bjdlzx

Topaz Energy (OTCPK:TPZEF) reported a slight cash flow increase for the quarter. But the per share cash flow was level with the previous fiscal year at the six-month period. The company has considerable exposure to some growth situation. But the weak natural gas pricing environment caused a pause in the expected growth of the company. As a passive investor in midstream interests and royalty interests, the company stands to benefit from the coming natural gas pricing recovery. It participates in that recovery without the usual upstream risks. As such, this is an issue that may appeal to a wider variety of investors.

Notes

Before we go any further, this company has some special considerations.

1. The company is a Canadian company that reports in Canadian dollars unless otherwise noted.

2. For United States investors, the knowledge of Tax Form 8621 for Passive Foreign Investment Company (PFIC) is a must. Investors need to know the “ins and outs” before they invest in a situation like this.

3. Be sure you as an investor understand how your broker handles Canadian securities in a retirement account.

Back To The Article

Previous articles, including the last one, have covered that this is a Tourmaline (OTCPK:TRMLF) subsidiary that went public. The main idea for going public was to take advantage of both the midstream and royalty markets as Canada does not have an established market in the same sense that the United States has. There is therefore a need for the company to provide “cash out” when companies need cash.

Royalty Interests

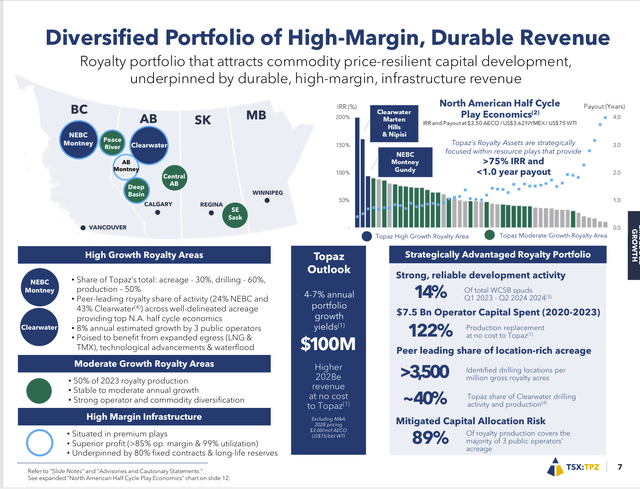

The company has a well-diversified royalty interest in a number of solid plays.

Topaz Energy Royalty Interest Map (Topaz Energy July 29, 2024, Second Quarter Earnings Corporate Presentation)

The royalties are paid based upon production. There are standard royalty agreements and there are negotiated agreements. However, just about any royalty agreement specifies an exclusion of the risk of dry holes. Usually, any negotiations would be in the area of production costs paid and possibly getting the product to market, so it gets sold.

Canada has a number of areas that have been revolutionized by advancing technology to the point where the areas are experiencing a revival or have become viable places to develop. Probably the hottest play above is the Clearwater Play where many operators are reporting returns in excess of 500%.

Tamarack Valley (OTCPK:TNEYF) reports three paybacks in the first year alone.

Midstream

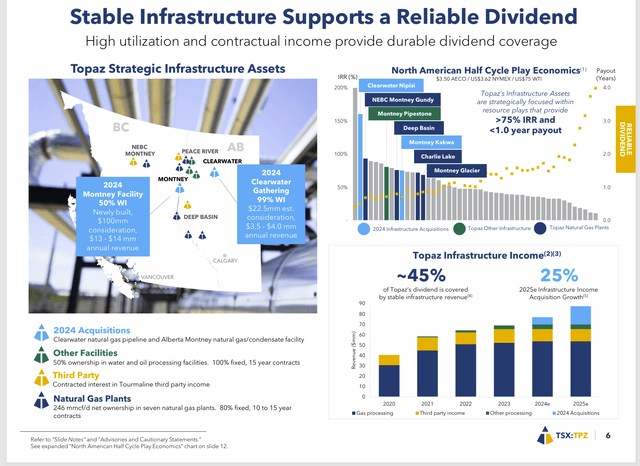

In roughly the same area in Canada, the company also has some passive (as in non-operated) midstream interests.

Topaz Energy Map Of Midstream Interests (Topaz Energy July 29, 2024, Second Quarter Earnings Corporate Presentation)

The midstream business does not follow the upstream business cycle. However, the midstream companies’ stocks often do. I have never figured that one out.

But this company has a steady business in the midstream interests that overall decrease earnings volatility due to the royalty interests shown before. That means this company has earnings that vary somewhere between upstream (very volatile) and midstream (not at all volatile). Many midstream companies have “take-or-pay” agreements that provide for a minimal payment during downturns.

This company has the additional advantage of not managing its interests. Therefore, the administrative costs to shareholders is very low.

