Material

Alloy

Intermediates

Others

by End-users

Batteries

Metal Processing

Pharmaceutical

Others

Lithium Metal Market Key Players

Albemarle Corporation,

Alpha-En Corporation

American Elements

China Energy Lithium Co., Ltd.,

China Lithium Products Technology Co., Ltd.

CNNC Jianzhong Nuclear Fuel Co., Ltd.

Ganfeng Lithium Co., Ltd.

JSC Chemical Metallurgical Plant

Li-Metal Corp.

Lithium Americas

Livent Corporation,

Manosanthi Group Of Company

Otto Chemie Pvt. Ltd.

Oxford Lab Fine Chem Llp

Pilbara Minerals

Pure Lithium

Shandong Ruifu Lithium Industry Co., Ltd.

Shanghai China Lithium Industrial Co., Ltd.,

Shenzhen Chengxin Lithium Group Co. Ltd.

Sion Power Corporation.

Spectrum Chemical

The Honjo Chemical Corporation

Tianqui Lithium Industries Inc,

Tru Group Inc

Key questions answered in the Lithium Metal Market are:

Which region has the largest share in the Global Lithium Metal Market?

What is the growth rate of the Global Lithium Metal Market?

What is the scope of the Global Lithium Metal Market report?

Who are the key players in the Global Lithium Metal Market?

Key Offerings:

Past Lithium MetalMarket Size and Competitive Landscape (2018 to 2022)

Past Pricing and price curve by region (2018 to 2022)

Market Size, Share, Size & Forecast by Different Segment | 2024-2030

Lithium MetalMarket Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by Region

Market Segmentation – A detailed analysis by segment with their sub-segments and Region

Competitive Landscape – Profiles of selected key players by region from a strategic perspective

Competitive landscape – Lithium MetalMarket Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER’s analysis

Value chain and supply chain analysis

Legal Aspects of Business by Region

Lucrative business opportunities with SWOT analysis

Recommendations

Maximize has also published reports on

The Calcium Chloride Market size was valued at USD 1.7 billion in 2023 and is expected to reach USD 2.3 billion by 2030, at a CAGR of 4.41%.

Polyfluoroalkyl Substances (PFAS) Waste Management Market size was valued at USD 1.97 billion in 2023 and is expected to reach USD 3.22 billion by 2030, at a CAGR of 7.27%.

Global Conductive Carbon Black Market size was valued at USD 375.72 million in 2023 and is expected to reach USD 726.06 million by 2030, at a CAGR of 9.8%.

Explore our top-performing reports on the latest trends:

♦ Global Therapeutic Vaccines Market : https://www.maximizemarketresearch.com/market-report/global-therapeutic-vaccines-market/25494/

♦ Global Bioabsorbable Stents Market : https://www.maximizemarketresearch.com/market-report/global-bioabsorbable-stents-market/21634/

♦ Global Multi Cloud Management Market : https://www.maximizemarketresearch.com/market-report/global-multi-cloud-management-market/26797/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

About Maximize

Maximize Market Research is a global market research and consulting company that provides businesses with insights to foster their growth and competitive advantage. The company specializes in delivering actionable and data-driven research reports tailored to help organizations make informed decisions. With a team of experienced analysts and consultants, Maximize Market Research offers expertise across multiple industries, including healthcare, technology, manufacturing, consumer goods, and more.

Their services cover market sizing, forecasting, competitive analysis, and customer insights, helping clients to address their strategic needs and identify emerging trends. The company emphasizes client success, offering detailed analysis and recommendations that support business transformation and operational excellence.

Maximize Market Research also provides custom research services, allowing businesses to get solutions specific to their market challenges. With a strong global presence, the company serves clients from various sectors, ensuring they stay ahead in a rapidly evolving market landscape.

This release was published on openPR.