(Bloomberg) — The world’s largest technology companies got hammered as concern about tighter US restrictions on chip sales to China spurred a selloff in the industry that has led the bull market in stocks.

Most Read from Bloomberg

From the US to Europe and Asia, chipmakers came under heavy pressure. American powerhouses Nvidia Corp., Advanced Micro Devices Inc. and Broadcom Inc. drove a closely watched semiconductor gauge down almost 7% — the biggest slide since 2020. Across the Atlantic, ASML Holding NV tumbled over 10% even after the Dutch giant reported strong orders. A plunge in Tokyo Electron Ltd. led losses in the Nikkei 225 Stock Average.

Wednesday’s action reprised a recent trend in which capitalization-weighted indexes underperformed the average stock, a consequence of weakness in the megacaps that dominate them. With firms such as Apple Inc. and Microsoft Corp. each making up 7% of the S&P 500, losses are hard to offset even when most of the index’s members are up — as it happened today.

The Biden administration told allies it’s considering severe curbs if companies like Tokyo Electron and ASML keep giving China access to advanced semiconductor technology.

“This news on the chip front is the kind of UFO (UnForeseen Occurrence) that could indeed create the kind of selling that could be the catalyst for a tradable correction in the stock market,” said Matt Maley at Miller Tabak + Co. “Broad indices have become very overbought.”

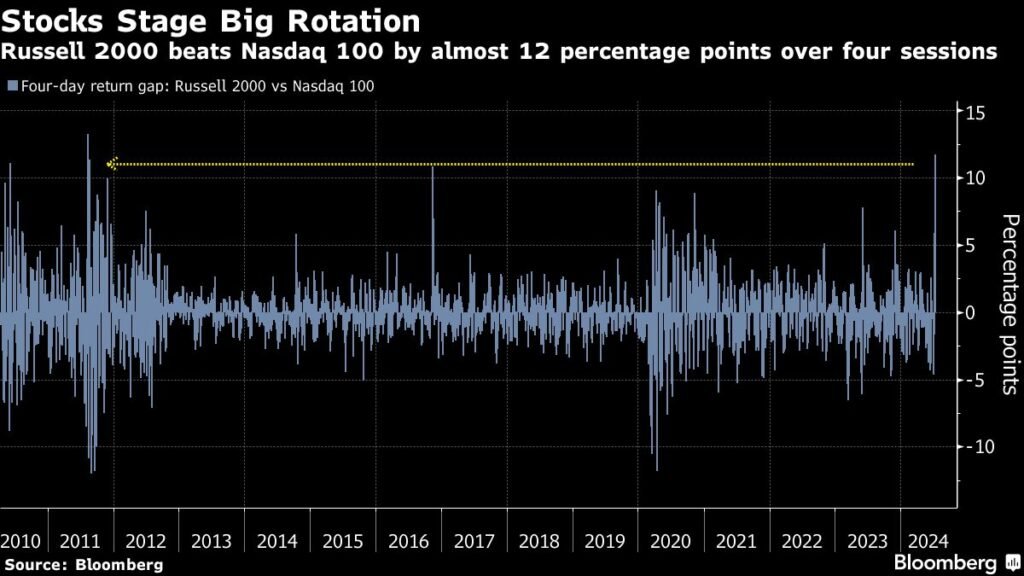

The S&P 500 fell 1.4%, while the tech-heavy Nasdaq 100 had its worst day since 2022. A Bloomberg gauge of the “Magnificent Seven” megacaps slipped about 3.5%. The Russell 2000 of smaller firms dropped 1.1%. Wall Street’s “fear gauge” — the VIX — hit the highest since early May. In late hours, United Airlines Holdings Inc. gave a bearish outlook.

A pair of chipmakers defied the selloff: Intel Corp. and Globalfoundries Inc. The Dow Jones Industrial Average climbed for a sixth straight day — notching another record. Financial shares outperformed, with U.S. Bancorp surging on solid results.

The bond market saw small moves. The Federal Reserve’s Beige Book showed slight economic growth and cooling inflation. The most-notable speaker on Wednesday was Governor Christopher Waller, who said the Fed is getting “closer” to cutting rates, but is not there yet. The yen led gains in major currencies, up almost 1.5%.