Earnings

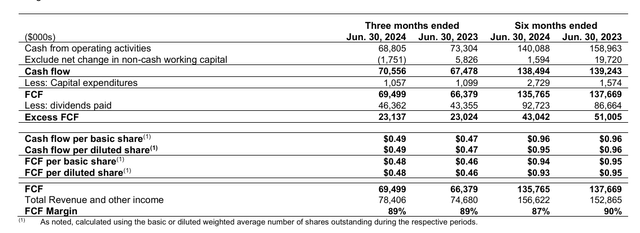

Probably the most important part of the second quarter earnings is the cash flow.

Topaz Energy Cash Flow Report Summary (Topaz Energy Second Quarter 2024, Earnings Press Release)

Elsewhere in the report, the company does show volume growth in which it has an interest. However, declining natural gas prices appear to have offset the growth.

But that means that when natural gas prices recover, the cash flow could increase both from production growth and from higher natural gas prices.

Note that the margin is typical of a passive investor type situation. Also note that the company retains roughly one-third of the cash flow to repay debt. Personally, I would prefer the debt a lot faster and then worry about the dividends. I think it is a safer way to go in this type of situation plus costs are lower if there is no debt to service.

Note also that the company did announce another acquisition that closed towards the end of June and will therefore materially contribute to the next quarter. That alone, should allow growth to resume.

Management also increased the dividend to C$.33 per share. That new rate will be paid in September.

Unlike the primary operator, this company can pick and choose capital projects to participate in. Any that it does participate in will lead to incremental growth as well.

Growing Business

This royalty company has invested in areas that are growing. Therefore, worries about depletion and “end of life” upstream issues are not pertinent here for the time being. There are royalty companies that are invested in older fields where remaining production is a consideration. This is not one of those.

There will come a time when production rates and growth hit maturity and then decline. At that time, there will be other considerations for this investment.

Summary

This was a quarter when there was not much growth. It would appear that financial derivatives (hedges) played a part in the flat earnings and cash flow comparison at the year-to-date comparison. But the second quarter growth was not that much either.

The midstream business only grows if the company elects to participate in a capital project or if the company makes an acquisition. Otherwise, the midstream business is fairly predictable based upon the previous quarter.

Sometimes there are maintenance issues or turnarounds that will affect midstream results. But those are generally considered nonrecurring by the market.

On the other hand, the royalty business is very much a growth business at the present time. Even if the company were to never acquire another interest, the earnings of the current possessions are likely to show growth for years to come. Those earnings will definitely be influenced by commodity prices.

Right now, natural gas prices are depressed. But when they recover, the royalty business could show accelerated growth.

The Future

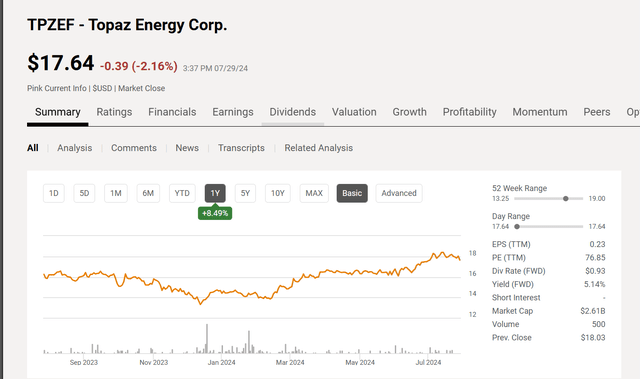

The stock has largely shown progress since the company went public.

Topaz Energy Stock Price History And Key Valuation Measures (Seeking Alpha Website July 29, 2024)

The dividend yield is more than half of what investors report for annual returns in the long term. Yet the slow growth here is likely to put the total return from a growing dividend and growing stock price into the low teens with less risk than the typical upstream company.

This company is rather new. But the close ties to Tourmaline make this a far less risky investment than would typically be the case. The new company risk is almost nonexistent when the resources of a company like Tourmaline are behind you.

I would like to see the finances run a little more conservatively. But the debt ratio is really not out of line for a midstream and royalty company.

For investors looking for a specialty situation, this is probably a strong buy consideration. There is the natural gas pricing recovery potential and the growth of the royalty areas in general that provide considerable cost-free upside potential. Additionally, the company is participating in some midstream capital projects and making occasional acquisitions to boost growth in that part of the business.

Risks

Royalty companies are exposed to commodity prices. The debt levels here would mean that a severe and sustained commodity price downturn could cause the company some financial stress. I would like to see management reduce debt levels to avoid that possibility.

The acquisition of the various interests needs someone with a firm grip on the business and the correct price to pay for the interest. The loss of this type of person could prove to be more difficult to replace than usual. Therefore, it would set back the company growth plans.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.