In a week marked by escalating tensions in the Middle East and surprising job gains in the U.S., global markets have experienced a mixed bag of reactions, with oil prices climbing and stock indices showing varying levels of resilience. Amidst this backdrop, investors are increasingly turning their attention to dividend stocks, which can offer a measure of stability and income potential during uncertain times. A good dividend stock typically combines strong financial health with consistent payout history, making it an attractive option for those seeking steady returns despite market volatility.

Top 10 Dividend Stocks

|

Name |

Dividend Yield |

Dividend Rating |

|

Guaranty Trust Holding (NGSE:GTCO) |

7.72% |

★★★★★★ |

|

Peoples Bancorp (NasdaqGS:PEBO) |

5.43% |

★★★★★★ |

|

Intelligent Wave (TSE:4847) |

3.97% |

★★★★★★ |

|

Premier Financial (NasdaqGS:PFC) |

5.39% |

★★★★★★ |

|

KurimotoLtd (TSE:5602) |

5.28% |

★★★★★★ |

|

Financial Institutions (NasdaqGS:FISI) |

4.88% |

★★★★★★ |

|

CAC Holdings (TSE:4725) |

4.54% |

★★★★★★ |

|

CVB Financial (NasdaqGS:CVBF) |

4.45% |

★★★★★★ |

|

James Latham (AIM:LTHM) |

5.71% |

★★★★★★ |

|

Banque Cantonale Vaudoise (SWX:BCVN) |

4.85% |

★★★★★★ |

Click here to see the full list of 2067 stocks from our Top Dividend Stocks screener.

We’re going to check out a few of the best picks from our screener tool.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cal-Comp Electronics (Thailand) Public Company Limited, along with its subsidiaries, manufactures electronic products globally and has a market cap of ฿47.44 billion.

Operations: Cal-Comp Electronics (Thailand) Public Company Limited generates revenue from service income of ฿1.52 billion, computer peripherals amounting to ฿153.65 billion, and telecommunication products totaling ฿21.12 billion.

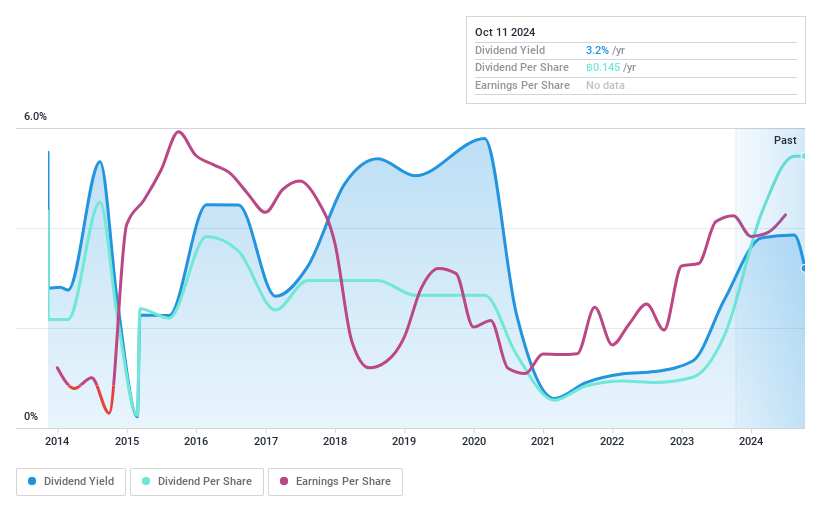

Dividend Yield: 3.2%

Cal-Comp Electronics (Thailand) has shown a volatile dividend history over the past decade, with recent increases. Despite earnings growth of 58.6% last year, its high debt level and shareholder dilution raise concerns. The payout ratio of 73% indicates dividends are covered by earnings, while a low cash payout ratio of 14.6% suggests strong cash flow coverage. However, recent sales figures show mixed performance, with September sales up but year-to-date figures down compared to the previous year.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wah Hong Industrial Corp. develops, produces, and sells composite materials and advanced plastic compounds in Taiwan and internationally, with a market cap of NT$3.88 billion.

Operations: Wah Hong Industrial Corp.’s revenue is derived from Taiwan (NT$3.79 billion), East China (NT$4.17 billion), and South China (NT$1.46 billion).

