Like many first-home buyers, Olympian Chloe Dalton found that skyrocketing property prices far outpaced her capacity to save for a deposit. This is why after years of saving she had to give up on buying in her Sydney home-town and is now looking interstate.

“I live on the Northern Beaches of Sydney and grew up here so the long-term goal would be to have a home here,” the 30-year-old told Yahoo Finance. “But unfortunately at this point, I can’t afford that.”

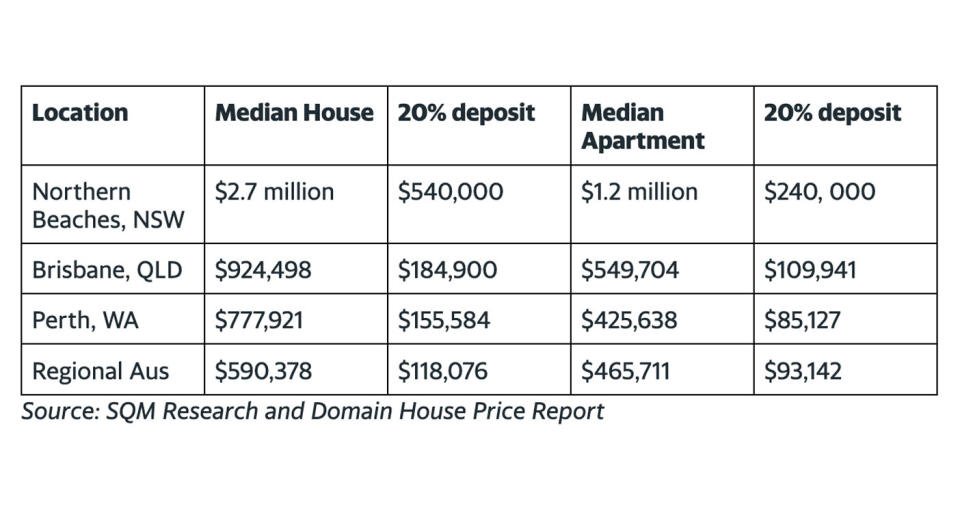

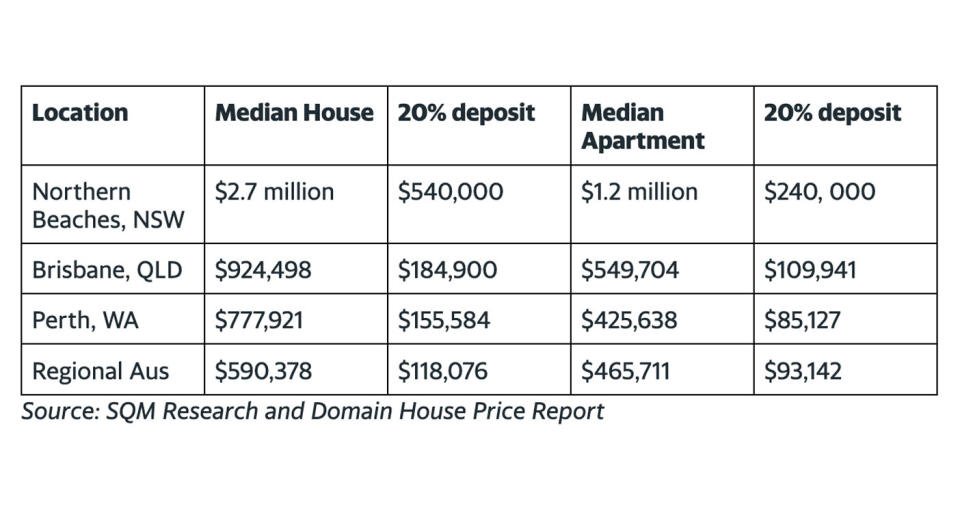

SQM research shows the median asking price for a house in this region is $2.7 million, with units fetching $1.2 million on average.

This would mean Chloe and her partner would need a combined deposit of $540,000 to buy their dream house with a 20 per cent deposit, or a $240,000 deposit for an average apartment.

The AFLW and Rugby 7s player — who won gold in Rio — has now decided to jump on a growing trend called “rentvesting”. She will continue to rent with her partner in Sydney, and they will invest in a more affordable location, like Queensland or Western Australia.

At the moment the median house price in Brisbane sits at $924,498 and Perth $777,921, both well below even an average apartment in Sydney’s Northern Beaches.

