Jentayu Sustainables Berhad (KLSE:JSB) shareholders might understandably be very concerned that the share price has dropped 37% in the last quarter. But that doesn’t change the fact that shareholders have received really good returns over the last five years. We think most investors would be happy with the 204% return, over that period. Generally speaking the long term returns will give you a better idea of business quality than short periods can. The more important question is whether the stock is too cheap or too expensive today.

Let’s take a look at the underlying fundamentals over the longer term, and see if they’ve been consistent with shareholders returns.

See our latest analysis for Jentayu Sustainables Berhad

Jentayu Sustainables Berhad isn’t currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn’t make profits, we’d generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over the last half decade Jentayu Sustainables Berhad’s revenue has actually been trending down at about 22% per year. On the other hand, the share price done the opposite, gaining 25%, compound, each year. It just goes to show tht the market is forward looking, and it’s not always easy to predict the future based on past trends. Still, this situation makes us a little wary of the stock.

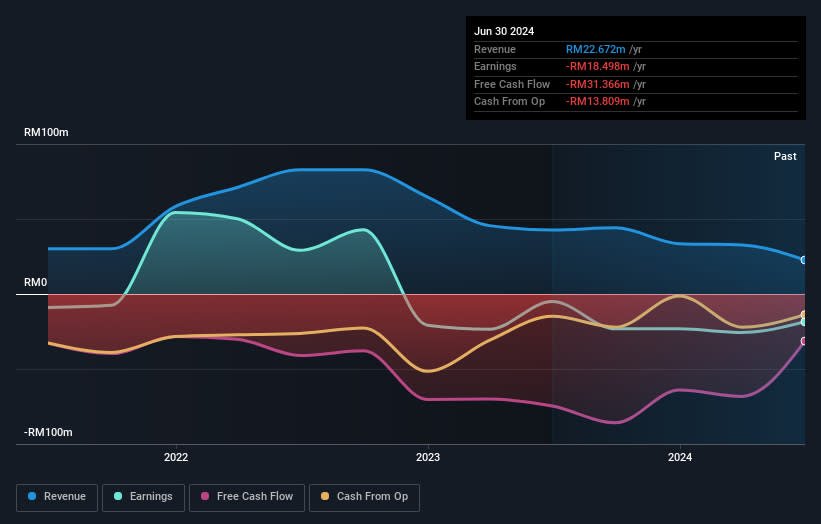

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We’re pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It’s always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Jentayu Sustainables Berhad’s earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

Investors should note that there’s a difference between Jentayu Sustainables Berhad’s total shareholder return (TSR) and its share price change, which we’ve covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Jentayu Sustainables Berhad’s TSR of 526% over the last 5 years is better than the share price return.

A Different Perspective

While the broader market gained around 18% in the last year, Jentayu Sustainables Berhad shareholders lost 39%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn’t be so upset, since they would have made 44%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It’s always interesting to track share price performance over the longer term. But to understand Jentayu Sustainables Berhad better, we need to consider many other factors. Like risks, for instance. Every company has them, and we’ve spotted 4 warning signs for Jentayu Sustainables Berhad (of which 1 can’t be ignored!) you should know about.

We will like Jentayu Sustainables Berhad better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.