CHENNAI: Chinese-owned Fintech companies offering short-term loans to lakhs of Indians through mobile apps are making a net profit margin of Rs 5.2 crore in just three months with just an investment of Rs 1 crore, an investigation by the Enforcement Directorate has found.

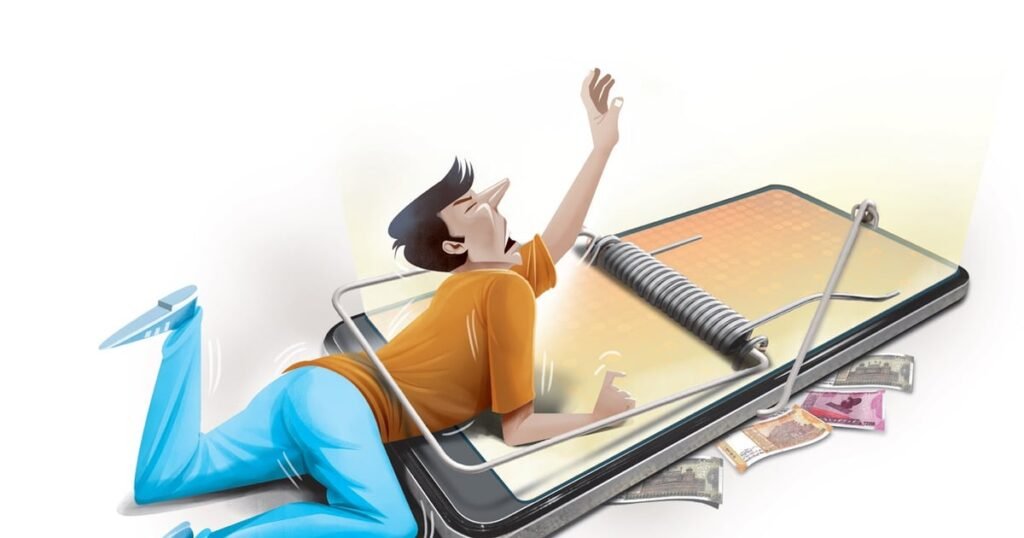

According to sources, this is made possible by charging 30%-40% of the sanctioned loan amount as an upfront processing fee and collecting interest rates as high as 36%. This pushes those taking loans into a debt trap and they end up taking fresh loans to pay off previous ones.

The processing fee makes the effective rate of interest on these loans as high as 2,000% per annum, eventually making repayment extremely difficult. This fee is charged every time a borrower takes a loan. These short-term loans are for anywhere between a week to four months.

For example, when a person takes a loan of Rs 5,000 through the app, the company charges Rs 1,500 (30%) as a platform fee and only disburses Rs 3,500 to the borrower’s account. However, an interest of 36% is charged on Rs 5,000, though only Rs 3,500 was disbursed.

ED investigation shows that with an initial investment of Rs 1 crore, which is given as short-term loans to several people, the company can earn a processing fee of Rs 15 crore and disburse loans worth Rs 50 crore to one lakh people in three months.

If just 80% of these loans are recovered, the company still makes a revenue of Rs 6.2 crore in 13 weeks, sources said. After the initial investment, it becomes a self-financing model, as the money keeps rolling over on a weekly or fortnightly basis, sources added.