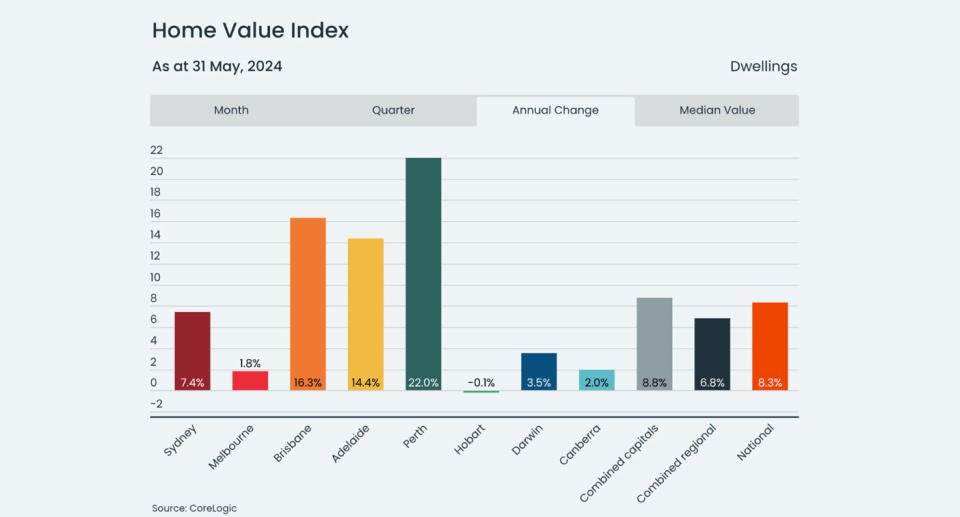

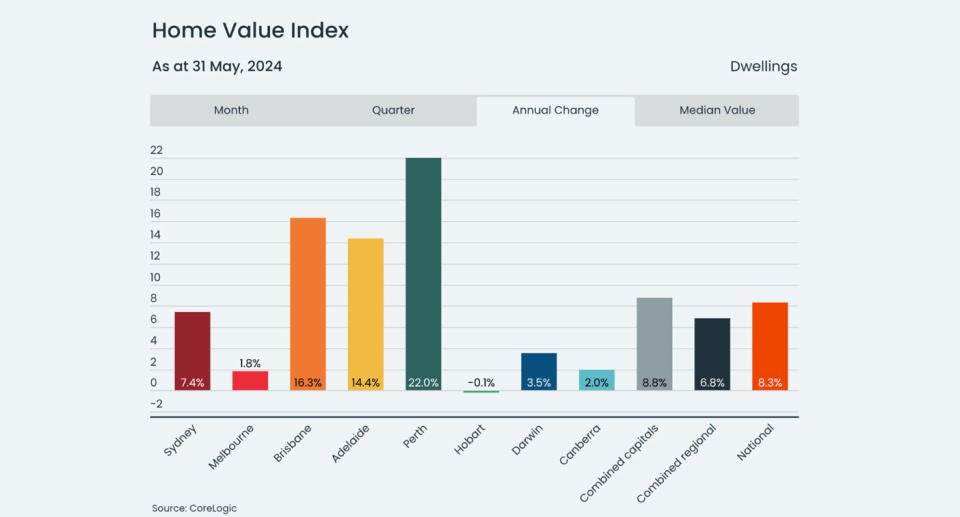

But, the clock is ticking on how long these places will stay affordable. Recent data from CoreLogic showed the median value of a home in Perth, Adelaide and Brisbane has risen by more than $12,000 month-to-month. Some Perth suburbs have been predicted to join the “million-dollar club” shortly.

This rise represents a growth fast outpacing the average homebuyers capacity to save. Research from Canstar shows potential first-time buyers were saving on average $1,605 per month to put towards their home deposit in 2023.

Saving $1,605 per-month would mean a couple could hypothetically save a 20 per cent deposit for a million-dollar home in six and a half years.

However, the problem buyers like Dalton are facing is that in six years time, your hard-earned deposit may be worth significantly less in terms of the property it can buy you.

Dalton, who won gold for Australia in the 2016 Olympics, has detailed her struggle to get on to the property ladder as rising values diminish hard-earned deposits.

“There’s so much talk about the property market – what’s going to happen, interest rates and everything,” the founder of the Female Athlete Project said.

“I think it’s hard to not feel swept up in that conversation and it adds this sense of pressure that you really need to get your foot in the door as soon as possible.”

Supply is also 40 per cent below the five-year average in some capital cities, according to CoreLogic.

RELATED

How much do I need for a home deposit? Expert’s warning on moving target

Jeremy Fisher, Director and founder of 1st Street Financial Mortgage Broker, warned this is why Australians’ hard-earned home deposits are losing value every day.

“You’ve got your typical first home buyer who might be aiming to purchase their first property at the end of this year with a $100,000 deposit,” he told Yahoo Finance.

“They might be hoping that equates to a 5 to 20 per cent deposit.

“But with the lack of stock on the market and prices continuing to go up, that deposit is worth less and less in terms of a property value.”

This means that money is losing value sitting in a regular savings account. Dalton said she decided to leave her bank after struggling to meet the base criteria needed to earn interest on her deposit.

“I had these hurdles to achieve the higher interest rate each month like making five transactions and depositing $1000 which wasn’t always easy,” she said.

“Especially as I wanted to keep my savings and transactions accounts separate so that my deposit stayed untouched.”

There are other higher-interest options, like a term deposit. But Fisher said these are “not ideal” for Australians looking to buy.

“Your money is locked up there and you never know when you are going to find a property and when you will need to access your savings,” Fisher said.

How can I grow my deposit if values are outstripping savings?

Dalton and her partner are now using a savings app to gather their deposit. Blossom allows users to invest in fixed-income assets with a goal return of 5.95 per cent to 7 per cent per annum.

She hopes this will help her keep up with the rising property market.

Gaby Rosenberg, co-founder of Blossom, said this where the app can come in handy.

“We’re trying to remove as many restrictions to invest as possible. So we have $5 minimums, flexible withdrawals and round-up functionality so you can contribute every day if you like,” she told Yahoo Finance.

She said customers have responded positively knowing they can achieve high-target returns with flexible withdrawals.

“You can make a withdrawal request at any time and then we are paying out withdrawals the same day,” she said.

Get the latest Yahoo Finance news – follow us on Facebook, LinkedIn and Instagram.