Key Impact Points:

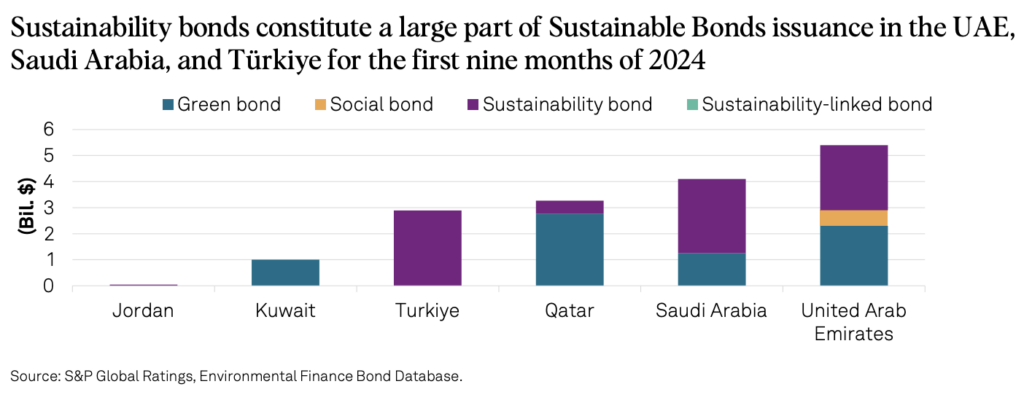

- $16.7 billion in sustainable bonds issued across the Middle East in the first nine months of 2024, led by UAE and Saudi Arabia.

- Sustainability bonds dominate, driven by financial institutions, while corporate issuances declined by 45% year over year.

- Regional shift towards funding social and environmental projects, contrasting with global trends where green bonds dominate.

Middle East Sustainable Bond Market Overview

According to the S&P Global Ratings Sustainability Insights: Middle East Sustainable Bond Issuance Trends Report, Middle East sustainable bond issuance reached $16.7 billion in the first nine months of 2024, with the UAE and Saudi Arabia continuing to lead the region. Although the issuance slowed by 18% compared to 2023, the decline followed a robust year boosted by the COP28 halo effect. The slowdown is largely due to rising interest rates and market normalization after the conference in November 2023.

S&P Global reported, “Sustainable bonds contribute to 15%-20% of total bond issuances (excluding sovereigns and private placements) in the region, higher than global levels of 12%-14%.” Including private placements and domestic issuances, the share of sustainable bonds drops to 10%-15%. While the first two quarters of 2024 saw stronger performance than global trends, the third quarter brought muted activity despite continued issuances.

Financial Institutions Drive Sustainability Bonds

Sustainability bonds are increasingly popular in the Middle East, with financial institutions leading the charge. Corporate issuances, however, have declined by 45% year over year. “Sustainability bonds lead the share of issuance, as more banks fuel issuances,” S&P Global noted. In contrast to global markets where green bonds represent 60% of sustainable bonds, the Middle East is seeing a growing emphasis on social elements, such as affordable housing and access to essential services.

“While funding climate transition and adaptation remains a priority in the region given the exposure to hydrocarbons, sustainability issuances (including funding social projects) have risen in 2024 compared with only green projects previously,” the report noted. This contrasts with global trends, where green bonds remain prevalent, accounting for about 60% of sustainable bonds.

Regional Issuances and Priorities

The UAE and Saudi Arabia remain the primary drivers of sustainable bond issuance in the Middle East, although Qatar has shown a notable increase in activity in 2024. Issuances in the UAE are more diversified by type compared to the rest of the region, but financial institutions dominate across all markets.

Related Article: Forbes Middle East Reveals its Sustainability Leaders 2024

Funding climate transition and adaptation continues to be a priority in a region reliant on hydrocarbons. However, there has been a shift toward funding social projects alongside environmental ones. “Renewable energy remains a key priority in the region, with most issuances including it as part of the use of proceeds,” the report states.

Positive Outlook for Sustainable Bonds

Despite the slowdown, S&P Global expects the sustainable bond market in the Middle East to recover and grow. “Sustainable bond issuance in the Middle East could require acceleration in implementing net-zero policies,” the report suggests. As the region continues to enhance its transparency and ESG reporting, particularly in the UAE and Saudi Arabia, its role in the global sustainable finance market is poised to strengthen.

For the full report, you can access it here.