The Singapore stock market has shown resilience amidst global economic fluctuations, with the Straits Times Index reflecting steady performance in recent months. In this dynamic environment, dividend stocks have garnered attention for their potential to provide consistent income streams and stability.

Top 10 Dividend Stocks In Singapore

|

Name |

Dividend Yield |

Dividend Rating |

|

BRC Asia (SGX:BEC) |

7.34% |

★★★★★☆ |

|

Bumitama Agri (SGX:P8Z) |

6.83% |

★★★★★☆ |

|

China Sunsine Chemical Holdings (SGX:QES) |

6.33% |

★★★★★☆ |

|

YHI International (SGX:BPF) |

6.56% |

★★★★★☆ |

|

Civmec (SGX:P9D) |

5.45% |

★★★★★☆ |

|

Singapore Exchange (SGX:S68) |

3.47% |

★★★★★☆ |

|

Singapore Airlines (SGX:C6L) |

7.95% |

★★★★★☆ |

|

UOB-Kay Hian Holdings (SGX:U10) |

6.52% |

★★★★☆☆ |

|

Oversea-Chinese Banking (SGX:O39) |

6.16% |

★★★★☆☆ |

|

Delfi (SGX:P34) |

7.03% |

★★★★☆☆ |

Click here to see the full list of 19 stocks from our Top SGX Dividend Stocks screener.

Let’s review some notable picks from our screened stocks.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DBS Group Holdings Ltd provides commercial banking and financial services across Singapore, Hong Kong, Greater China, South and Southeast Asia, and internationally, with a market cap of SGD101.31 billion.

Operations: DBS Group Holdings Ltd generates revenue primarily from Consumer Banking/Wealth Management (SGD9.34 billion) and Institutional Banking (SGD9.18 billion), with additional contributions from Treasury Markets (SGD695 million).

Dividend Yield: 6.1%

DBS Group Holdings’ dividend payments are covered by earnings with a payout ratio of 54.1%, and this is expected to remain sustainable with a forecasted payout ratio of 65.4% in three years. Despite some volatility over the past decade, dividends have generally increased. Recent executive changes include the appointment of Tan Su Shan as Deputy CEO, bringing extensive experience to the role, while net income for H1 2024 rose to S$5.74 billion from S$5.20 billion last year.

Simply Wall St Dividend Rating: ★★★★★☆

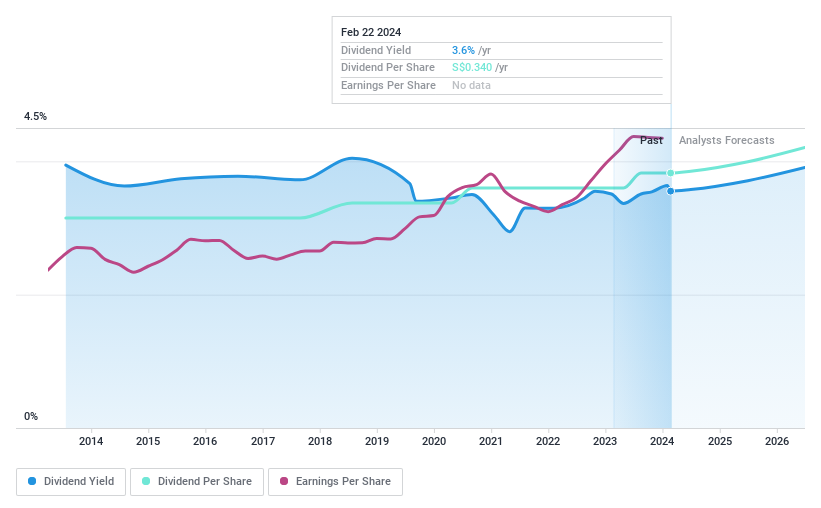

Overview: Singapore Exchange Limited operates integrated securities and derivatives exchanges, related clearing houses, and an electricity market in Singapore, with a market cap of SGD11.09 billion.

Operations: Singapore Exchange Limited generates revenue from four main segments: Equities – Cash (SGD334.94 million), Platform and Others (SGD240.20 million), Equities – Derivatives (SGD334.05 million), and Fixed Income, Currencies and Commodities (SGD322.50 million).

Dividend Yield: 3.5%

Singapore Exchange’s dividend payments are well-supported by earnings and cash flows, with payout ratios of 61.7% and 69.9%, respectively. While its dividend yield is lower than the top quartile in Singapore, the company has maintained stable and growing dividends over the past decade. Recent financial results show revenue increased to S$1.23 billion, with net income rising to S$597.91 million for FY2024, reinforcing its ability to sustain dividend payments.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Overseas Bank Limited, along with its subsidiaries, offers a range of banking products and services globally and has a market cap of SGD51.32 billion.

Operations: United Overseas Bank Limited generates revenue primarily through its Group Wholesale Banking (SGD6.69 billion), Group Retail (SGD5.11 billion), and Global Markets (SGD400 million) segments.

Dividend Yield: 5.7%

United Overseas Bank’s interim dividend of S$0.88 per share, with a payout ratio of 51%, indicates a sustainable dividend supported by earnings. Despite past volatility in dividends, recent increases show improvement. The bank’s net income for H1 2024 was S$2.91 billion, slightly down from last year but still robust. Recent board changes and strategic partnerships aim to enhance operational efficiency and regional expansion, potentially benefiting future dividend stability and growth.

Next Steps

-

Reveal the 19 hidden gems among our Top SGX Dividend Stocks screener with a single click here.

-

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio’s performance.

-

Simply Wall St is a revolutionary app designed for long-term stock investors, it’s free and covers every market in the world.

Contemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:D05 SGX:S68 and SGX:U11.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com