(Bloomberg) — Investors will initially favor traditional haven assets and perhaps lean into trades most linked to former President Donald Trump’s chances of winning the White House after he survived an assassination attempt, according to market watchers.

Most Read from Bloomberg

Currencies begin trading at 5 a.m. in Sydney when the US dollar could get a boost, along with other refuges from market volatility like Japan’s beleagured yen, the Swiss franc and gold. Bitcoin rose above $60,000 in the wake of the attack.

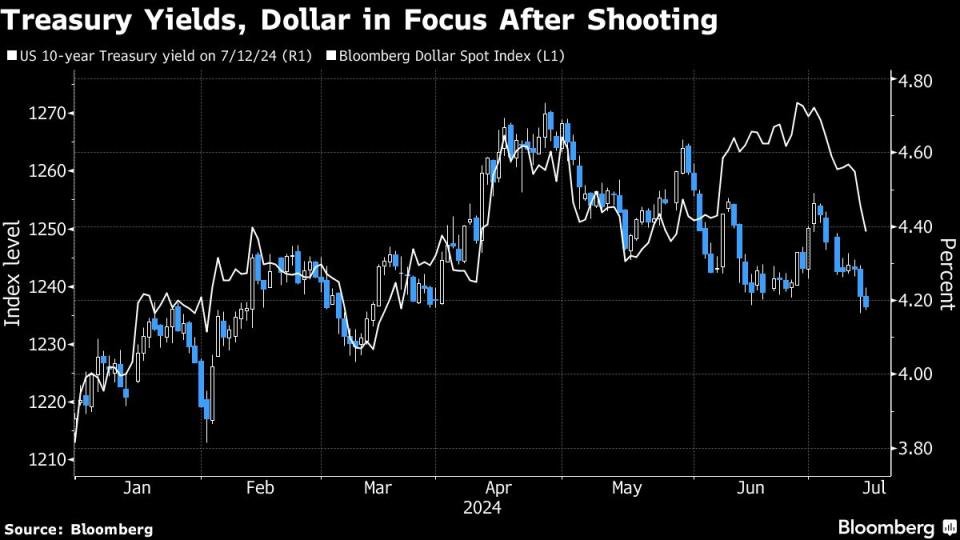

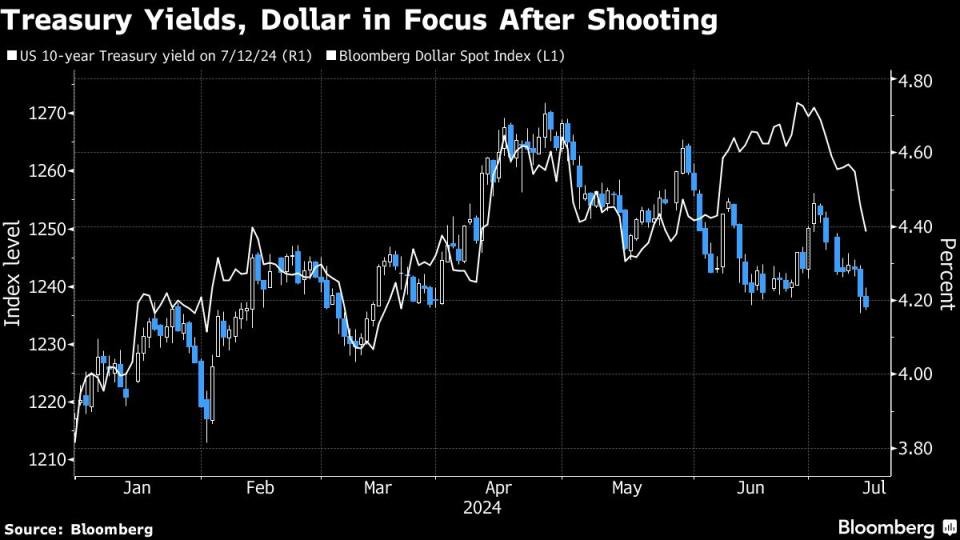

Traders will also be watching futures contracts on the S&P 500 index and on the US Treasuries market, both of which start trading at 6 p.m. in New York; Cash trading of US bonds won’t get going until 7 a.m. in London due to a national holiday in Japan.

