Although Social Security is in no danger of going bankrupt or becoming insolvent, its payout trajectory, including cost-of-living adjustments (COLAs), is very much in question.

No program has proven more vital to the financial well-being of our aging labor force than Social Security. An analysis from the Center on Budget and Policy Priorities found that 22.7 million people, including 16.5 million adults aged 65 and older, were lifted above the poverty line by their Social Security payout in 2022.

Further, more than two decades of annual surveys from Gallup have shown that up to 90% of retirees lean on their monthly payout to cover some portion of their expenses. In other words, Social Security is a program that most retired workers and aging Americans would struggle to live without.

Image source: Getty Images.

Although Social Security is in no danger of going bankrupt, becoming insolvent, or disappearing, the program’s foundation has shown signs of breaking down, which has put the current payout trajectory in jeopardy.

Social Security is facing a greater than $23 trillion long-term funding shortfall

Every year since the first Social Security retired-worker check was mailed in 1940, the Social Security Board of Trustees has released a report that effectively lifts the hood on the program’s current financial situation. This annual report also estimates how fiscal and monetary policy changes, demographic shifts, and other factors will impact revenue collection and benefit outlays over the short run (10 years following the release of a report) and long term (75 years after the release of a report).

Since 1985, every Trustees Report has cautioned that long-term revenue collection would be insufficient to cover outlays. In other words, the tea leaves have suggested that Social Security is facing a 75-year funding shortfall for quite some time.

The 2024 Trustees Report pegged Social Security’s funding deficit at a whopping $23.2 trillion through 2098. The magnitude of this deficit has risen with consistency in recent years.

But there’s a far bigger worry than what Social Security might look like come 2098.

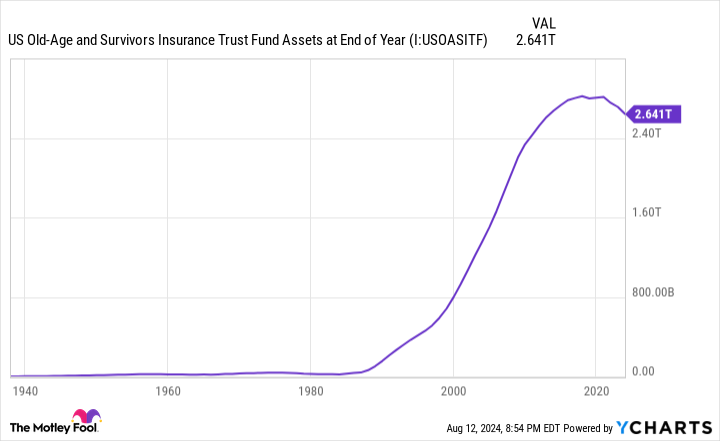

The OASI’s asset reserves could be depleted in nine years. US Old-Age and Survivors Insurance Trust Fund Assets at End of Year data by YCharts.

Could you handle a $508-per-month reduction to your Social Security check?

According to the latest Trustees Report, the Old-Age and Survivors Insurance Trust Fund (OASI), which is responsible for parsing out benefits to more than 51 million retired workers and 5.8 million survivor beneficiaries, is projected to exhaust its asset reserves by 2033. “Asset reserves” represent the excess cash built up since the program’s inception, which is invested in special-issue, interest-bearing government bonds.

To reiterate, the depletion of the OASI’s asset reserves doesn’t mean it would be bankrupt or insolvent. It would, however, signal that the current payout schedule, including annual cost-of-living adjustments (COLAs), isn’t sustainable.

The Trustees predict that sweeping benefit cuts of up to 21% may be necessary by 2033 to sustain payouts through 2098 without the need for any further reductions.

In June 2024, the average retired-worker beneficiary brought home $1,918.28. Assuming an average annual COLA of 2.6% — I chose this specific figure because it’s the average COLA over the trailing-20-year period — the average retired-worker benefit by 2033 would be $2,416.79 per month. A 21% reduction in OASI benefits nine years from now would lower this monthly payout by $507.53, or about $6,090 on an annual basis.

How did Social Security’s once rock-solid foundation crumble?

Considering that America’s leading retirement program enjoyed more than a three-decade stretch (1984-2017) where its asset reserves increased on an annual basis, many current and future beneficiaries are left wondering how its once impervious foundation began crumbling.

I can assure you it has absolutely nothing to do with prominent social media myths concerning “Congress stealing funds” or “undocumented workers receiving benefits.” Both of these claims are patently false. The culprit for Social Security’s widening funding deficit lies with an assortment of ongoing demographic shifts.

For example, Social Security relies on a relatively healthy number of legal immigrants entering the U.S. every year. Migrants tend to be younger, which means they’ll spend decades in the labor force and contribute to the program via the 12.4% payroll tax before receiving a retired-worker benefit of their own one day. However, the net migration rate into the U.S. has declined every year since 1998, based on data from the United Nations.

Another undeniable problem is that the U.S. fertility rate in 2023 hit an all-time low. For a variety of reasons, including delaying marriage and concerns about the U.S. economy, fewer children are being born. A generation from now, this is going to result in a further reduction to the worker-to-beneficiary ratio.

Income inequality is also worsening. In 2024, all earned income (wages and salary, but not investment income) ranging from $0.01 to $168,600 is subject to Social Security’s payroll tax. Meanwhile, earned income above $168,600 is exempt from the payroll tax. Over the last four decades, the percentage of earned income exempted from payroll taxation has significantly increased.

Image source: Getty Images.

Lawmakers realize there’s a problem, but there’s no simple solution

The only way sweeping benefit cuts will be avoided is through action on Capitol Hill from our elected officials. Although lawmakers from both parties recognize that deficiencies exist with America’s leading retirement program, they’re approaching a fix from opposite ends of the spectrum.

While you can peruse the policy proposals of both parties in greater detail, it boils down to this:

- Most Democrats in Congress favor increasing taxation on high-earning individuals and boosting benefits for lifetime low earners.

- Most Republicans on Capitol Hill prefer raising the full retirement age to reduce program outlays for future generations.

The truth is that both broad-based proposals would strengthen Social Security — but they also have unique flaws.

For instance, increasing the full retirement age would eventually reduce lifetime benefit outlays by forcing future generations of retirees to either wait longer to collect their full check or accept a steeper permanent payout reduction by claiming early. Unfortunately, this wouldn’t do a thing for the predicted depletion of the OASI’s asset reserves in just nine years.

Comparatively, increasing taxation on the rich would generate additional revenue and presumably kick the can on the OASI’s asset reserve depletion date years or decades down the line, depending on how this additional revenue was allocated. But this plan doesn’t come anywhere close to resolving the $23.2 trillion long-term funding shortfall.

With Democrat and Republican lawmakers unable to find anything resembling common ground, and bipartisan cooperation needed to amend the Social Security Act in the Senate (60 votes are needed), there’s simply no easy fix to this growing problem.