The Biden administration is in a tenuous position. US companies feel that restrictions on exports to China have unfairly punished them and are pushing for changes. Allies, meanwhile, see little reason to alter their policies when the presidential election is just a few months away.

Meanwhile, Donald Trump, speaking in an interview with Bloomberg Businessweek, questioned whether the US has a duty to defend Taiwan — a major hub of semiconductor manufacturing.

“Normally, the impact of these types of headlines isn’t long-lasting, but in this case, we would note that semis have been underperforming the broader market for the last couple of weeks now,” said Bespoke Investment Group strategists. “So that’s something to watch.”

The tech underperformance is coming after a first half which saw megacaps propel the market higher, stretching valuations for these names and leaving them with a tougher setup for the rest of 2024.

Can the market keep powering ahead without tech?

“Much of this year’s equity gains have come from a handful of names currently under direct threat from the political arena,” said Jose Torres at Interactive Brokers. “An important question is if the rest of the market, which generally lacks thrilling tales on a relative basis, can offset the waning momentum in ‘Magnificent Seven’ stocks.”

At Goldman Sachs Group Inc., Scott Rubner says “I am not buying the dip.”

The tactical strategist bets the S&P 500 has nowhere to go from here but down. That’s because this Wednesday, July 17, has historically marked a turning point for returns on the equity benchmark, he said, citing data going back to 1928. And what follows, he says, is August — typically the worst month for outflows from passive equity and mutual funds.

Jonathan Krinsky at BTIG says the market is “nearing the end of the typical bullish window.”

Sentiment remains extremely complacent on the surveys and transactional indicators, he noted.

“While the rotation out of megacap tech into cyclicals and small-caps is encouraging, it felt a bit forced happening in such a short period of time,” Krinsky said. “Even if this is going to be a more long-lasting rotation, we likely won’t be able to see that new leadership until after we see a higher correlation correction and then see what leads coming out of that.”

Corporate Highlights:

-

Tesla Inc. forming an autonomous taxi platform will be the catalyst for a roughly 10-fold increase in its share price, Ark Investment Management LLC’s Cathie Wood said, echoing years of bullish predictions about a business the carmaker has yet to stand up.

-

Amazon.com Inc.’s marketing portal for merchants crashed Tuesday night, according to multiple Amazon sellers and consultants, fouling up one of the online retailer’s biggest sales of the year.

-

Morgan Stanley became the latest big Wall Street bank to tap the US investment-grade market Wednesday after reporting earnings, as strong investor demand helps lenders borrow at lower yields than would have been possible at the start of the month.

-

Johnson & Johnson’s second-quarter profit beat Wall Street projections on strong pharmaceutical sales, while the company cut its full-year forecast to account for a spate of recent acquisitions.

Key events this week:

-

ECB rate decision, Thursday

-

US initial jobless claims, Philadelphia Fed manufacturing, Conference Board LEI, Thursday

-

Fed’s Mary Daly, Lorie Logan and Michelle Bowman speak, Thursday

-

Fed’s John Williams, Raphael Bostic speak, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 fell 1.4% as of 4 p.m. New York time

-

The Nasdaq 100 fell 2.9%

-

The Dow Jones Industrial Average rose 0.6%

-

The MSCI World Index fell 0.9%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.3%

-

The euro rose 0.3% to $1.0936

-

The British pound rose 0.3% to $1.3008

-

The Japanese yen rose 1.4% to 156.19 per dollar

Cryptocurrencies

-

Bitcoin fell 0.1% to $64,610.01

-

Ether fell 0.7% to $3,416.9

Bonds

-

The yield on 10-year Treasuries was little changed at 4.15%

-

Germany’s 10-year yield was little changed at 2.42%

-

Britain’s 10-year yield advanced three basis points to 4.08%

Commodities

-

West Texas Intermediate crude rose 2.6% to $82.89 a barrel

-

Spot gold fell 0.4% to $2,457.97 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Cecile Gutscher and Sujata Rao.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.