‘’This weekend’s events will likely cause increased volatility on Monday open both in stock and bond markets,” said Ipek Ozkardeskaya, senior analyst at Swissquote Bank. “We expect to see flight to safe havens like Swiss franc and gold. Bitcoin has reacted positively to the news as a result of kneejerk flight to safety.”

Initial market commentary suggested the shooting of Trump at a Saturday rally in Pennsylvania may prompt traders to boost his probability of success in November’s election. His support for looser fiscal policy and higher tariffs are generally viewed as likely to benefit the dollar and weaken Treasuries.

Other assets positively linked to the so-called Trump trade include the shares of energy firms, private prisons, credit-card companies and health insurers. Traders will also closely watch market measures of expected volatility on Monday, such as those on the tariff-sensitive Chinese yuan and Mexican peso, which had begun to price in the US vote.

“Should the election become a landslide victory for Trump, this probably reduces uncertainty, which is positive for risk assets,” said Charles-Henry Monchau, chief investment officer at Banque SYZ. “Meanwhile, this could lead to more upward pressure on bond yields and a steepening of the yield curve.”

Tech and renewable-energy stocks could suffer, he added.

Bitcoin may also rise further, given both its appeal to investors seeking a hedge for political turmoil away from conventional financial assets, and Trump’s pro-crypto stance.

“This news marks a changing point in American political norms,” said Kyle Rodda, senior financial market analyst at Capital.com, adding that he was seeing client flows into Bitcoin and gold after the shooting. “For markets, it means haven trades but more skewed towards non-traditional havens.”

Trump said he was shot in the right ear after gunfire erupted at his rally. His campaign said in a statement that he was “fine” after the incident, which saw him rushed from the stage. An attendee at the rally was shot and killed and two others were in a critical condition.

What Bloomberg’s Strategists Say…

“Currencies will be the first major market on Monday in Asia to react to the weekend’s shooting. There’s potential for extra volatility, and getting a clear read may be especially tough because liquidity will be hampered by Japan’s national holiday.”

— Garfield Reynolds, Asia team leader for Markets Live

Strategists had already expected a volatile run into the election, not least because Democrats are still agonizing over President Joe Biden’s candidacy after his poor debate performance last month raised questions about his age. Investors had been also grappling with the possibility that the election may end in a protracted dispute or political violence.

But there is little precedent for events like those in Pennsylvania. When President Ronald Reagan was shot four decades ago, the stock market dipped before closing early. The next day, March 31, 1981, the S&P 500 rose over 1% and benchmark 10-year Treasury yields fell 9 basis points to 13.13%, according to data compiled by Bloomberg.

“Markets will naturally stand on high alert for any potential copycat repeat attacks,” said Neil Jones, a foreign-exchange salesperson to financial institutions at TJM Europe. “I would expect the dollar to open stronger across the board, a function of an initial reflex risk reaction and perceptions Trump’s popularity poll rating is set to increase.”

Bond investors should pay particular attention as the attack is likely to boost Trump’s election chances, and ultimately lead to worries about the fiscal outlook, according to Marko Papic, California-based chief strategist at BCA Research Inc.

Yields surged in the wake of Biden’s poor debate performance, showing the sensitivity of Treasuries — particularly longer-dated securities — to signs that Trump will get the chance to enact his fiscally expansive platform.

“The bond market should at some point, become aware of President Trump’s higher odds of winning the White House than any of his rivals,” Papic wrote. “And I continue to believe that as his odds rise, so should the probability of a bond market riot.”

—With assistance from Greg Ritchie.

(Updates with details of the open from second paragraph, new commentary)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.