With a forward dividend yield of about 14%, AGNC Investment (AGNC 1.82%) is a stock that likely shows up on a lot of income-focused investors’ radars. The mortgage real estate investment trust (mREIT), which buys government agency mortgage-backed securities (MBS), has had a difficult few years due to increasing interest rates that have reduced the value of its holdings.

With the mREIT recently reporting its second-quarter results, let’s see if there are signs of a turnaround ahead.

Declines in book value return

The biggest issue facing AGNC over the past few years is the drag that higher interest rates have had on its MBS portfolio, which is reflected in its tangible book value (TBV).

From the end of 2021 until the end of 2023, the mREIT saw its TBV decline from $15.75 per share down to $8.70 at the end of 2023 — a huge 45% drop. Mortgage REITs are typically valued at a multiple of their book values, so not surprisingly, the stock price followed its TBV down.

Over the two quarters prior to its most-recent results, AGNC had seen its TBV begin to bounce back, going from $8.08 per share at the end of the third quarter of 2023 to $8.84 at the end of the first quarter of 2024.

However, TBV declined to $8.40 when the company reported second-quarter results. It said the drop stemmed from cooling inflation in the quarter and agency MBS spreads widening versus Treasury yields. In other words, as inflation cooled, Treasury interest rates fell while MBS prices remained elevated.

Expecting multiple Fed rate cuts

However, management remained optimistic about the government-agency MBS market over the longer term, noting that the Federal Reserve forecast still predicts nine rate cuts over the next two years. And the company believes that demand for government-agency MBS will begin to improve as the landscape for banking regulations becomes clearer.

The company said that since the quarter ended, its book value has risen by about 2%. Taking into consideration dividend accruals, book value would be up about 1%.

Looking at other important metrics in the quarter, AGNC had an improved average net interest spread of 2.69%, compared to 3.26% a year ago and 2.98% in the first quarter. The mREIT has done a good job in keeping its funding costs down through hedging. It said during the quarter that it continued to gradually shift toward swap-based hedges.

Overall, AGNC generated $0.53 per share in net spread and dollar roll (a hedging strategy equivalent to short selling but specifically employed in MBS markets to avoid losses when MBS values decline) income, which it uses to pay out its dividend. It generated a negative 0.9% economic return on its tangible common equity, with its TBV falling $0.44 per share while it paid out $0.36 per share in dividends during the quarter.

AGNC ended the quarter with higher debt, with 7.4x tangible net book value “at risk” leverage (debt + net receivables or payables for unsettled investment securities outstanding/shareholder equity excluding goodwill). That compares to 7.1x at the end of the first quarter and 7.2x a year ago. However, the mREIT has carried higher leverage in the past, and in a better environment, has the opportunity to increase the leverage to bolster returns.

It issued $434 million in stock in the quarter through an at-the-market (ATM) stock program. When mortgage REITs sell stocks above book value, it helps increase book value and can be accretive to earnings if invested in securities with attractive yields. As such, equity raises for mREITs do not have the same type of negative dilutive connotations as they do for regular companies.

Image source: Getty Images

Are better days ahead for AGNC?

Even with the decline in TBV, the worst does appear to be over for AGNC. The MBS market has settled into a steadier range, while the possibility of more interest rate hikes seems extremely low.

To really get the stock moving, though, the mREIT would greatly benefit from the Fed starting to lower rates. Similar to how the value of AGNC’s portfolio declined as the Fed aggressively raised interest rates, its value should increase as interest rates decline. While the start of Fed interest rate cuts has taken longer than first predicted, economists still generally expect it to start cutting rates starting in September and gradually continue throughout 2025.

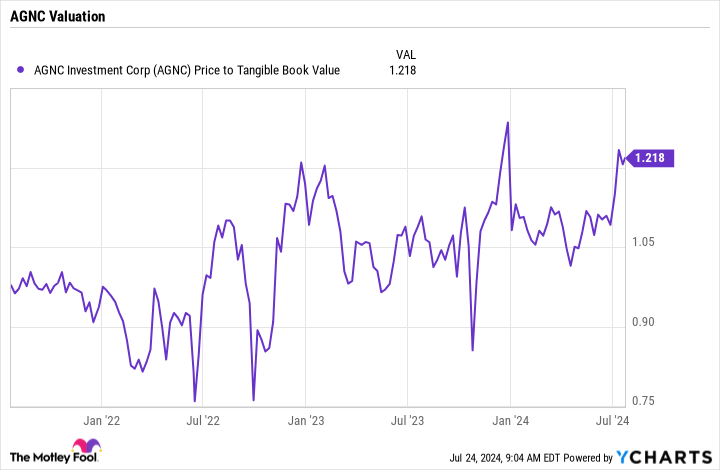

AGNC price-to-tangible-book-value data by YCharts.

That would be great news for AGNC and its investors. The stock currently trades at 1.2 times TBV, which is toward the high end of the valuation range it has typically traded around. However, with TBV set to increase with lower interest rates and the stock paying $0.36 in dividends per quarter, now looks like a good time to add the stock before the Fed starts easing rates, since the stock historically has performed very well during easing cycles.