(Bloomberg) — A steel-industry crisis in China is sending iron ore prices tumbling. Meanwhile, soybean stockpiles are at a record high in the Asian nation. In the US, a hot summer is raising demand for natural gas.

Most Read from Bloomberg

Here are five notable charts in global commodity markets to consider as the week gets underway.

Iron Ore

Iron ore is trading at the lowest level since 2022, making the steel-making staple one of this year’s worst-performing commodities. Shanghai rebar futures have collapsed to a seven-year low amid weakening demand from China, the world’s largest steel market, as officials battle a property crisis. Top producer China Baowu Steel Group Corp. warned of a worse challenge for the industry than major downturns in 2008 and 2015. Market watchers including Macquarie Group Ltd. expect iron ore to remain under pressure as global supplies appear to be running ahead of demand.

Natural Gas

The US reported its first summer weekly withdrawal of natural gas stockpiles since 2016 and the first for this time of year in at least a decade. A hot summer has caused people to blast their air conditioners, boosting demand for gas to power the plants that support the electricity grid. The supply drop is a tell-tale sign that gas, which has traditionally been thought of as a heating fuel, is becoming increasingly critical to keeping the lights on and air-conditioners blowing in hotter months.

China Soybeans

China made its largest purchase of US soybeans for the new crop since 2023 last week, adding to a mountain of inventories. Still, the Asian nation has been slow to secure US supplies of the crop farmers start harvesting next month, with outstanding volumes at the lowest since Donald Trump’s trade war years. China has shifted away from US purchases over the past few years, taking advantage of bumper Brazilian crops. It’s set to start the 2024-25 marketing year with enough soybeans to cover more than a third of its demand for the season — the most since at least 2004.

Nuclear Power

The global nuclear industry has experienced a renaissance in recent years, with more than 80 designs for small modular reactors (SMR) under development. But BloombergNEF doesn’t anticipate SMR’s arrival on the grid until the 2030s, due to costs and regulatory challenges. Meanwhile, reactor projects, particularly in the West, are consistently running behind schedule and costing more than imagined. Electricite de France SA’s Hinkley Point C plant is still under construction and NuScale Power Corp.’s Idaho-based project was terminated due to high costs.

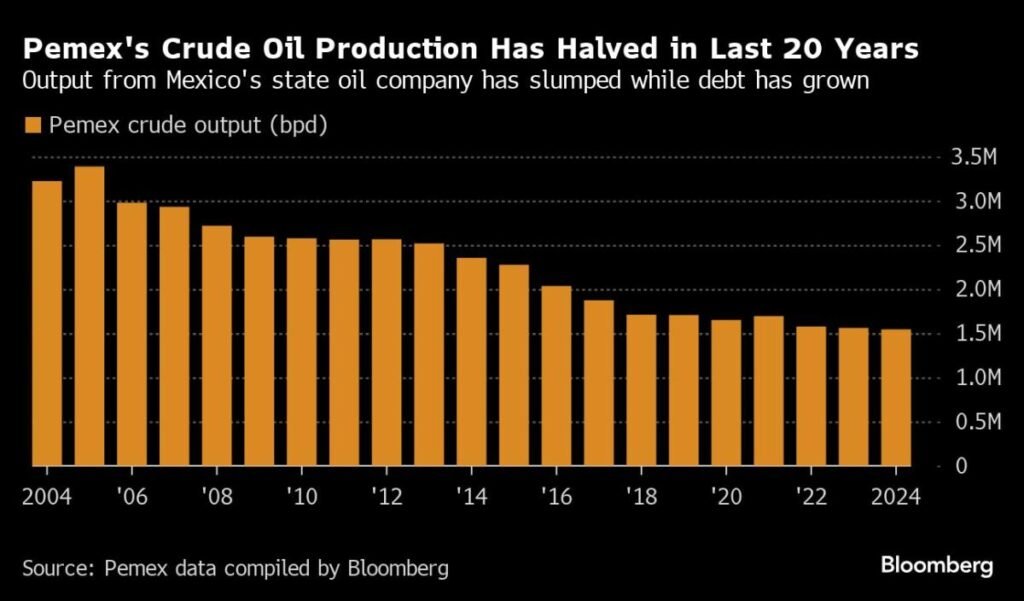

Mexican Oil

Oil output from Mexico’s Petroleos Mexicanos has slumped to about half its peak from 20 years ago. It’s a bad sign for the state-owned driller, whose conventional assets are running dry as it tries to dig itself out from under a nearly $100 billion debt burden. It now may be shifting focus to work more closely with the private sector, reaching a deal with driller CME Oil and Gas to explore deeper into two mature fields in the Gulf of Mexico, a plan that aims to increase output from them 10-fold by 2028.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.