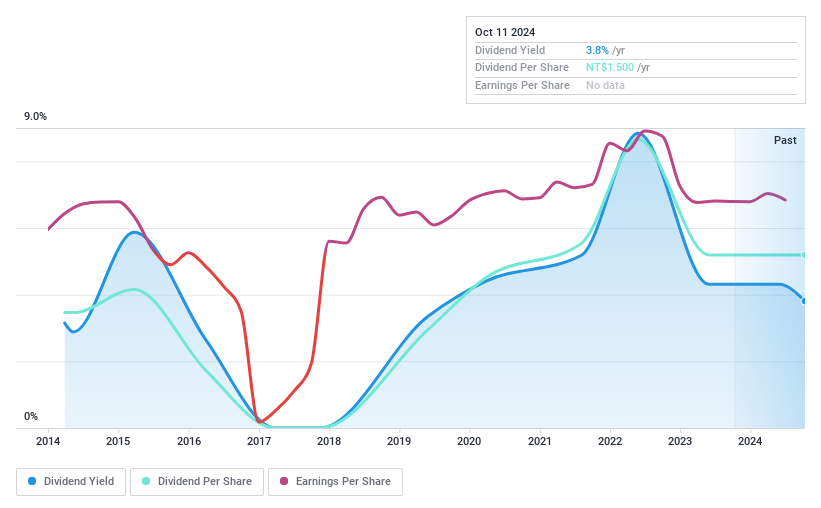

Dividend Yield: 3.8%

Wah Hong Industrial’s dividend payments have been volatile over the past decade, with a current yield of 3.81%, below the top 25% in Taiwan. Despite this, dividends are covered by earnings and cash flows, with payout ratios of 70.7% and 34%, respectively. Recent earnings show a decline in Q2 net income to TWD 78.22 million from TWD 103.35 million last year, though six-month figures improved slightly to TWD 113.87 million from TWD 107.37 million.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ampoc Far-East Co., Ltd. researches, manufactures, and supplies equipment and materials for the electronic industry in Taiwan with a market cap of NT$10.92 billion.

Operations: Ampoc Far-East Co., Ltd.’s revenue segments include NT$2.14 billion from Zhongchi – Machine Equipment, NT$1.05 billion from Taipei – Consumable Materials, NT$600.62 million from Others – Machine Equipment, NT$301.84 million from Others – Consumable Materials, and NT$60.95 million from Taipei – Maintenance.

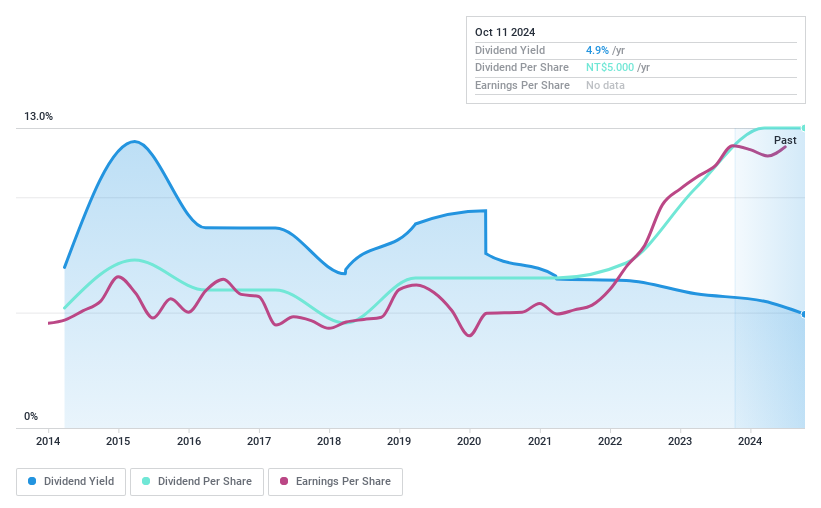

Dividend Yield: 4.9%

Ampoc Far-East’s dividend yield stands at 5.24%, placing it in the top 25% of Taiwan’s market; however, the dividend is not well supported by free cash flow, with a high cash payout ratio of 92.3%. Despite earnings growth of 7.4% over the past year and a payout ratio of 82.1%, dividends have been unreliable and volatile over the last decade, showing inconsistency in payment stability. Recent Q2 results indicate increased sales to TWD 903.24 million from TWD 810.45 million last year, with net income rising to TWD 185.68 million from TWD 163.15 million previously.

Seize The Opportunity

-

Get an in-depth perspective on all 2067 Top Dividend Stocks by using our screener here.

-

Have a stake in these businesses? Integrate your holdings into Simply Wall St’s portfolio for notifications and detailed stock reports.

-

Streamline your investment strategy with Simply Wall St’s app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SET:CCET TPEX:8240 and TWSE:2493.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com